Dear Friends,

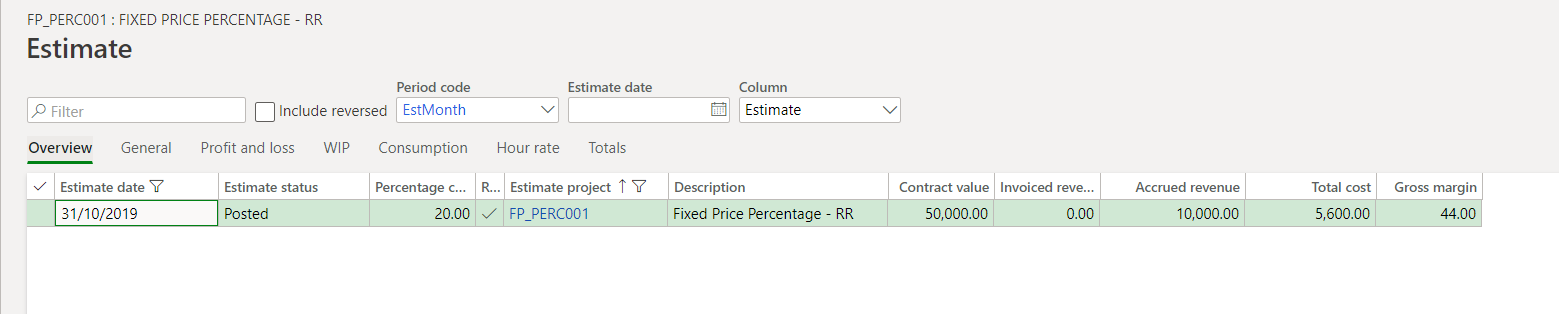

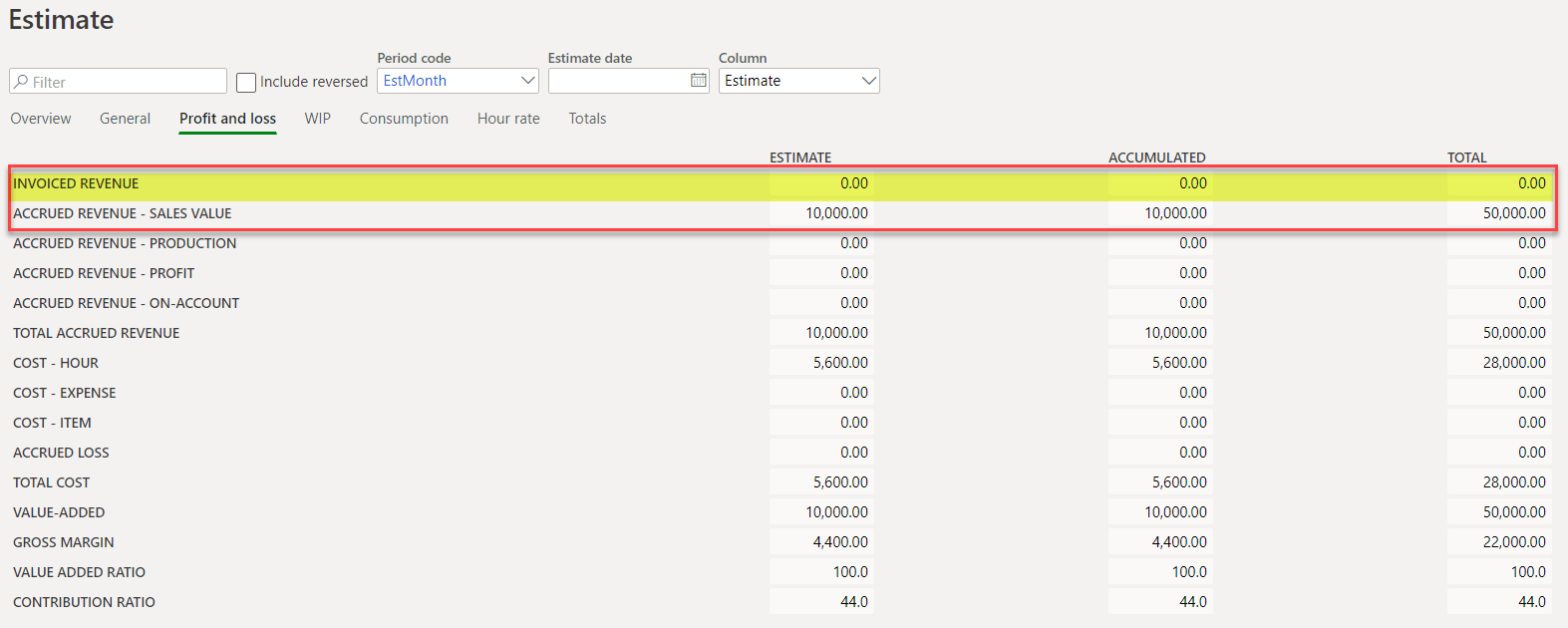

I created a Fixed Price project and posted some hour transactions. So, the cost is booked. Based on this cost, I have run the Estimate and posted the accrued revenue. The details are below:

Accrued Revenue is 10,000

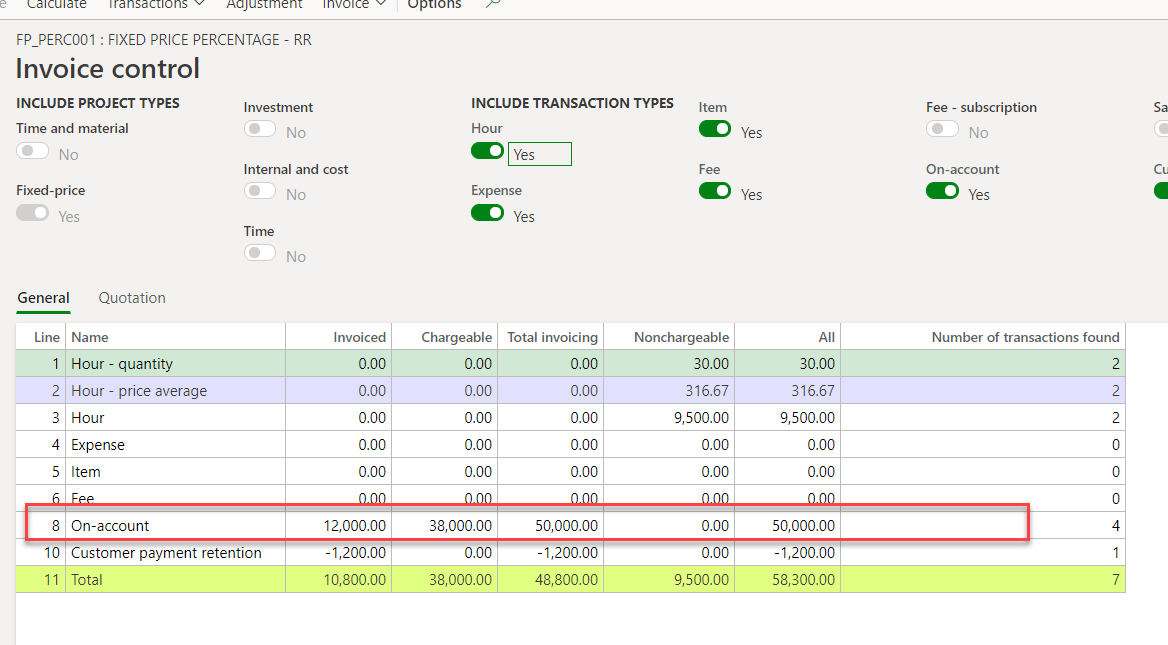

Now, I wanted to book the actual revenue. So, I created and Invoice Proposal (Based on Milestone defined in the billing rule). The details are follows:

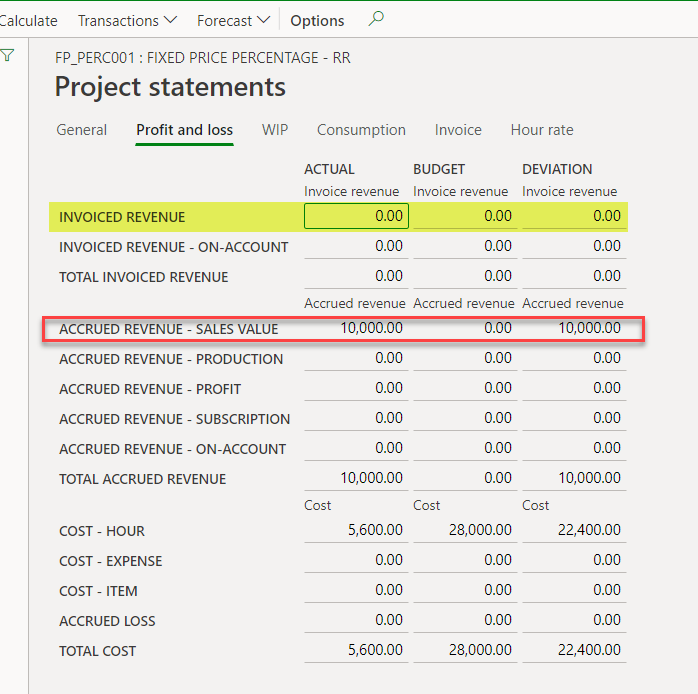

But, when I look at the project statement, the actual invoice is not getting reflected. The invoiced revenue is still showing 0

As per my posted invoice, the actual revenue should be 12,000. Should I reverse the accrued revenue? Even if I reverse, will system show the invoiced revenue? Theoretically, when I have actual revenue, my P&L should be based on the Invoiced revenue and not from Accrued revenue. Am I right?