Hi All,

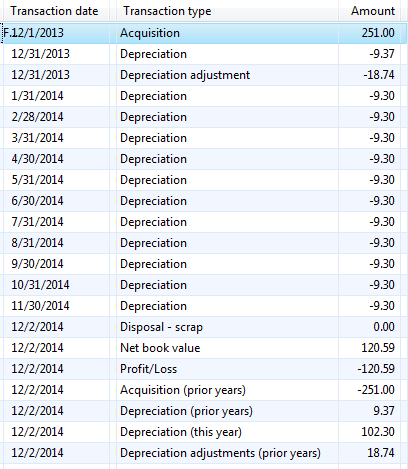

I have a question in regards to how depreciation adjustments are calculated by the system. The fixed asset in question was placed in service on 10/1/13 and the acquisition date is 12/1/13. In this example the depreciation per month should be -$9.37. The depreciation for the previous 2 months, -$18.74, shows up as a depreciation adjustment when the depreciation process is run on 12/31/2013. My understanding is that this amount of $18.74 should show up as "depreciation" instead of "depreciation adjustment". The issue here is that when we disposed of the fixed asset on 12/2/2014, the depreciation adjustment amount is not calculated in the profit/loss. The loss on this asset is -$120.59 when it should actually be -$139.33 (120.59+18.74). In the transactions screen it looks to me that the depreciation from previous years is "reversed". Can anyone please help me understand how depreciation adjustments work and why this is not included in the profit/loss?

(We are using AX 2012 R2 RTM)

Thanks in advance for your continued help!

*This post is locked for comments

I have the same question (0)