Hi,

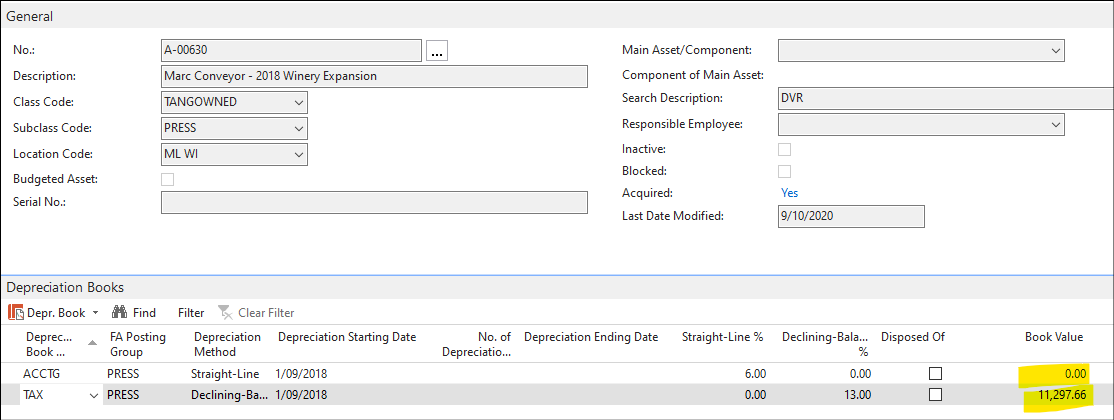

I have processed and posted a FA reclassification (merge A-00630 into A-00629) through to the FA G/L Journal and posted it through to the GL.

This used our ACCTG depn book and correctly cleared out the asset card.

Now I want to do the same for our TAX depn book so the asset card of A-00630 is cleared of all balances.

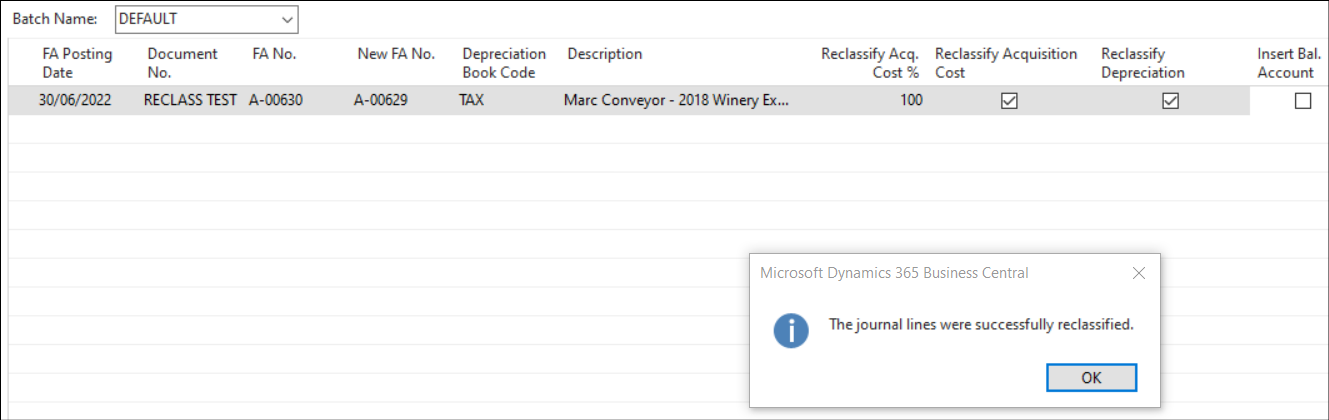

I set up the Fixed Asset Reclassification the same way, but with TAX instead of ACCTG in the depn book code

The issue is I cannot see where the reclassification is sits while it waits to be posted to the FA Ledger Entries.

It is not under the default batch in the FA journal.

I have checked FA Ledger Entries to see if it auto posts - it has not.

Any help would be much appreciated.