Consideration for the Consignment Accounting in Dynamics GP

Mahmoud Saadi

Mahmoud Saadi

From an accounting perspective, consignment is a process in which goods are transferred from a specific party called the “Consignor” who is the owner of these goods to another party or business called “Consignee”. The consignee gives a promise to sell these goods in return of a predefined profit margin, and the consignor payment is due once the goods are sold, or at later periods considering the agreed upon payment terms.

In this essence, here are the things to be considered:

- The goods remains at the consignee locations, and shall not be reported as part of their inventory value

- Liability for the consigned goods is not recognized, until the items are sold

- The ownership of the goods remains for the consignor

- The consignee is supposed to pay the consigner the agreed upon sales amount (including goods cost and specific profit margin).

- The consignee is to keep specific margin for them, which is deducted from the sales amount.

System Perspective

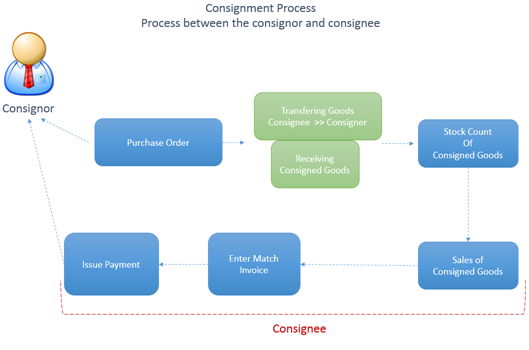

In Dynamics GP, this process can be easily handled by considering the supply chain capabilities, considering the purchase order cycle and payable management. The diagram below summarizes the overall processes to be included in order to fulfill the consignment requirements. The steps will be thoroughly illustrated below in details, considering the general ledger effect on a step by step.

Definition Consideration:

Item and vendor definition shall be thoroughly considered in the light of item and vendor “accounts”.

Item Card:

Consigned goods shall be defined within Dynamics GP, and linked to the following accounts:

- Inventory Account: Consignment /Inventory

Balance sheet Account

Typical balance: Debit

Account Category: Inventory - Cost of Goods Sold: Consignment/COGSProfit and Loss Account

Typical balance: Debit

Account Category: Cost of Goods Sold - Sales Account: Consignment/ SalesProfit and Loss Account

Typical balance: Credit

Account Category: Sales - Sales Return Account: Consignment/ Sales ReturnProfit and Loss Account

Typical balance: Debit

Account Category: Sales Returns - Inventory Return Account: Consignment/ Inventory ReturnBalance Sheet Account

Typical balance: Debit

Account Category: Inventory

Vendor Card:

The vendor card primarily requires two accounts which are the AP account and the Accrued purchases account. It would be quite important to separate the accrued purchase account for consignment items from the usual accrued purchases, for reconciliation purposes.

- Account Payable: AP Account

Balance sheet Account

Typical balance: Credit

Account Category: Accounts Payables - Accrued Purchases: Consignment OffsetBalance Sheet Account

Typical balance: Credit

Account Category: Inventory

The accrued purchase use seems odd in here, but doing so will net the inventory amount to zero when a shipment is posted, ensuring that no inventory value will be reported in the balance sheet for consigned goods.

Consignment Process Steps

Step One | Purchase Order (optional)

Once an agreement is finalized between the consignor and the consignee, a purchase order is issued to go through a predefined workflow to gain the required approvals before receiving the items.

Step Two | Receiving Transaction Entry

Consigned goods are to be received from the receiving transaction entry, considering the “Shipment Type”, there should not be any recognition of liability toward the items until these items are sold.

Once the shipment is posted, the following journal entry will be generated:

Account Debit Credit

Consignment/ Inventory X 0

”Accrued Purchase” Consignment/ Offset 0 x

Step Three| Sales Order processing

The consigned goods are processed through sales order processing to be sold at the agreed upon price which ensures profitability for both; the consignor and the consignee. Posting the sales invoice will generate the following Journal Entry:

Account Debit Credit

Consignment/ Inventory 0 X

Consignment/ COGS X 0Consignment/ Sales 0 X

Consignment/ AR X 0

Step Four | Purchasing Enter Match Invoice

At this phase, the consignee should enter an invoice for the shipment entered in step 2, the invoice will clear the consignment offset account and recognize the liability toward the vendor.

Here is the journal entry generated:

Account Debit Credit

”Accrued Purchase” Consignment/ Offset X 0

Accounts Payable 0 X

Step Five| AP Payment

At this phase, the consignee will issue a payment for the consigner to clear the liability recognized in the previous step.

Account Debit Credit

Accounts Payable X 0

Cash 0 X

Finally, as related to the consigned inventory stock count, it could be processed on a routine bases to track the quantities and report them accordingly to the consignor. To facilitate this process, consigned items can be separated in a specific inventory class to have common characteristics, and could be reported easily.

Best Regards,

Mahmoud M. AlSaadi

This was originally posted here.

Like

Like Report

Report

*This post is locked for comments