Hello Experts,

I need to know how can i process a Import transactions through Purchase Order? Below is my scenario:

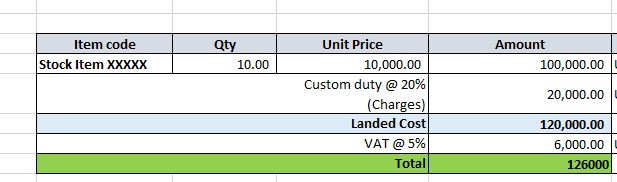

In the Above example, I am importing stock item from USA. After the item reaches to UK territory, I have to pay Customs duty @ 20% on the Item value (100,000.00) and VAT @ 5% on the landed cost i.e. Item value + customs duty (100,00.00 + 20,000.00). The Custom duty and VAT amount are paid to customs department. The VAT amount has to be recorded in the Input VAT ledger account, which later will be considered during 'Settle and post VAT' declaration process.

I am thinking of below steps to configure the above example:

1. Custom duty as Charge code - In this charge code Item will be debited and Credit will be the (Customs duty payable ledger account).

2. VAT@5% as VAT code - In this VAT % to be defined. (In the calculation parameters - in the Origin field "Percentage of net amount" in the Margin base field "Net amount of invoice balance"

3. Import VAT group - In this VAT group VAT@5% code is assigned.

4. Item VAT group - In this VAT group VAT@5% code is assigned.

Creating a purchase order and assigning the Customs duty as charges to it. In the lines selecting the Item code and assigning the Import VAT group and Item VAT group. But after i post the VAT amount is not calculating on the landed cost.

So please help me how can I achieve the above scenario in D365 for finance and operations.