D365: SEPA direct debits feature

Galyna Fedorova

Galyna Fedorova

In today’s post, I’d like to dig into SEPA direct debits payment feature in AX.

What is all about?

SEPA stands for Single Euro Payments Area with the aim to make intra-European payments as convenient as a domestic payment. SEPA direct debit transfer is a payment method where the customer allows a vendor to debit the due amount directly from the customer’s bank account. This is done through a mandate authorization signed by the customer.

SEPA direct debit is particularly suited to support recurring transactions, subscriptions, “on-demand”, “pay-as-you-use”, or returning customer scenario’s. In this process mandate is required. A mandate is a document set-up between a creditor (the vendor, merchant) and a debtor (the customer) that gives the creditor the approval to debit the debtor’s account for a given product/service. This is some kind of proof that the Creditor is mandated to debit the Debtor’s account.

Before I dive in this feature I want to present normal lifecycle scheme.

- PAYEE creates Mandate which is identified by a Unique Mandate Reference that allows to identify the contract to which the SEPA direct debits are attributable. PAYEE sends Mandate to PAYER.

- PAYER signs in the Mandate. Debtor must sign this mandate in order to prove that he or she consents to the creditor debiting the debtor’s account.

(Goods are shipped and invoice is generated)

- PAYEE sends pre-notification to the customer before debiting his account. The creditor must pre-notify the debtor of the upcoming direct debit at least 14 calendar days before the due date.

- PAYEE initiates the collection of a SEPA direct debit for delivered services or goods by means of a payment order the payee sends to own bank. Let’s call this step as SEPA direct debit order.

- The order for a SEPA direct debit is cleared on the specified execution date through the National Clearing System.

- Funds from the debtor’s bank account will be debited and transferred to the creditor’s bank account.

- The payer’s bank debits the payer’s account for the amount of the SEPA direct debit order on the specified execution date, and the payee’s bank credits the payee’s account for the amount of the SEPA direct debit.

Now let’s jump into AX to look at this process

Set up a number sequence for direct debit mandates

This setting is important to generate unique number of each direct debit mandate. This number sequence will be used on the customer record while creating new mandate

Click Accounts receivable > Setup > Accounts receivable parameters.

Click Number sequences, and then in the Number sequences area, select a number sequence code for the Direct debit mandate ID reference.

Set up Accounts receivable parameters for direct debit mandates

Click Accounts receivable > Setup > Accounts receivable parameters.

Click Direct debit, and then in the Direct debit area, make the following selections.

Set the following:

Days required for the first pre-notification 14

Days required for recurring pre-notifications = 14

Days required for the first core scheme bank submission = 5

Days required for recurring core scheme bank submissions = 2

Month between usage and expiration = 36

The days are taken from SEPA rule book. Follow the link to review details – https://www.europeanpaymentscouncil.eu/sites/default/files/KB/files/item%205%20EPC016-06%20Core%20SDD%20RB%20v8.1%20Approved.pdf

Set up a method of payment for direct debit mandates

Click Accounts receivable > Setup > Payment > Methods of payment.

Enter a code for the method of payment, such as SEPA.

Enter a name for the method of payment, such as SEPA Direct Debit.

In the Payment type field, select Electronic payment.

Select the Require mandate check box to create payments using direct debit mandates

Note: The Require mandate check box is available only if you select Electronic payment in the Payment type field

Expand File formats FastTab.

Generic electronic reporting to Yes.

Select Export format configuration.

If no format available, go to Organization administration > Electronic reporting.

Click Repositories link.

Click Open button.

Select the following node: Payment model > ISO20022 Direct debit.

On the right-hand side, select ISO20022 Direct debit.

In the Versions section, click Import:

Click Yes.

Click Yes.

Go back to the Method of payment and select Export format configuration SEPA Direct debit.

Edit customer information

Click Accounts receivable > Customers > All customers.

Double-click on a customer name.

On the Action Pane, click Edit.

On the Sales Demographics FastTab set currency to EUR.

On the Payment defaults FastTab set method of payment SEPA.

On the Addresses FastTab set the address.

This address will be used during Mandate creation.

Create bank account for the customer

Click Accounts receivable > Customers > All customers.

Double-click on a customer name.

On the Action Pane, click Bank accounts.

Click New

Make sure that SWIFT, Currency and IBAN are correctly filled for that bank account

Add direct debit mandate information to a customer account

Click Accounts receivable > Customers > All customers.

Double-click on a customer name.

On the Action Pane, click Edit.

On the Direct debit mandates FastTab, click Add.

Enter information about the mandate.

Make the following selections.

Bank account: Select the customer’s bank account. The IBAN and SWIFT code fields must be filled in for the bank account if it is used for direct debits.

Creditor bank account: Select the company’s bank account. The IBAN and Direct debit ID fields must be filled in for the bank account if it is used for direct debits.

Signature date: at this point keep it blank

Mandate scheme: Core

Payment frequency: Recurring

Pay attention to the Mandate status. Now it’s Incomplete due to blank signature.

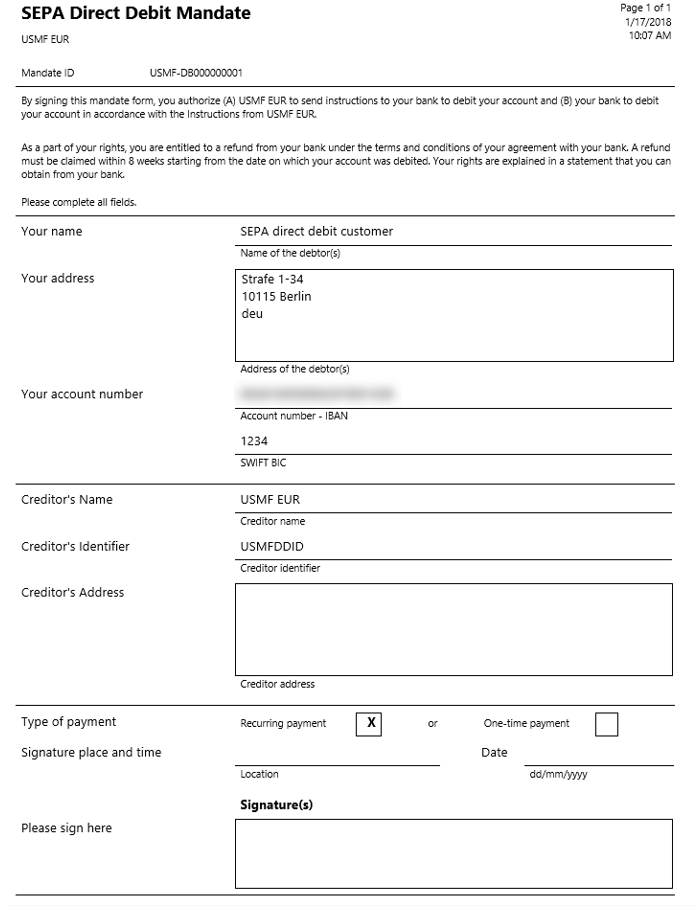

Generate a mandate for the customer to sign

On the Direct debit mandates FastTab, select a mandate, and then click Print > Mandate report.

Send this mandate to customer.

Return back by clicking on Edit button and change Signature date. Enter the date when the mandate was signed.

Pay attention to the Status, not it’s New.

Attach a scanned mandate to the customer account

Once customer sends it back, attach the scanned copy to the mandate

On the Direct debit mandates FastTab, select a mandate, and then click Attachments.

Enter a free text invoice for a customer

Click Accounts receivable > Invoices > All free text invoices.

On the Action Pane, click New.

Select a customer who has a direct debit mandate

Method of payment will be automatically filled in from customer.

In the Direct debit mandate ID field, select a mandate reference.

Add Free text invoice lines.

On the Action Pane, click Post.

In the Post free text invoice form click OK.

Click View / Original.

The invoice is printed. The SEPA direct debit notification section is printed at the bottom of the invoice.

Print a direct debit mandate notification report

Click Accounts receivable > Customers > All customers.

Double-click a customer.

On the Direct debit mandates FastTab, select a mandate, and then click Print > Notification report.

Send this report to a customer to let them know which invoices are scheduled to be paid through the mandate.

Create payment for customer who has direct debit mandate

Payment journal form will be used to create a payment proposal for customers who have direct debit mandates.

To create a payment proposal, follow these steps:

Click Accounts receivable > Journals > Payments > Payment journal.

Select a journal name, and then click Lines.

Select a journal line, and then click Payment proposal > Create payment proposal.

In the Customer payment proposal form, click Records to include.

In the Customer payment proposal query form, in the Criteria field, select the criteria for the customer transactions.

In the Customer payment proposal form, enter other information for the payment proposal as needed. In our case we will need to mimic the real scenario, so we will put Payment date = Due date of invoice (2/16/2018).

Click OK.

Click Create payments button. At this point transferring payment proposal to the journal will be done.

Click Functions > Generate payments.

In the Generate payments form, select SEPA Method of payment.

Note: Once you select the Method of payment, File name field will become visible.

Specify File name.

In the Bank account field, select the bank account for SEPA direct debit.

Click OK.

In the Electronic report parameters form, specify details for the reports.

You are asked what to do with the package (payment file and reports).

Select Save -> Save as.

Select the path and click Save.

Payments are generated, and the payment status in the Journal voucher form changes to Sent.

Verify the folder. The following files are created.

The following xml file has been generated.

<?xml version=”1.0″ encoding=”utf-8″?>

<Document xmlns=”urn:iso:std:iso:20022:tech:xsd:pain.008.001.02″ xmlns:xsi=”http://www.w3.org/2001/XMLSchema-instance” xsi:schemaLocation=”urn:iso:std:iso:20022:tech:xsd:pain.008.001.02 pain.008.001.02.xsd”>

<CstmrDrctDbtInitn>

<GrpHdr>

<MsgId>00584</MsgId>

<CreDtTm>2018-01-17T12:21:26</CreDtTm>

<NbOfTxs>1</NbOfTxs>

<CtrlSum>10000</CtrlSum>

<InitgPty>

<Nm>Contoso Entertainment System USA</Nm>

<PstlAdr>

<Ctry>US</Ctry>

<AdrLine>123 Coffee Street Suite 300 Redmond, WA 98052 USA</AdrLine>

</PstlAdr>

</InitgPty>

</GrpHdr>

<PmtInf>

<PmtInfId>0058420180216FRST</PmtInfId>

<PmtMtd>DD</PmtMtd>

<BtchBookg>false</BtchBookg>

<CtrlSum>10000</CtrlSum>

<PmtTpInf>

<SvcLvl>

<Cd>SEPA</Cd>

</SvcLvl>

<LclInstrm>

<Cd>CORE</Cd>

</LclInstrm>

<SeqTp>FRST</SeqTp>

</PmtTpInf>

<ReqdColltnDt>2018-02-16</ReqdColltnDt>

<Cdtr>

<Nm>Contoso Entertainment System USA</Nm>

<PstlAdr>

<Ctry>US</Ctry>

<AdrLine>123 Coffee Street Suite 300 Redmond, WA 98052 USA</AdrLine>

</PstlAdr>

</Cdtr>

<CdtrAcct>

<Id>

<IBAN> </IBAN>

</Id>

</CdtrAcct>

<ChrgBr>SLEV</ChrgBr>

<CdtrSchmeId>

<Id>

<PrvtId>

<Othr>

<Id>USMFDDID</Id>

<SchmeNm>

<Prtry>SEPA</Prtry>

</SchmeNm>

</Othr>

</PrvtId>

</Id>

</CdtrSchmeId>

<DrctDbtTxInf>

<PmtId>

<EndToEndId>ARPM000772-68719570994</EndToEndId>

</PmtId>

<InstdAmt Ccy=”EUR”>10000</InstdAmt>

<DrctDbtTx>

<MndtRltdInf>

<MndtId>USMF-DB000000001</MndtId>

<DtOfSgntr>2018-01-17</DtOfSgntr>

</MndtRltdInf>

</DrctDbtTx>

<DbtrAgt>

<FinInstnId>

<BIC>1234</BIC>

</FinInstnId>

</DbtrAgt>

<Dbtr>

<Nm>SEPA direct debit customer</Nm>

<PstlAdr>

<Ctry>DE</Ctry>

<AdrLine>Strafe 1-34 10115 Berlin deu</AdrLine>

</PstlAdr>

</Dbtr>

<DbtrAcct>

<Id>

<IBAN> </IBAN>

</Id>

</DbtrAcct>

<RmtInf>

<Ustrd>FTI-00000006</Ustrd>

</RmtInf>

</DrctDbtTxInf>

</PmtInf>

</CstmrDrctDbtInitn>

</Document>

The following Attending note report has been generated.

The following Control report has been generated.

The following Covering letter report has been generated.

Click Post > Post. Payments are posted.

To verify mandate information for customer transactions and print the mandate information, follow these steps:

Click Accounts receivable > Customers > All customers.

Select customer account.

On the Direct debit mandates FastTab, verify the mandate information.

Click Transactions to review all transactions for selected mandate.

To view the remaining invoices for the selected mandate, click Print > Notification report.

The report is blank since all invoices have been paid.

That’s it!

This was originally posted here.

Comments

-

D365: SEPA direct debits featureHi, great explanation!How do you handle the payments?We are creating direct debit transactions but having troubles import payment file for settlement (CAMT054C?).In addition, the bank us using PAIN002 as a return file for Direct debit, is this possible to use for settlement of Direct debit in D365?Kind regards,Martin

Like

Like Report

Report

*This post is locked for comments