Hello Kendra,

Thank you for posting your question related to setting up Sales Tax in Dynamics 365 Business Central.

The following link to Microsoft Dynamics 365 Business Central Docs site will hopefully provide further details related to setting up Sales Tax for Canada:

https://docs.microsoft.com/en-us/dynamics365/business-central/localfunctionality/canada/ca-sales-tax

I will highlight some key points below that will hopefully provide some initial direction and clarification.

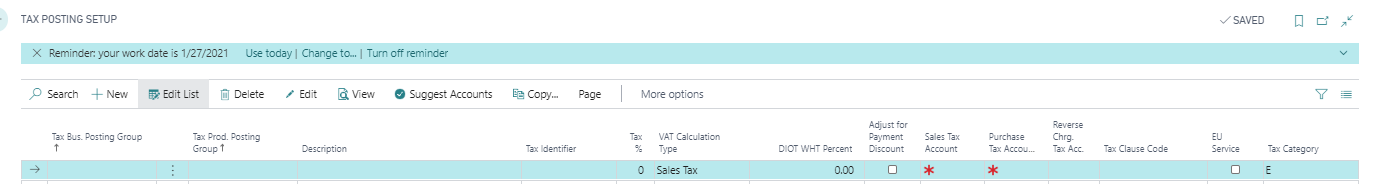

1) Tax Posting Setup in Canada and the United States will actually only be used to establish that Sales Tax is the tax to be charged. The full Tax Posting Setup is used primarily in VAT environments only. As shown below, you will have a single line with Sales Tax defined as the Tax Calculation Type.

2) Once Sales Tax is defined as the relevant tax, you may either use the Assisted Setup for Sales Tax or setup Sales Tax directly.

The assisted setup video is found at the following: https://www.youtube.com/watch?v=qMs4BoSytN8&index=13&list=PLcakwueIHoT8K1m148oMqo7amR2a7Bz-8

To setup directly, it will include setting up Tax Area Codes, Tax Jurisdictions, Tax Groups, and Tax Details. These are discussed in the Microsoft Docs link above.

The fundamentals of the setup are:

Tax Jurisdictions in Canada are the Federal GST along with each Province being a Tax Jurisdiction. The Jurisdictions are then grouped into a Tax Area Codes. The Tax Area Code is assigned to each Customer and Vendor based on their region/Province. There is also a Tax Liable flag that indicates for example whether the customer is liable for Sales Tax. This is particularly important if a Customer has a Tax Area for where the customer resides but then the customer is a charitable or non-profit organization where the customer is not subject to Sales Tax. The Tax Liable flag on the Sales and Purchase Lines is defaulted based on the default in the Header of the document that defaults from the Customer card. Note: The Tax Jurisdiction is where different G/L Accounts are setup to manage the posting of the accrued Sales Tax liability.

Tax Groups are created and then assigned to each product that is bought and sold, so it can be Items of Inventory, G/L Accounts, or Resources as the primary master records that are assigned Tax Groups. The Tax Group could simply be TAXABLE and NONTAXABLE to manage the various products sold. Or, if the products have varying tax rates, it may require setting up multiple product groupings for TAXABLE for the different rates. This is primarily in the US where some states/counting may have different tax rate on certain product types. The Tax Group field can be shown on the lines so that it can be modified if a particular sale should have a different rate for the transaction

Finally, the Tax Details table is where the Tax Jurisdiction is matched with each Tax Group and assigned a tax rate. This Table is where the Tax Rates are defined instead of in the Tax Posting Setup.

Hopefully, the information will help clarify some of the questions you presented and give you direction moving forward.

Have a great day.

Best Regards

Tom