Hello,

I am trying to configure the VAT declaration Excel (SE) for Sweden. Using same sales tax codes and same codes on the report setup for the sales tax codes as Microsoft recommended Sales tax report for Sweden - Finance | Dynamics 365 | Microsoft Docs

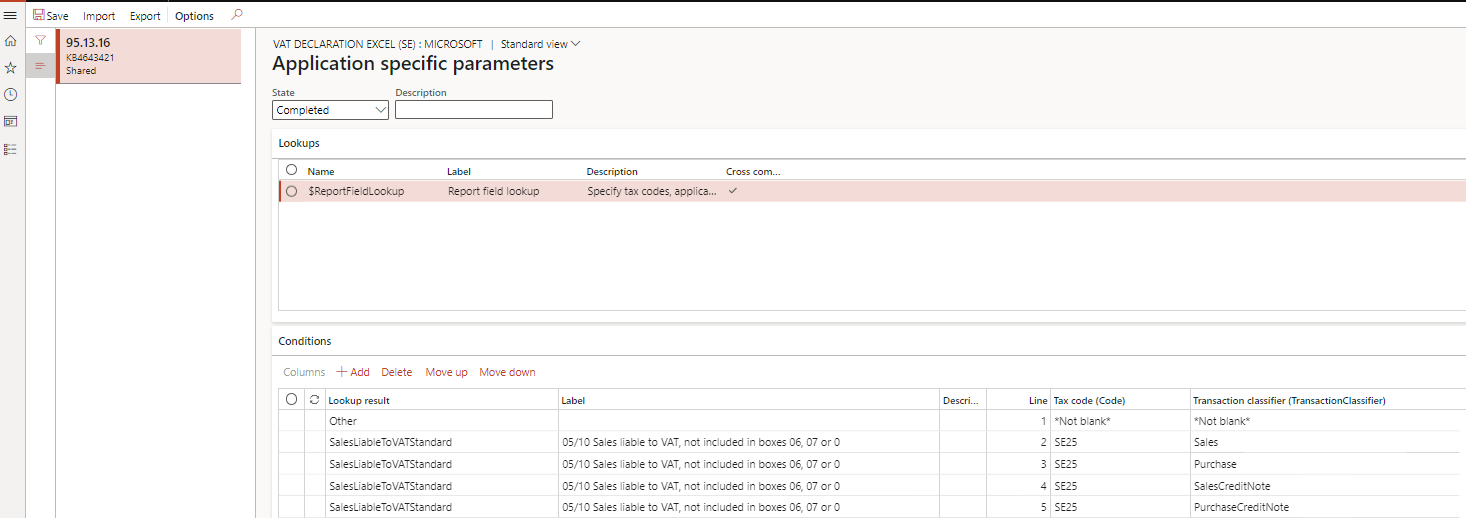

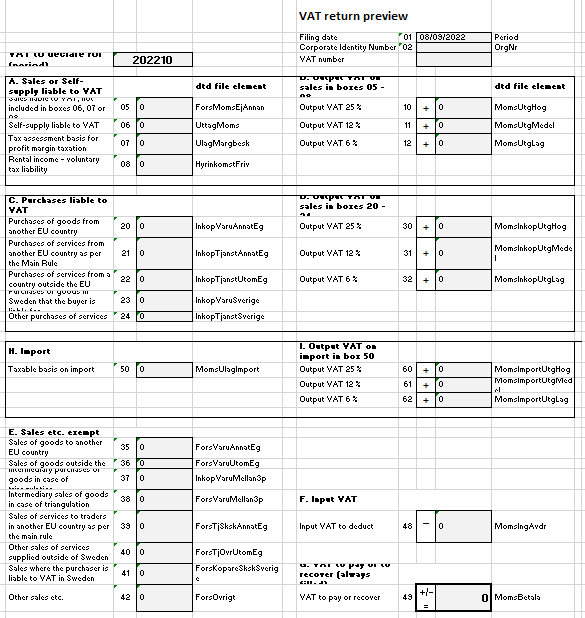

However, I am facing some problems at the time of generating the "Report sales tax for settlement period". The reason why I am not able to achieve the same information recorded in the tax in D365 and the report with the value in the correct boxes is due to the configuration of VAT declaration Excel which is appearing at Electronic reporting Workspace/Reporting Configurations/Tax Declaration Model/VAT Declaration XML (SE)/VAT Declaration Excel (SE)/Configuration/Setup (It is the version 95.13.16 as Microsoft recommended)

The Configuration under the conditions is the part that I am not able to do in order to obtain the correct results in the "Report sales tax for settlement period". Does anyone have an example about how should this be completed?

This are the steps that I followed but I am not obtaining any values in the report.

If I read this documentation correctly. VAT declaration (Sweden) - Finance | Dynamics 365 | Microsoft Docs

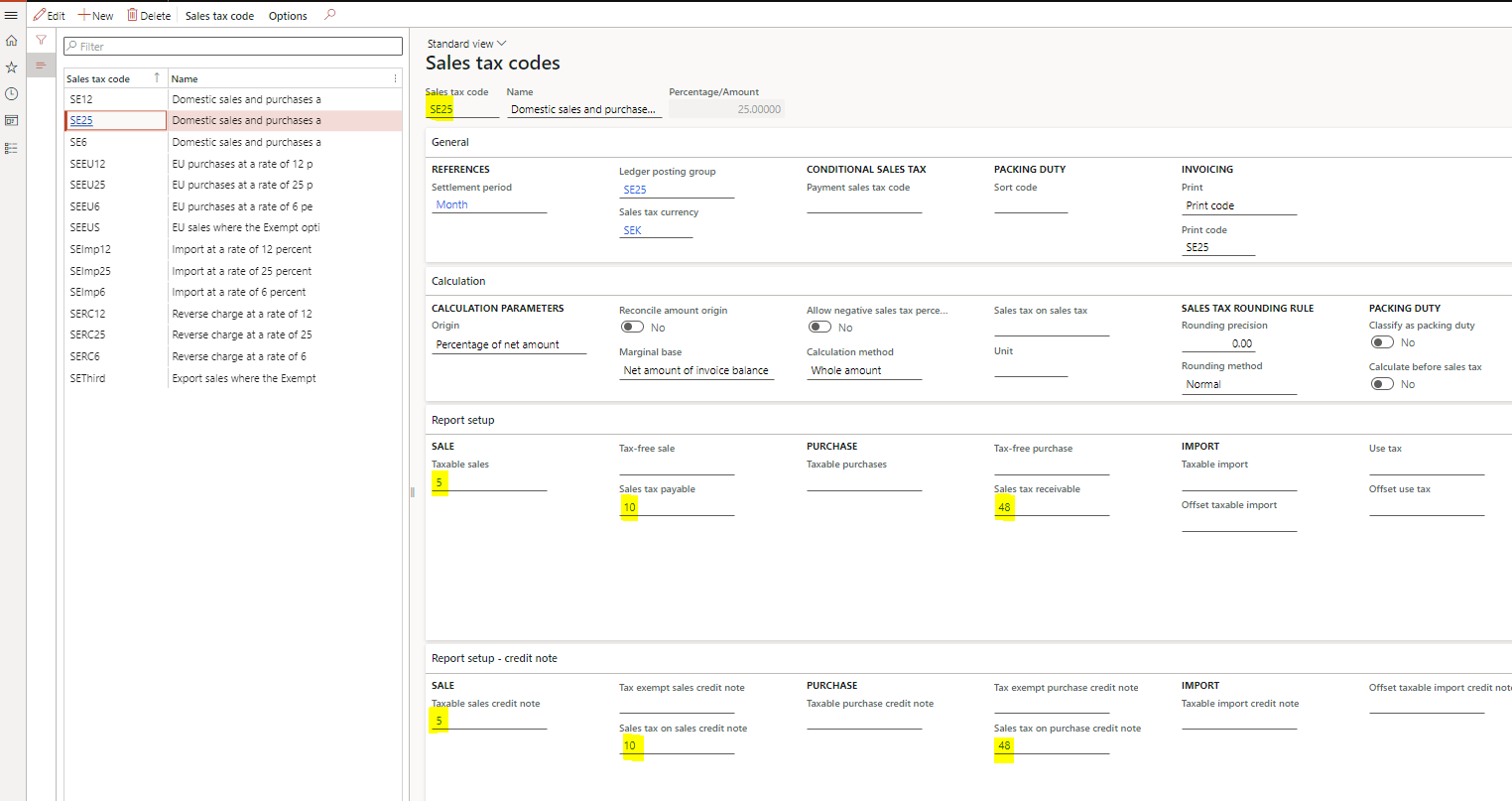

- If I use the VAT code SE25 for a customer invoice. I should include Lookup result SalesLiableToVATStandard (05/10) with code "SE25" (I included all the possible options Sales, Purchase and credit note of both)

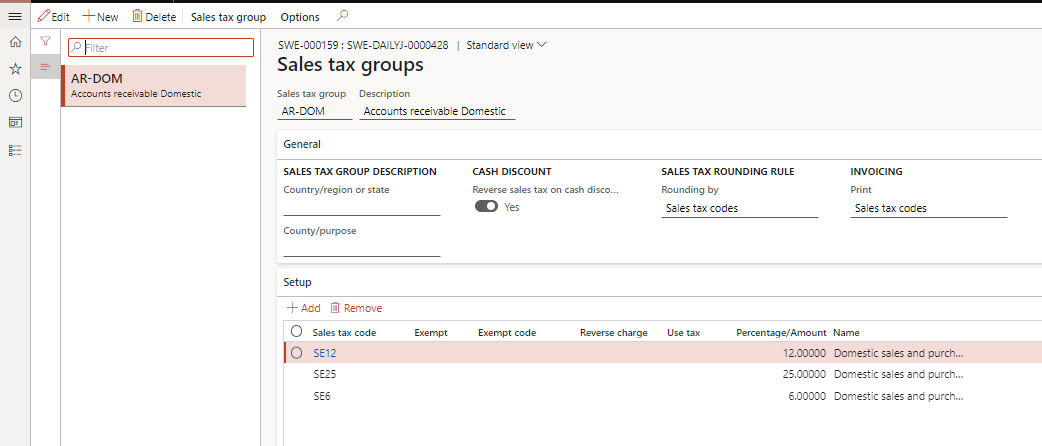

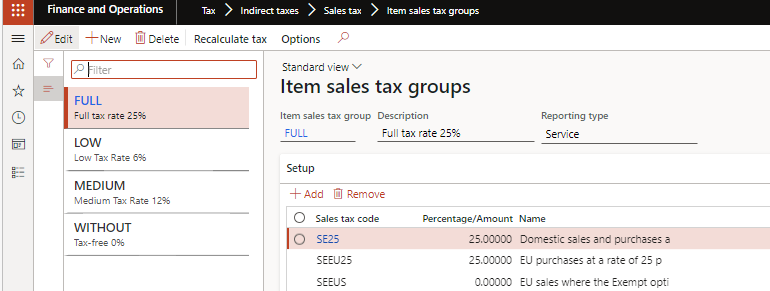

Transaction processed in the system (General ledger journal contain Sales tax group AR-DOM and Item sales tax code FULL)

Sales tax group AR-DOM contain the SE25

Item sales tax code FULL contain the SE25

Sales tax code SE25 with the codes in the report setup

However, the Report sales tax for settlement period is appearing as 0 for all the categories

Both transaction and report done in October.