Hi

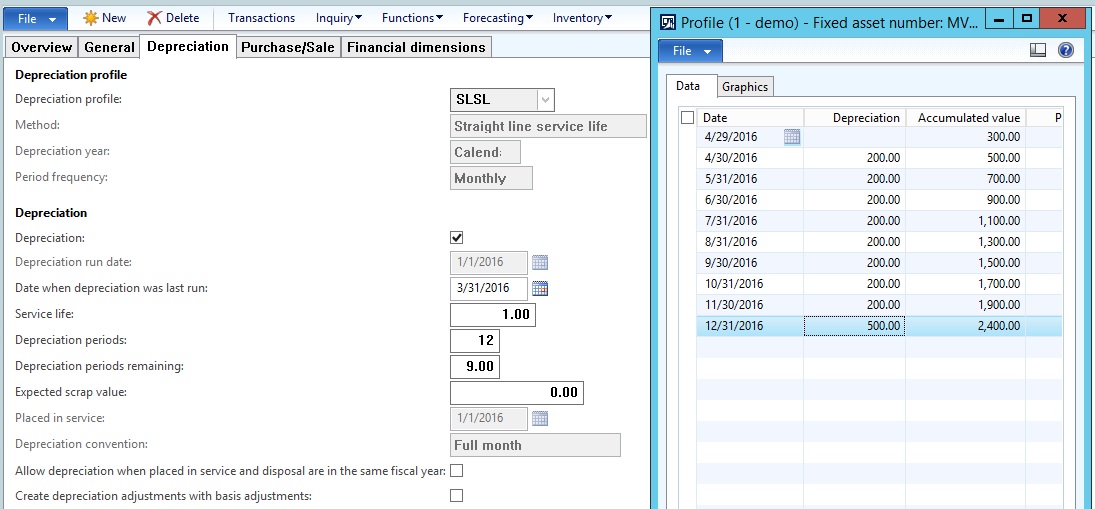

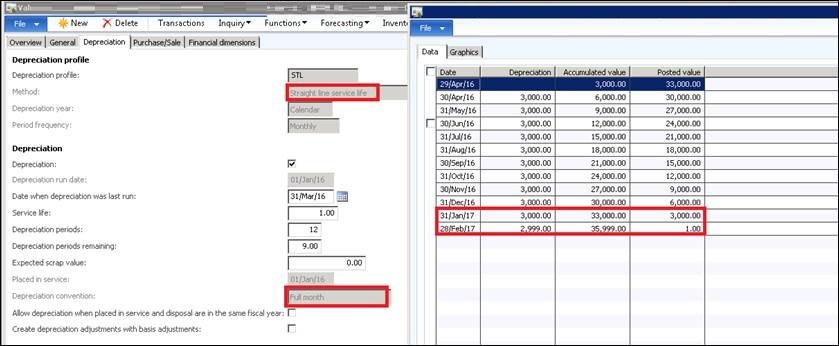

I am using a FA Straight Line Service Life method

eg 1/1/16 acquistion 1,200

service life = 12

monthly depreciation = 100/month

1/4/16 acquisition adjustion = 1200

depreciation for april onward = 200/month

I do want to to have adjustment happen on the last period.

How do i make the depreciation to run for 200/month until the FA is fully depreciated?

I tried in Ax2012 R2 should be able to do so

Refer to below

*This post is locked for comments

I have the same question (0)