Josh,

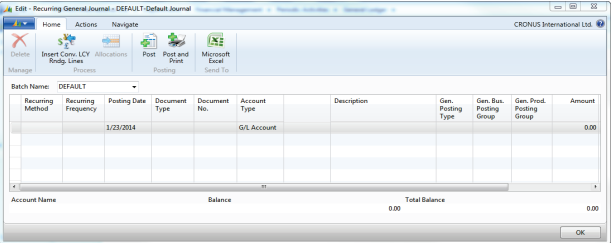

The Recurring General Journals page contains recurring journals of all general journal types, and can be accessed as follows:

Note: Only the recurring general journals post to general ledger accounts and they will be discussed later in this lesson.

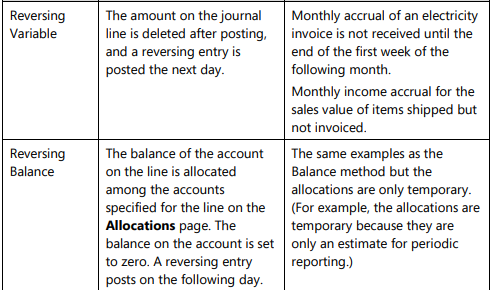

The Recurring Method field determines how the amount on the journal line is treated after posting. The following table shows the various recurring methods.

The Recurring Frequency field contains a formula that determines how frequently the entry on the journal line will be posted. This formula can contain no more than 20 alphanumeric characters that the program recognizes as abbreviations for time specifications. For example, if the formula 1M is entered with a Posting Date of 01/15/10, after the journal is posted, the date is changed to 02/15/10. Use one of the following methods to post an entry on the last day of every month after the current month: • Post the first entry on the last day of a month and enter the formula 1D+1M-1D (1 day + 1 month - 1 day). With this formula, the program calculates the date correctly regardless of how many days are in the month. • Post the first entry on any arbitrary day of a month and then enter the formula: 1M+CM. With this formula, the program calculates one full month plus the remaining days of the current month. Note: If you are posting monthly accruals that must be reversed the following month (Reversing Fixed, Reversing Variable, and Reversing Balance methods), post them on the last day of each month. The first entry must be posted on the last day of the current month and the recurring frequency must be either 1D+1M-1D or 1M+CM. This makes sure the reversal is always posted on the first day of the following month.

Hope this helps.

Thanks,

Steve