Hello,

I currently have a project that is classified as project type investment. There are a few POs that have been fully received/invoiced associated with this Project.

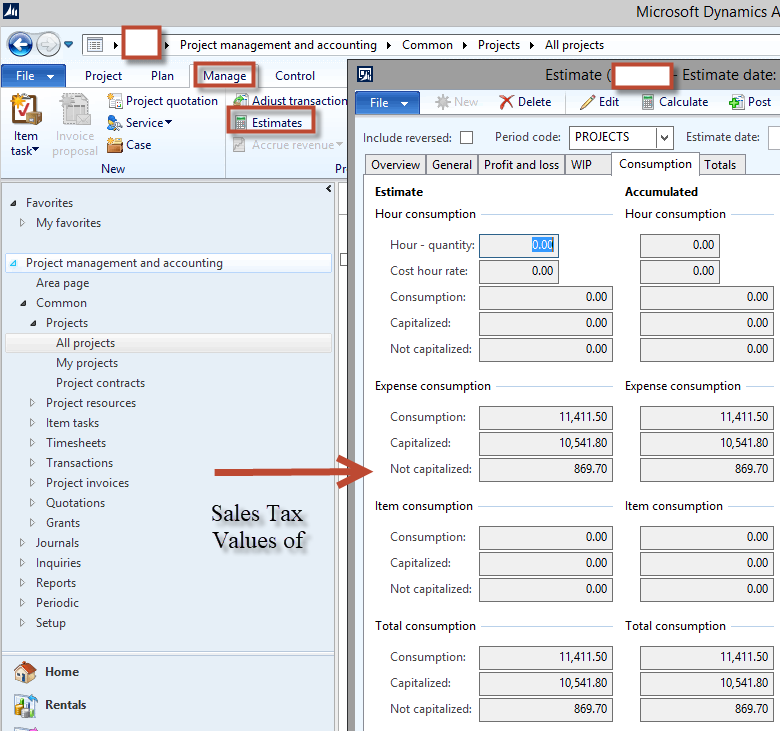

When I go to the header tab -> Manage -> Estimates and create an estimate, I notice that while reviewing the 'Consumption' tab the sum of all POs appears in the 'Consumption' field.

In the Capitalized field is the sum of the totals of all of the items purchased on the purchase orders (excluding tax). In the Not Capitalized field contains all of the sales tax for the project purchase orders.

Is there a way to have the sales tax included in the capitalized values?

*This post is locked for comments

I have the same question (0)