Augustas,

The Exchange Rate Gain and Loss Accounts, on the Business Unit, instruct BC when consolidating which G/L Account to use when bringing a Business Unit into the Consolidating Company and calculating the translation exchange rate adjustment between the Consolidated Company LCY and the Business Unit on the Consolidation Date.

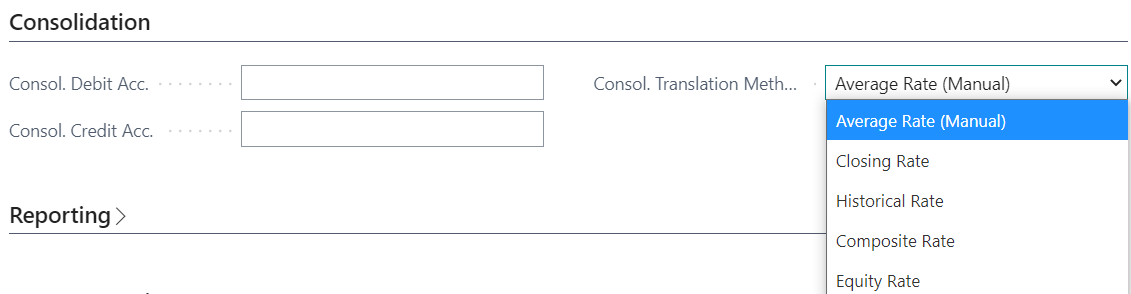

You establish on each Chart of Account how that specific account will calculate these gains and loss by the Consol. Translation Method:

Consol. Translation Method – this field contains the consolidation translation method that will be used for the account. The translation method identifies the currency translation rate to be applied to the account. The following are options in the Consol. Translation Method field:

Average Rate (Manual) – the average rate for the period to be consolidated. Calculate the average either as an arithmetic average or as a best estimate and enter it for each business unit.

Closing Rate – the rate that prevails in the foreign exchange market at the date for which the balance sheet or income statement is being prepared. Enter the rate for each business unit.

Historical Rate – the rate of exchange for the foreign currency that prevailed when the transaction occurred.

Composite Rate – the current period amounts are translated at the average rate and added to the previously recorded balance in the consolidated company. This method is typically used for retained earnings accounts because they include amounts from different periods and are therefore a composite of amounts translated with different exchange rates.

Hope this all helps.

Thanks,

Steve