Josh,

Disposing of Fixed Assets is easy. You can dispose through the Sales Invoice, if are receiving money. Through Fixed Asset G/L Journal is disposing with zero funds. Or Fixed Asset Journal is not integrated with the General Ledger.

Here are the steps:

Salvage Value

Salvage value represents the residual value of a fixed asset when it can no longer be used. Post the salvage value of an asset from a purchase invoice or from the FA journal when you post the acquisition cost.

To post salvage value from a purchase invoice, add the Salvage Value field to the purchase lines by using the Choose Column function. Enter the salvage value in the field as a positive or negative number and then post the invoice as usual.

NOTE: If the asset contains the salvage value, Depreciate lower than Zero means depreciate under the salvage value.

The salvage value reduces the depreciation base and therefore reduces all depreciation amounts. The final rounding amount reduces only the last depreciation amount. In the following scenario, the salvage value has caused a reduction in the yearly depreciation of 200 each year. If no salvage value existed, the depreciation would be 1,200 per year, and not 1,000.

Scenario – How to use Salvage Value

An asset has a book value of 800 and a salvage value of -800. This means that the asset is fully depreciated. Follow these steps to use salvage value.

- In the FA depreciation book for the asset, in the Fixed Depr. Amount below Zero field, enter 1,000.

- Run the Calculate Depreciation batch job for the asset. The system calculates the depreciation as 1,000. This makes the book value -200. If the Salvage Value is 0, the system calculates depreciation as 1,800. This results in a book value of -1,000.

NOTE: A salvage value is not posted as an alternative to a Final Rounding Amount. The Final Rounding Amount is set up in the FA depreciation book and reduces the last depreciation amount. The system does not post the final rounding amount.

Final Ending Book Value

The final ending book value is frequently used to represent a fully depreciated asset that is still active. When you use a salvage value, a reduction in depreciation over the life of the asset is allowed. However, some local laws give only the reduction of the last depreciation amount. You can reduce the last depreciation amount by inserting an ending book value in the Fixed Asset Card.

When you use this feature on most of the fixed assets, you can set up a default ending book value in the relevant depreciation book.

Disposal of Fixed Assets

When you sell or otherwise dispose of a fixed asset, you must post the disposal value together with any related gain or loss.

A disposal entry must be the last entry posted for an asset so that you can record related disposal costs for an asset. You must record related disposal costs in the FA G/L Journal before the actual disposal entry. You must also post all disposal entries through the FA G/L Journal, the FA Journal, or a sales invoice.

To set up the disposal method for each depreciation book, in the Disposal Calculation Method field. The system can handle disposals by using one of the follow methods:

- Net method, post to either a disposal loss or gain account. This is the most common method that is used.

- Gross method, post to a book value gain or loss account and to a sales gain or loss account.

When you enter the sales price in a journal, the system calculates the gain or loss on the disposal and calculates all other relevant entries. The gain or loss amount will be calculated automatically from the difference between the sales price and the book value.

Examples – Disposal of Fixed Assets

The following examples include both the Net method and the Gross method of disposal by using the following amounts:

When you post the disposal of the fixed asset by using a journal or sales invoice, the system calculates the gain or loss on disposal and creates the other entries. The following examples show which amounts are posted to the accounts when you post the disposal of a fixed asset. The result of both methods is the same in the financial statement.

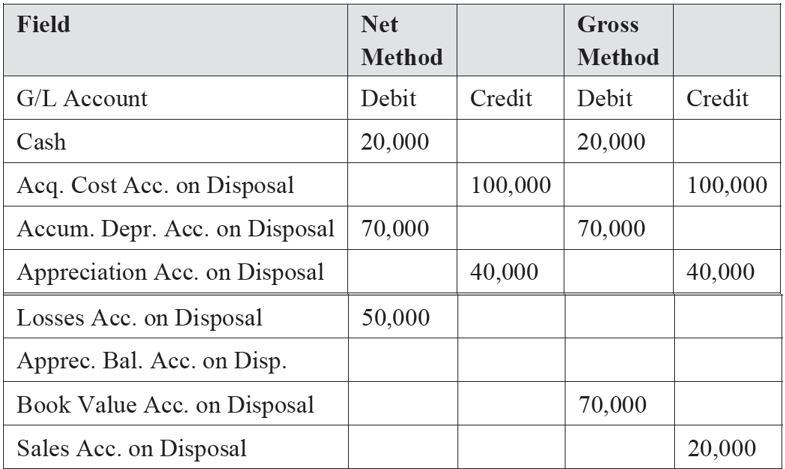

Disposal of Fixed Assets – Example A

Appreciation is included in the book value and is part of the calculation of gain or loss. This is specified in the FA Posting Type Setup page.

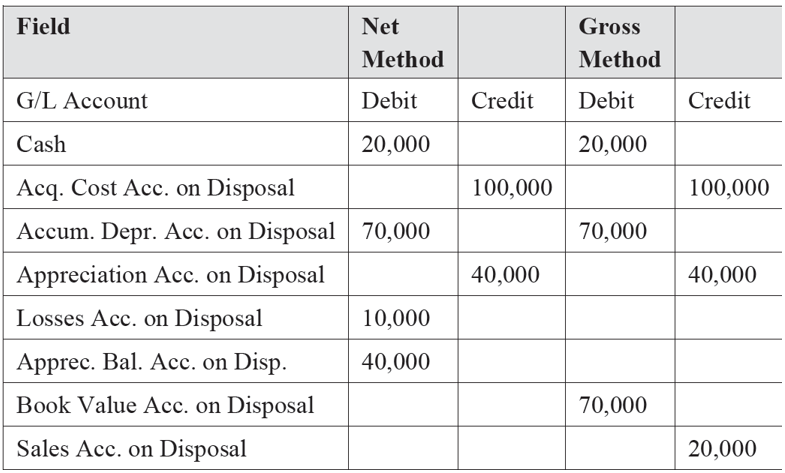

Disposal of Fixed Assets – Example B

Appreciation is included in the book value, but not included in the gain or loss calculation.

Posting the Disposal through the FA Journals

Another way to post disposals is through the FA G/L Journal. Follow these steps to post disposals through the FA G/L Journal.

- Enter the appropriate information in the line.

- Enter the disposal amount as a credit or negative number.

- Click Post.

You can also post the FA disposal in combination with a VAT posting group. The system automatically creates the Sales VAT amount. If the system must post the sales VAT automatically, enter the gross amount in the Amount field.

Follow these steps to view the results of the journal entry.

- Open the ledger entries from the depreciation book of the asset.

- Use the Navigate function to view the actual entries made in the general ledger. This shows the posted disposal entry.

If you record a disposal for an asset without integration to the general ledger, you must record it in an FA Journal. The same information that is in the FA G/L Journal is recorded automatically.

When you trade in an asset, you must record both the sale of the old asset (the disposal) and the purchase of the new one (the acquisition). You cannot record this type of transaction as a single transaction.

NOTE: Avoid use the Inactive field until two years after the last transaction on the asset. If an asset is sold in the current fiscal year and the asset is recorded as inactive. Then the asset will not appear in the Fixed Asset - Book Value 01 report for the current fiscal year.

Partial Disposal

When you sell or otherwise dispose of a part of an asset, you must split the asset into two or more assets before you record the disposal transaction.

Disposal from a Sales Invoice or a Sales Order

You can create a sales invoice by selecting the type of Fixed Asset on the line. This lets you invoice an asset to a customer. The disposal of the asset works in the same manner as a disposal through a FA G/L journal.

The following steps explain how to create a sales invoice for the disposal of an asset.

- On the Navigation Pane, click Departments, click Financial Management, click Receivables, and select Sales Invoices.

- Click New to create a new sales invoice.

- Press ENTER or TAB to find the next available invoice number.

- In the Sell-to- Customer No. field enter 30000.

- In the Posting Date and Document Date fields, enter 01/31/10.

- In the Lines FastTab, select Fixed Asset in the Type

- Click the drop-down list in the field, and select the asset FA000030 VW Transporter.

- Enter the quantity in the Quantity Usually the quantity will be 1. No more than one asset per sales line can be sold.

- Enter the net sales price in the Unit Price field of the sales line.

- Right-click the column header and open the Choose Column function, add the until FA Posting Date field and then click OK, select the check-box.

- Click Statistic view the sales statistics for this invoice. The system now has calculated the Sales VAT and automatically enters Disposal in the FA Posting Type field because only one FA Posting Type for assets in sales invoices exists.

- Click Post, to post the invoice.

You can watch my video series on Fixed Assets:

https://www.youtube.com/watch?v=Vm3cnTaYkdc&t=59s

https://www.youtube.com/watch?v=C1v1l4hDbZs

Hope this helps.

Thanks,

Steve