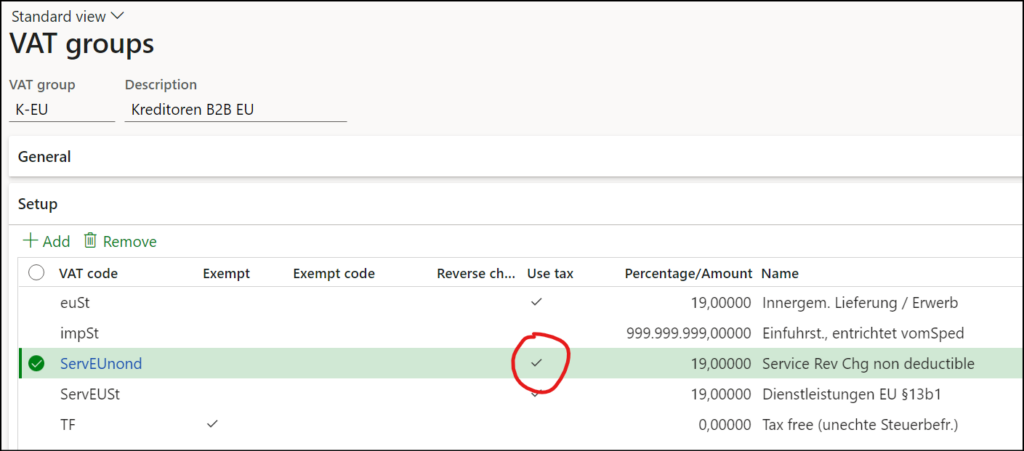

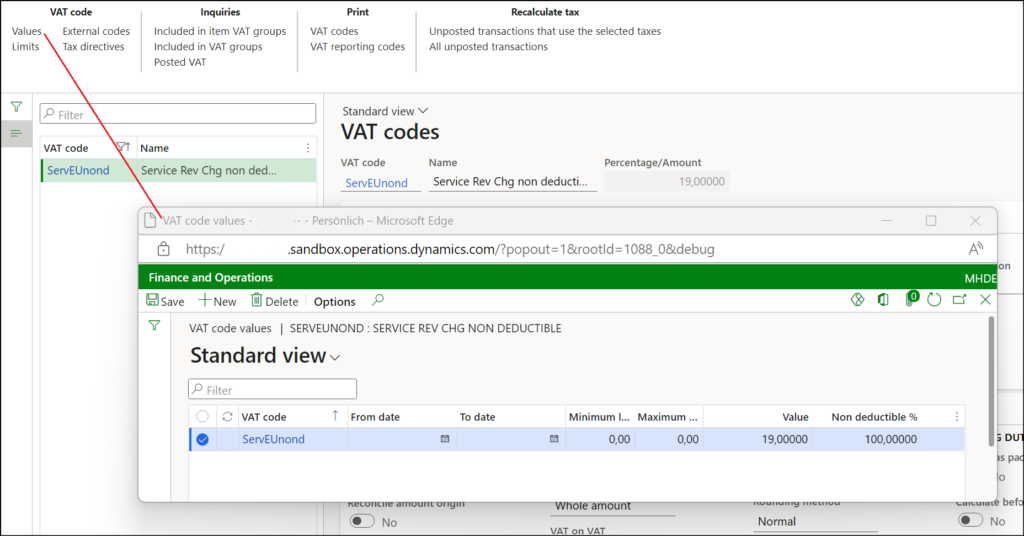

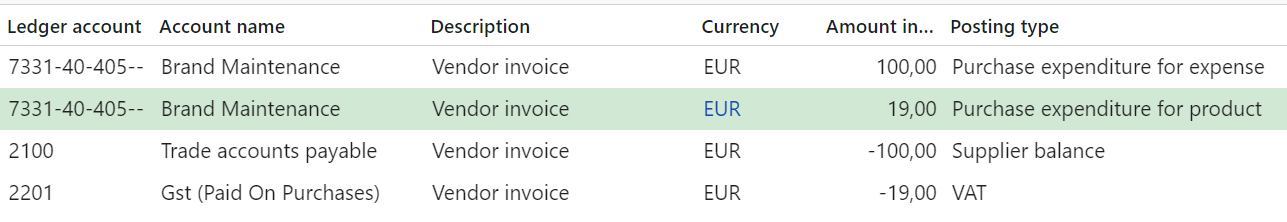

Sometimes you pay Reverse Charge in D365

Views (23)

Eugen Glasow

Eugen Glasow

The post Sometimes you pay Reverse Charge in D365 appeared first on ER-Consult.

This was originally posted here.

Like

Like Report

Report

*This post is locked for comments