Hello zkasmani,

How are you going in to generate the Vendor 1099s? Is it via this path: AP > Periodic tasks > Tax 1099 > Tax 1099 detail report ?

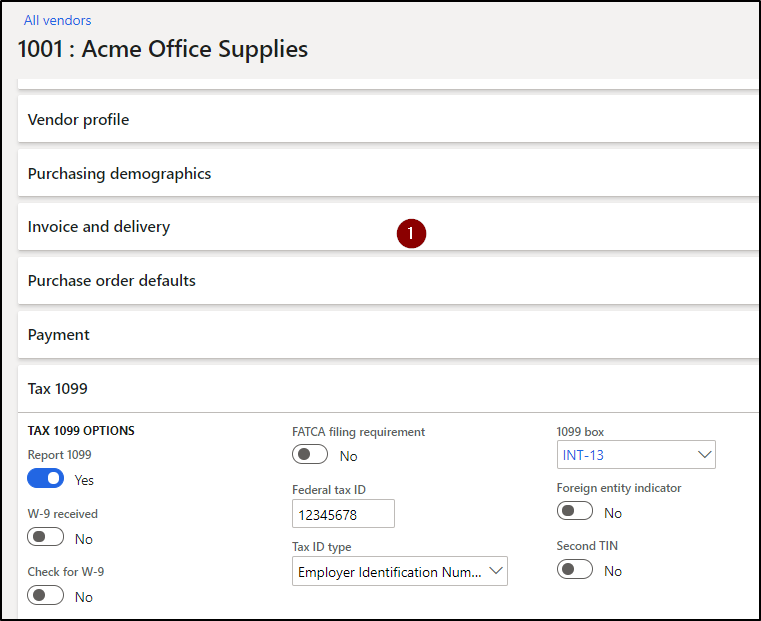

In my example test, I took a vendor (1001) and gave them a single 1099 box of "INT-13".

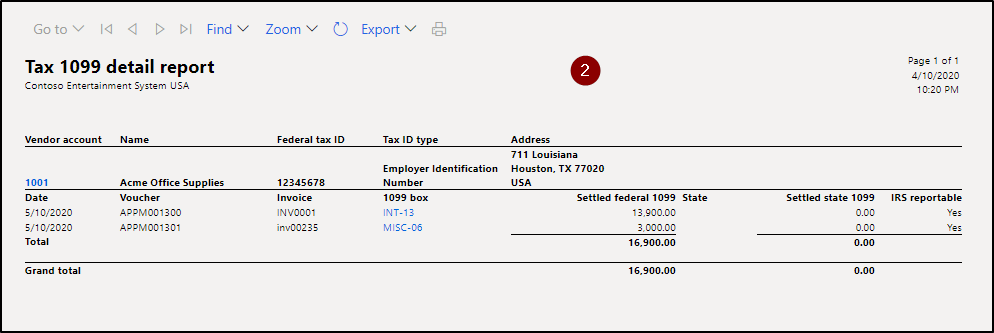

Then I created 2 PO's for this vendor; invoiced and paid both of them. 1 PO had a 1099 box = INT-13 (vendor default), the other had a 1099 box of "MISC-06".

As we can see, they both pulled into my report.

Also of note, in order for them to pull into the report, the total payments for that 1099 box will have to exceed the amount you have defined in your system: AP > Periodic tasks > Tax 1099 > 1099 fields

- this is where the threshold is stored for each box.

In my scenario, any payments over $0.01 for INT-13 will populate our 1099 form. And any total payments over $600.00 for MISC-06 will populate the form.

Please let me know if this was what you're referring to.

And please correct any misunderstandings / misinterpretations.

Thanks so much!