Hi,

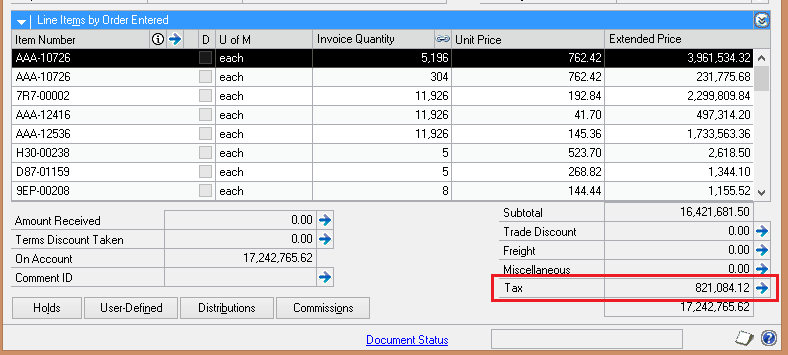

When calculate tax we are getting a small difference in tax calculation. 5% on 16,421,681.50. Is there any option to fix this issue. or is there any round of option when calculated line item extended price

| 16,421,681.50 |

821,084.08 to be as per calculation |

|

821,084.12 from GP |

|

(0.05) |

*This post is locked for comments

I have the same question (0)