Revan,

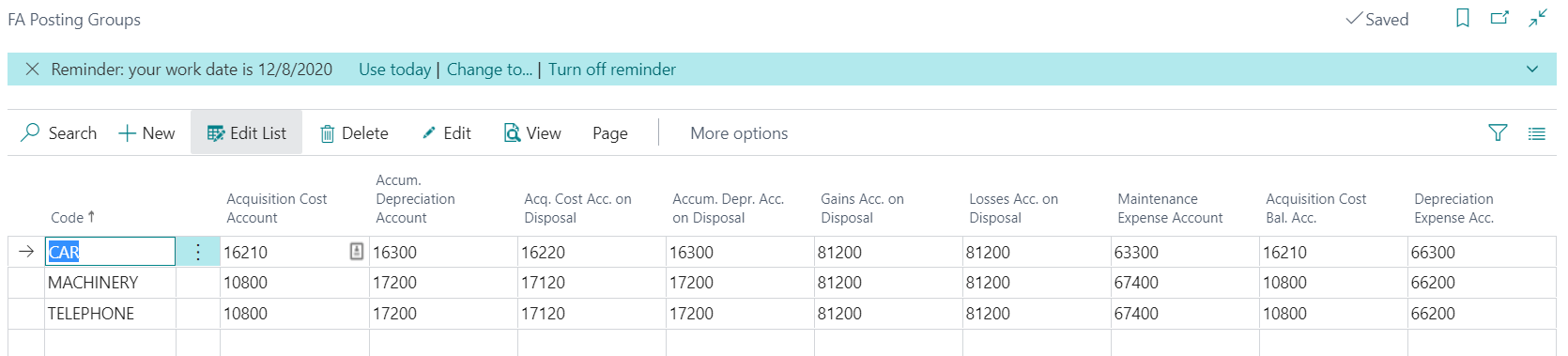

The FA Posting Group is like the General Posting Setup or Inventory Posting Setup in that it relates the fixed asset transaction to the correct G/L Account. I normally fill in all of them, except Maintenance if I am not posting Maintenance entries. I also setup 1 FA Posting Group by my Assets Type or different Chart of Accounts (i.e. Buildings, Leasehold Improvements, FF&E, Machinery, Automobiles, etc..). Here is an overview of the main columns:

Acquisition Cost - This is Balance Sheet Account where Fixed Assets are reflected (additions)

Accum. Depreciation - This is the Balancing Account when running and posting Depreciation. This account appears in the Balance Sheet next to Acquisition G/L Account

Acq. Cost Acc. on Disposal - This is the G/L Account that when a Fixed Asset is disposed will record the reversal of the Acquisition Cost. In other words, its a contra-account to the Acquisition Account. Normally, this account is the same as the Acquisition Cost account, unless you like keeping it separate.

Accum. Depr. Acc. on Disposal - This is the G/L Account that when a Fixed Asset is disposed will record the reversal of the Accum. Depreciation. In other words, its a contra-account to the Accum. Depreciation Account. Normally, this account is the same as the Accum. Depreciation account, unless you like keeping it separate.

Gains Acc. on Disposal/ Losses Acc. on Disposal - Both of these are the G/L Account that when a Disposal is posted record the NET Gain or Loss on Disposing the Fixed Asset. In most cases the G/L Account is the same. To determine a Gain or Loss you take the Acquisition Cost minus Accum. Depreciation = Net Book Value. Now take the Net Book Value and apply any proceeds received for disposing the Fixed Asset. If the proceeds are greater you have a Gain and if less you have a loss (i.e. Acq. Cost = 10,000, Accum Depr = 5,000, NBV = 5,000, Proceeds = 2,500, Loss of Disposal = 2,500).

Depreciation Expense - This is the G/L Account used when posting Depreciation Expense.

Hope this answers your question.

Thanks,

Steve