***Updated January 2024***

The following items were issues found in the Canadian Year end update and will be addressed with the January/February Hotfix.

1. Some French windows are miss-aligned, due to new CPP2 fields.

2. QPP Age limit changes for the 2024 year.

3. The CIBC Canadian Payroll bank format is incorrect and getting rejected.

4. T4 XML is rejected due to incorrect tag.

To work around this issue now, you create the XML file.

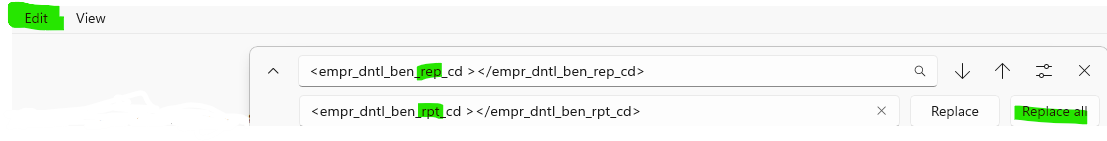

Open it up in notepad and Choose the Edit option. Find and replace to fix the file, then it will upload fine.

The file is created with this tag below:

<empr_dntl_ben_rep_cd ></empr_dntl_ben_rep_cd>

and it should be:

<empr_dntl_ben_rpt_cd ></empr_dntl_ben_rpt_cd>

Example in notepad

********

We hope you all are enjoying your year-end thus far!

Changes this year for the 2023/2024 Year-End Update can be found Canadian Payroll Year-End and Tax Updates for Microsoft Dynamics GP | Microsoft Learn however, I did want to include some of the main points below:

T4127 updates

T4127-JAN Payroll Deductions Formulas – Effective January 1, 2024 – Canada.ca

Approved Numbers for Quebec

Software Development Number for XML – RQ-22-01-072

RL-1 Slip Authorization number FS2301187 (enter in the Payroll T4/R1 Print window)

RL-1 form and XML – Changes

T4 Slip & XML – Changes

T4A – form & XML – Changes

Basic Personal Amount Updates.

Detailed Documentation for 2023 Regulatory Changes

Notes:

-It is more important this year than ever with the NEW CPP2 to follow the below steps and make sure all payroll is done, the update is applied. The 2023 year-end close process is completed prior to running 2024 payroll.

-If you use Canadian Payroll for Dynamics GP, DO NOT install the US Year end update or use the November DVD image as an issue was found. You can use the October DVD image and wait till the Canadian Year end releases mid-December 2023.

- ROE Serial Numbers Can Now Start with M

- Additional CPP and QPP Contributions

- Reporting Benefits on extra boxes of the T4 form

- Tables changes for the Canadian Year End

Now, let’s get started with our year end steps that should be the same year after year, but still are good reminders for everyone.

What steps should I take to close the year?

~For more detailed steps, please refer to the Year-end closing procedure for the Canadian Payroll module in Microsoft Dynamics GP, by clicking: Year-end closing procedures for the Canadian Payroll module in Microsoft Dynamics GP (Original KB 861806)

- Complete all the pay runs for the current year.

- Complete any necessary 2023 Payroll reports.

- Make a backup of the data.

- ***Install the 2023 Canadian Payroll Year-End Update/2024 Tax Update. ***

- Complete the “Year End File Reset” process.

- Make a backup of the data.

- Create the T4, T4A, and RL-1 statements, and print the T4, T4A, and RL-1 reports.

- Edit the T4, T4A, and RL-1 records as necessary.

- Create T4, T4A, and RL-1 Summary records.

- Print the T4, T4A, RL-1 reports and create T4, T4A and RL-1 XML file, if appropriate.

- Verify that the Pay periods for 2024 are set up correctly.

**This will be translated to French.

Key Points to remember:

- The Year End Close process moves all your current year data into the Last Year (LY) tables, and it doesn’t take the date into consideration. For this reason, it is very important that you complete ALL 2023 Payrolls (step 1) and then complete at least through the year end file reset (step 5) before doing any 2024 payrolls.

- It is vital that you install the Year-End Update before the Year End Reset (Steps 4 and 5) because you are prompted during the Year End Reset to update Basic Personal Amounts. If you miss this, you will need to restore from a backup.

- When you do the Year End Reset it changes the Basic Personal Amounts for employees. Depending on the Province it will either add a fixed amount or increase the amount by an indexation factor as determined by the Provincial Authority.

- This is an all-inclusive update.

Be sure to refer to the 2023 Year-End Blog Schedule to review current and upcoming blog posts and other helpful resource links related to Year-End Closing for Dynamics GP.

Thanks

Terry Heley

Microsoft