Hello,

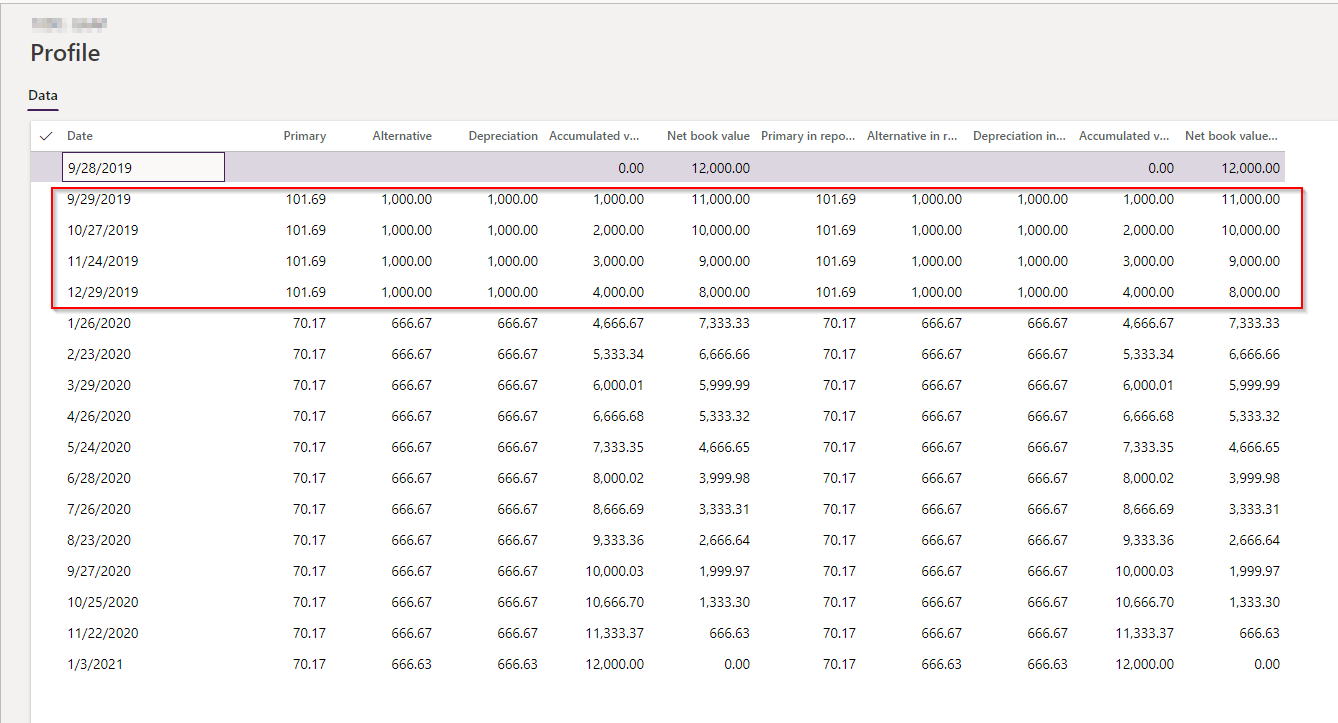

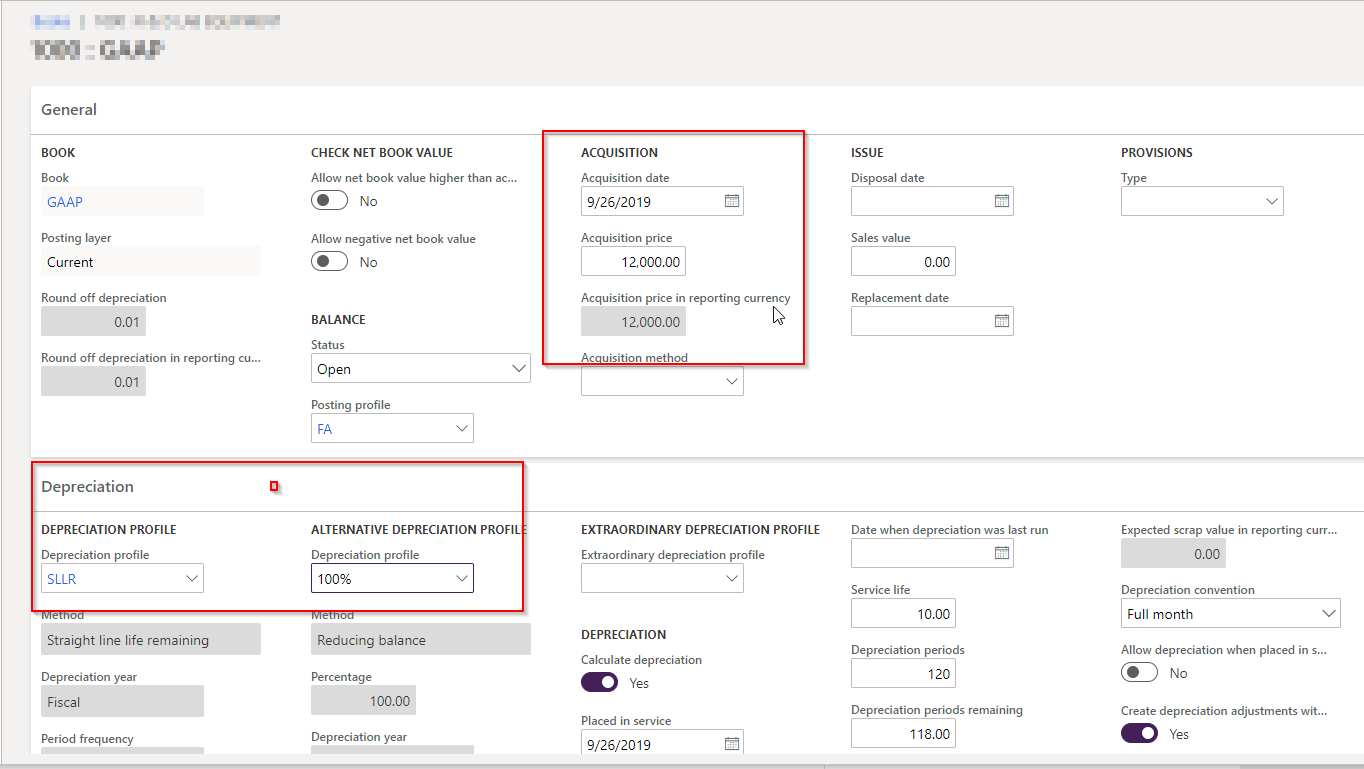

I am really confused the way my alternative depreciation is working. It is throwing me off a lot. I have an asset which has a life of 10 yrs and I have acquired it for $12,000 as of Sep 30, 2019. It has a straight line remaining set up as dep profile while the alternative depreciation is 100%. It is calculating depreciation of $1000 per month for the 1st 3 months, how? If I remove the alternative dep, then it is fine (100 per month) but with alternative depreciation why it is giving me 1000 per month for FY 2019. This is the GAAP book

Have a look at the profile, it is depreciating the whole asset in just 2 years why? How does alternative depreciation work?