Good morning Vinay,

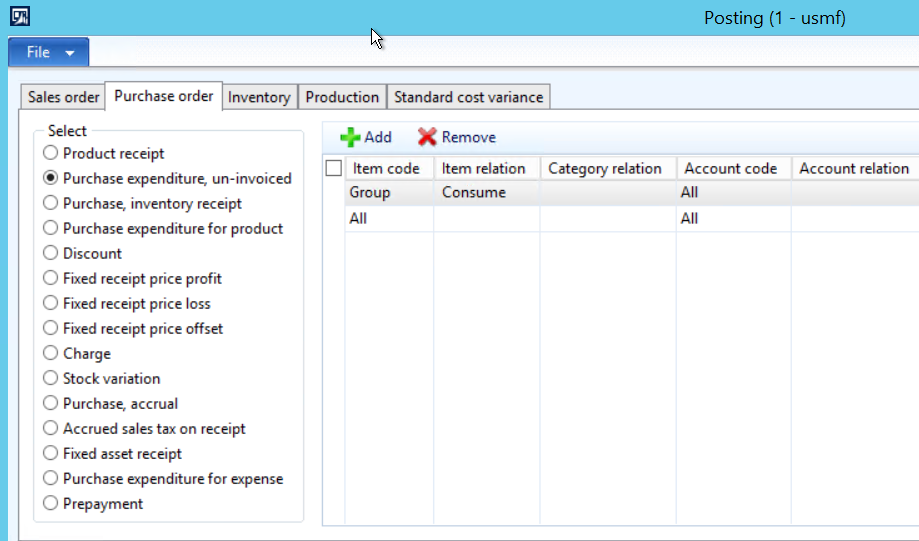

You can identify the transactions that will be posted from the inventory posting matrix that I shared in the next screenprint.

In general, for an ordinary stocked product, the following accounting vouchers are created:

Step 1: Product receipt posting

DR: Product receipt

CR: Purchase expenditure uninvoiced

DR: Purchase expenditure uninvoiced

CR: Purchase accrual

At the end of the day you have a posting that debits inventory and credits a liability account.

Step 2: Post invoice

This reverses all postings from step 1 and makes some additional entries. Usually as follows:

DR: Purchase inventory receipt

CR: Purchase expenditure for product

DR: purchase expenditure for product

CR: Accounts payable

These are a number of postings but by analyzing the transaction and posting type of your voucher you can easily see what is posted and when.

Best regards,

Ludwig