Thank you guys. I understand that I need to have there all the VAT or tax exempt numbers for all customers or vendors. Not only the ones that are exempt but I all of them though.

Still I have 2 questions regarding the same.

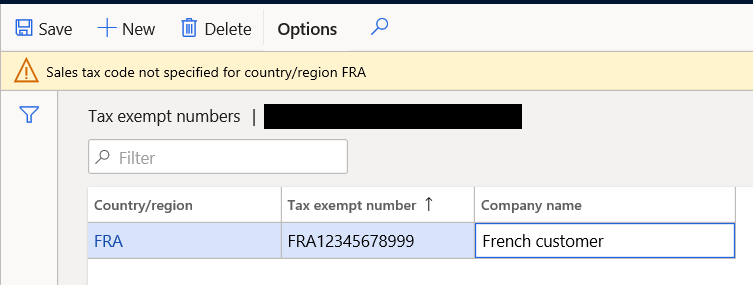

1. When creating a new tax exempt number I receive this warning message. The number is created and can be added to a customer but I would like to understand why do I get the message.

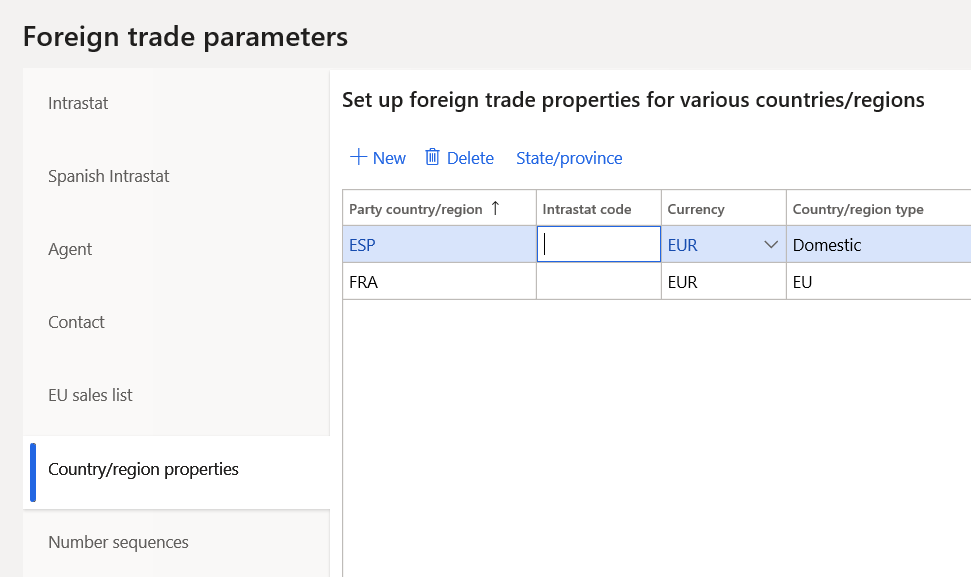

The country is added on:

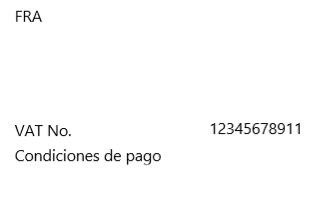

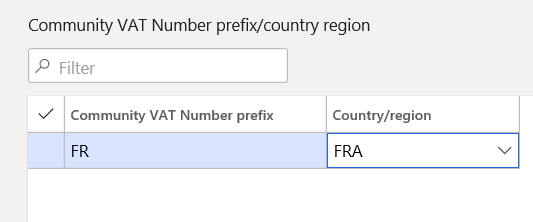

2. There is this other form that seems related. As I understand, this automatically generated the European format for a tax exempt number. Is it correct? Or, is this setup for something else? This is, if a French company, for example, has a local VAT number of 12345678911, by creating it like that as tax exempt number and having this setup:

It should result in the following "European tax exempt number": FR12345678911. Is this correct? If so, where would I see that the tax number has not the FR in front or not? Not in a free text invoice: