Jim,

This is answered from an operating rather than technical perspective. We have had vendors that make the same request, and the way we have handled this is to treat the purchase as a prepayment ( prepayment on the face of the PO or as a manual prepayment added to a payment batch). We enter the header for the invoice in Enter/Match Invoices so as not to lose track of it but keep it in a preliminary status until we are able to match it. When the goods are received, we match the invoice and the system prepayments automatically apply to the invoice.

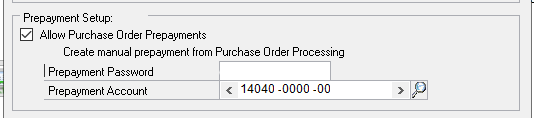

To use the system prepayments will require setup if you have not setup prepayments before - in Purchase Order Processing Setup, check "Allow Purchase Order Prepayments" and "Create manual prepayment from Purchase Order Processing", add the Prepayment Account (asset account to be debited) to be used in the transaction. You will want this to be a posting account.

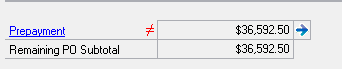

Next, in the purchase order enter the prepayment amount in the Prepayment field of the PO Entry. There will be a red ≠ when the amount is entered until it has been paid.

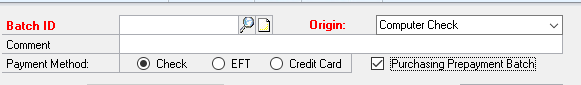

To create the prepayment, build the payment batch. Check the box "Purchasing Prepayment Batch". This batch will only accept prepayment purchase orders.

Build the batch by selecting the POs that have a prepayment on them. When you print the payments, the PO number will appear as the voucher number rather than the invoice number that is usually there.

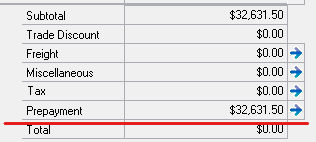

The outstanding payment for the vendor is carried in the books until the goods are received and invoiced. The prepayment will be automatically applied to the invoice upon matching, and shows up on the line above the total.

This does not recognize any liability or expense until the goods are received, but sounds like that is what you are after.

As far as auditors and transferring title at point of dispatch, I would handle this with a manual journal entry at the end of the period debiting "inventory in transit" and crediting an appropriate liability account.

Sharon