Hi PaladinSteve,

For 1) You are right that fee transactions are used for billable amounts without associated costs. However, at the time the fee journal is posted, there is no ledger voucher generated because this voucher is generated at the time you post the invoice. The only thing that a fee journal does is recording a transaction that can in a second step be invoiced.

For 2) You can use the pending vendor invoice form also for service transactions. This requires that you make use of a procurement category that is linked to a project category. I know that this is a hurdle for some accountants who are used to enter account numbers but you can overcome this fear for example by including the account number into the project category name.

You can of course, continue using journals for recording invoices but be aware that you might see those costs late at a project, which is not an issue as long as you have fast invoice throughput times. Yet, I experienced a situation where an invoice >1 mio requires a long time to get approved. Because the company also used journals and not the pending vendor invoice form, the saw the costs late - too late - at the project level. So, just keep this issue with the committed project costs in mind if you want to use journals.

For 3) Let's start with a T&M project, which is commonly used.

Here you have 3 options:

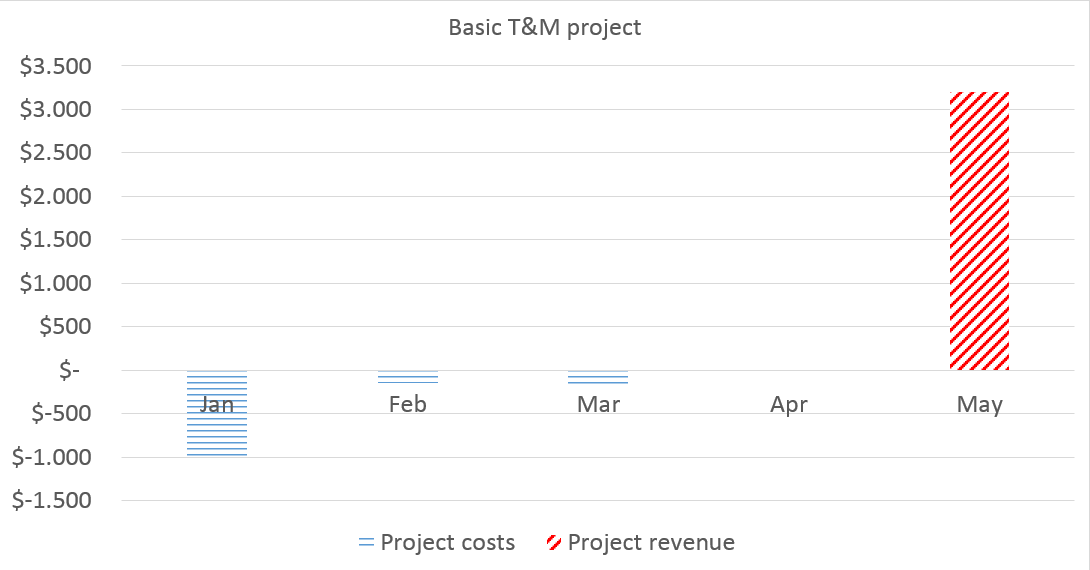

3.1. A basic T&M project where all costs post to P&L

You typically make use of that for short running projects where costs and revenues match within a single period. That is, where you often write invoices to your customers for the expenses recorded.

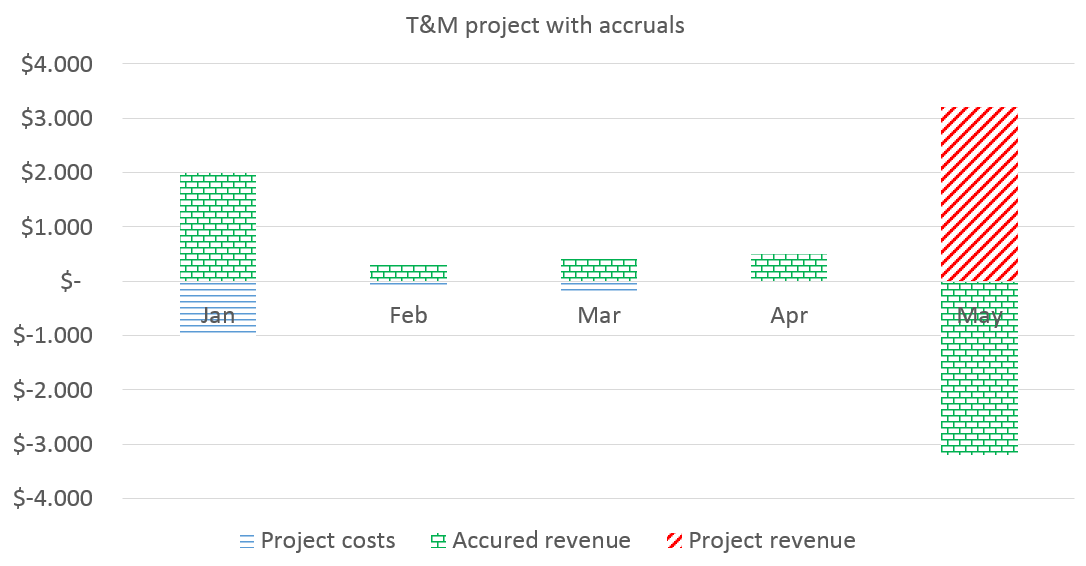

3.2. A T&M project with the accrual parameters active

You use this setup for longer running projects where you need a periodic match between costs and revenues. What happens here is that all costs are posted to a P&L account. At the same time, a revenue accrual is created based on the expected sales price. At the time an invoice is created, the revenue accrual is reversed and replaced with the actual invoice revenue account setup in the project posting profiles.

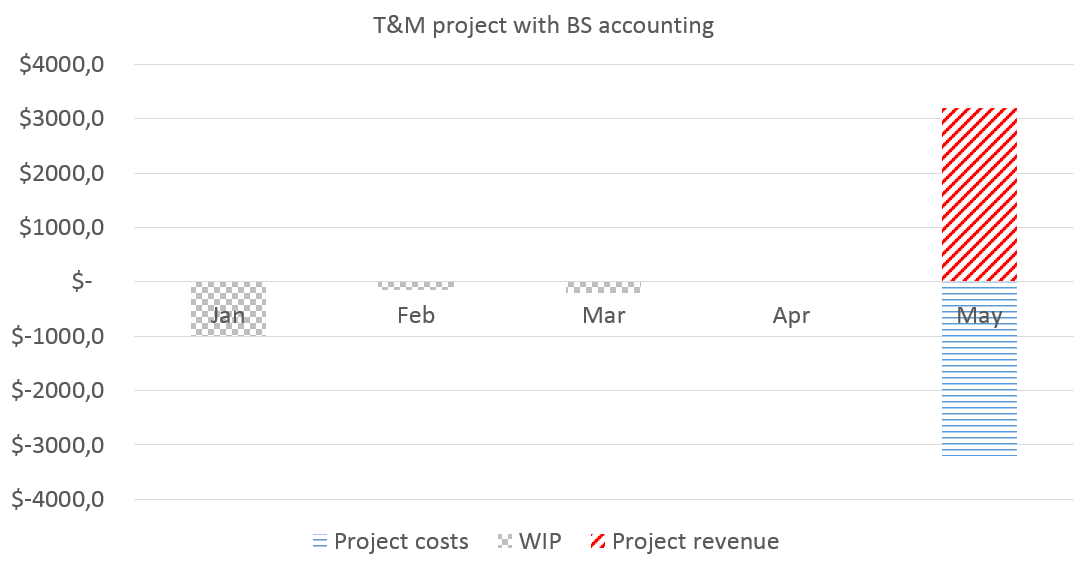

3.3. A T&M project with a Balance Sheet Accounting Setup

I have not seen this often in practice. What happens with this setup is that all costs are 'stored' in a WIP account in the balance sheet until you invoice the customer. At the time the invoice is created, the WIP postings are reversed and shifted to the project cost accounts. At the end of the day, you can compare costs and revenues at the time an invoice is created.

I attached you some screenprints below that illustrate the difference between those setups.

The graphics illustrate a situation where hours are posted in January, expenses in February, item costs in March, fees in April and the invoice in May.

Hope this helps.

Best regards,

Ludwig