Hi,

I´m trying to understand why do we need these two different forms:

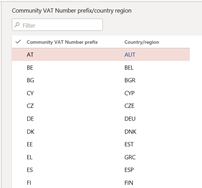

1. Community VAT number prefix/country region --> Is this to have in the "EU sales list" report the country code informed?? Anything else?

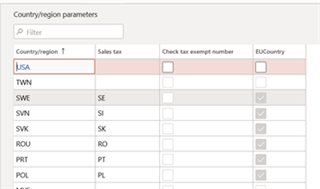

2. Country / region parameters --> why do we inform here the Sales tax column with the country code? Isn't it enough with the form from point 1?

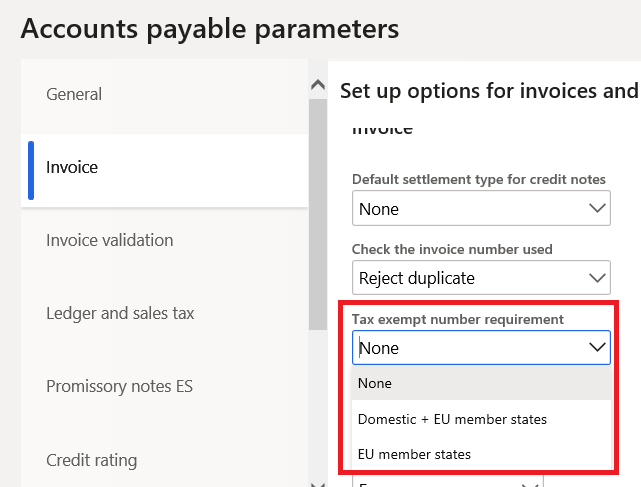

What are the implications of ticking/unticking

* Check tax exempt number --> Isn't this controlled by this parameter?:

* EU country - goes to the EU sales list report or does not go?

Also, question that applies to both forms above. Is there any data entity that can be used to copy the information from one company to another or from one environment to another?