The new Tax Update's out, the new Tax Update's out...

Views (1111)

Belinda Allen

Belinda Allen

If you use GP US Payroll, you need to make sure you install Round 2 of the Payroll Tax update for 2011.

For 2011, the employer portion of FICA Social Security is 6.2%, while the employee portion of FICA Social Security has been dropped to 4.2%. Very confusing, I know.

Round 1 dropped both sides, so the paychecks would calculate correctly (at a rate of 4.2%.)

Round 2 corrects the Employer side. Please note that if you made tax deposits based on the reports created with payroll, you will need to make an additional payroll tax deposit for the employers additional 2%.

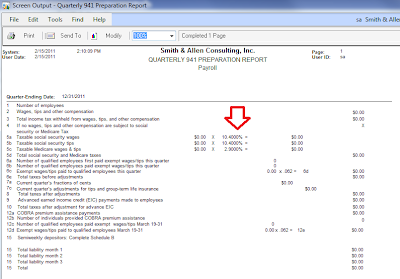

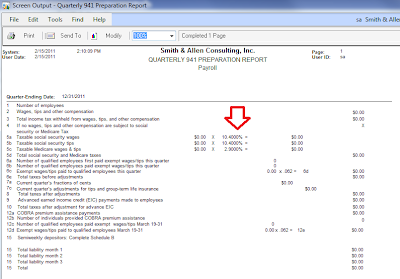

You can use your quarterly report, to help you calculate the difference you (may) owe the IRS.

For 2011, the employer portion of FICA Social Security is 6.2%, while the employee portion of FICA Social Security has been dropped to 4.2%. Very confusing, I know.

Round 1 dropped both sides, so the paychecks would calculate correctly (at a rate of 4.2%.)

Round 2 corrects the Employer side. Please note that if you made tax deposits based on the reports created with payroll, you will need to make an additional payroll tax deposit for the employers additional 2%.

You can use your quarterly report, to help you calculate the difference you (may) owe the IRS.

This was originally posted here.

Like

Like Report

Report

*This post is locked for comments