Hello Experts,

I am noticed that a difference between individual tax amount before (Temporary sales tax transaction from action pane Sell tab -> Tax group -> Sales tax) and after (Posted sales tax from invoice journal screen). Attached the screen shot as bellow,

Temporary sales tax transaction screen.

Actual tax for highlighted row = 3511 * (15 / 100) = 526.65

Debugged the Temporary sales tax transaction calculation and figure out the following steps,

1. Base tax - Sales subtotal / (tax code), Here we are using 15%.

2. Calculated tax at run time - Calculate the individual item sales tax and fill the temporary table and takes sum of the calculation.

3. Calculated difference - Calculated tax at run time - Base tax

4. Find the biggest calculated tax amount and subtract the Calculated difference (from Step 3).

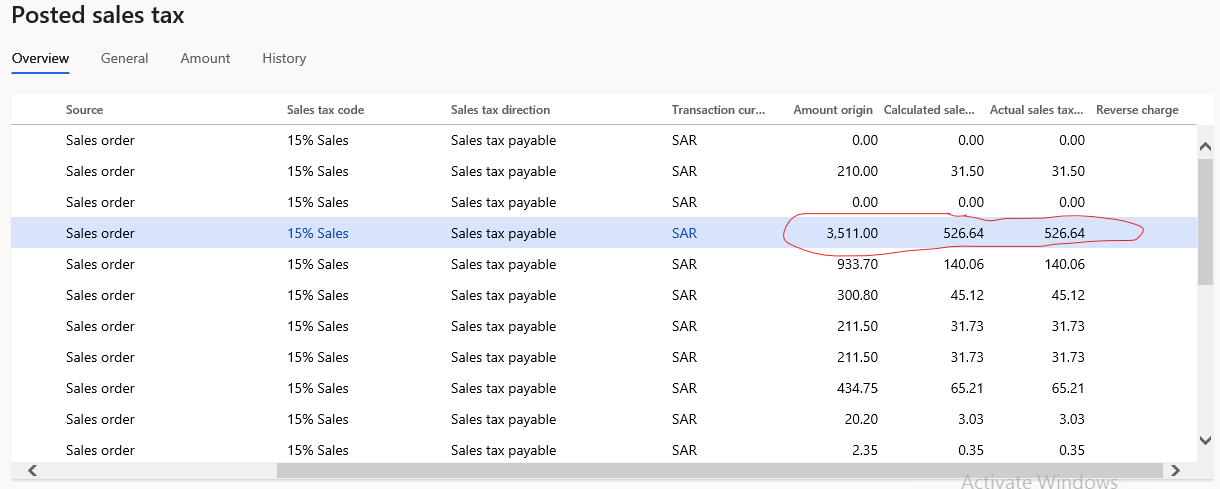

Posted sales tax screen for above same row.

How the calculation are made in FinOps and excited to looking forward to the tax calculation methodology using in FinOps. Any help would be appreciated.

Thank you.