Hi

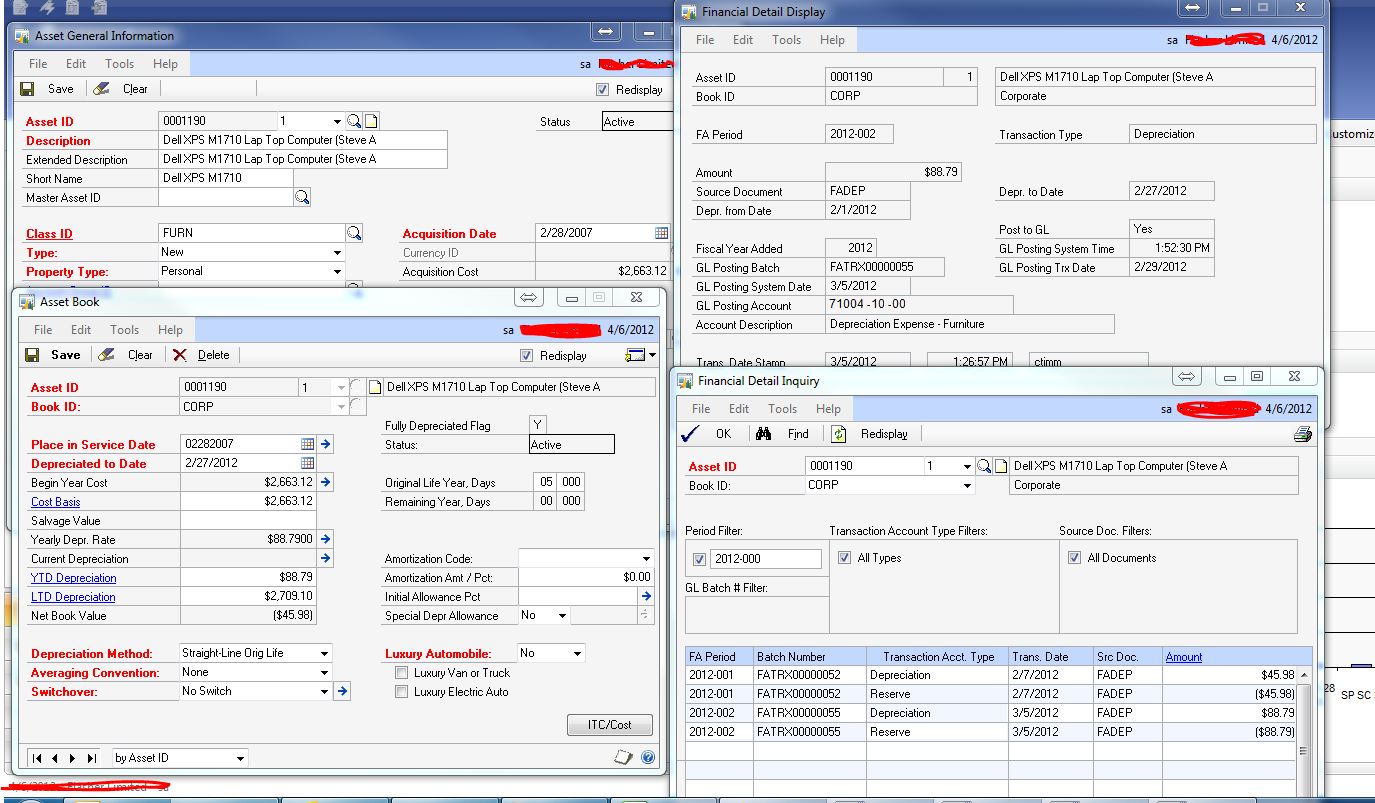

Fixed Assets- Overstated depreciation.

We have found for 4-5 assets depreciation is overstated. Users says they have not changed any Depreciation Sensitive field.

Assets life was 5 yrs-Place in Service Date : 02/28/2007 Last Depreciate to Date: 02/27/2012.

I don’t know why only for few assets System Calculated Negative Depreciation?

Please need help to troubleshoot issue.

For your reference please find enclosed screen shot.

Thanks

Sandip

*This post is locked for comments

I have the same question (0)