Hi Gecel,

If Item has Unit price incl. VAT flag true and you want it to be different from Unit Price Excl. VAT then there is a setup for that. It is called VAT Bus. Posting Group Pr. Actually it is the same VAT Bus. Posting Group table but it is assigned on items for those where items prices already included VAT. There are two places where we can do this.

Setup:

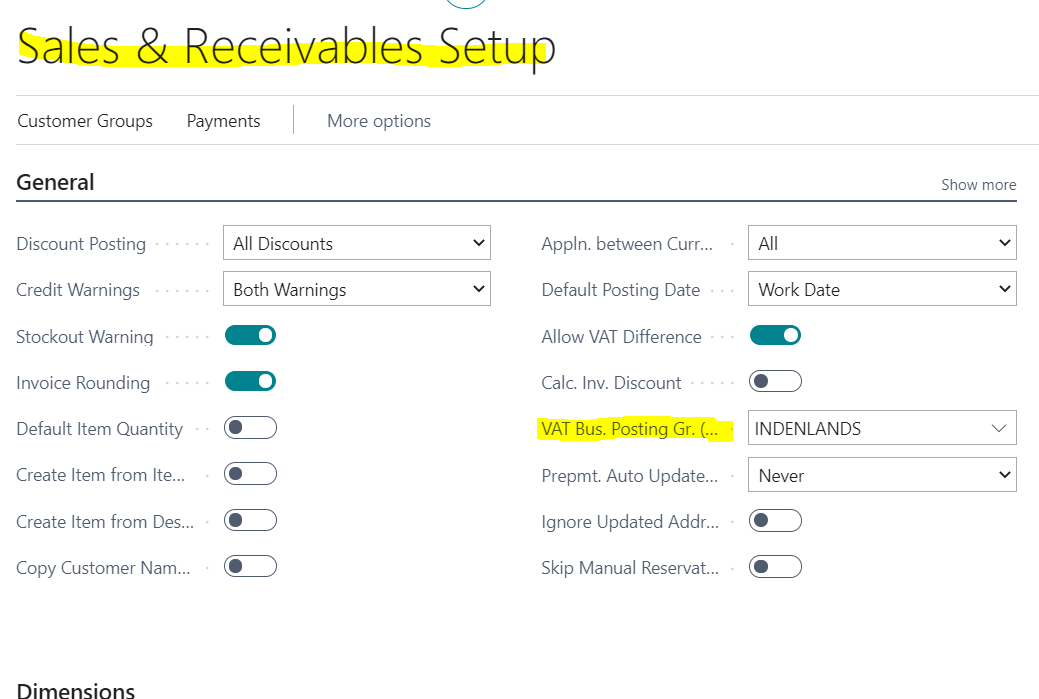

One is on Sales & Receivables setup. Open Sales & Receivables setup and add the value in VAT Business Posting Group Pr. Here you should take care that this setting will be for all of the items.

Second place where you can do this setup is on item table. May be this field is not visible on card but you can add using config package as I can see you know how to import data. So you can add value to that field. You can setup at both places and the group added on card level will get priority. If item card has no value then system will get from Sales & Receivables setup.

Working:

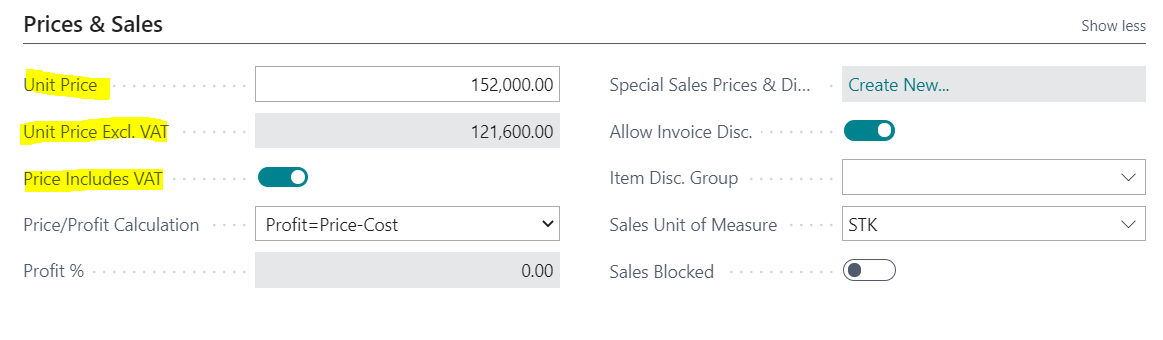

When you put some unit price in the item card where price incl. VAT flag is true. System will use the combination of VAT Bus. Posting Group Price (either from S&R setup or from item card) and VAT prod posting group to get the VAT % from the VAT Posting setup and then deduct VAT updates the value in Unit Price excl. VAT.

How you can test it without any setup:

For a very simple demo. Open an item with unit price incl. VAT, take its Gen prod posting group and go to VAT posting setup. See the combination where Gen Bus posting Group is empty (As you have not put VAT Bus Posting Group Price neither in S&R setup nor in item card) and Gen prod posting group with the item's gen prod posting group. Put some value in VAT %. Come back to item card and see the difference between Unit price and Unit Price Excl. VAT.

Hopefully it will help you. Please verify my answer if it fulfills your query.

Regards,

Bilal Rai