Good Day

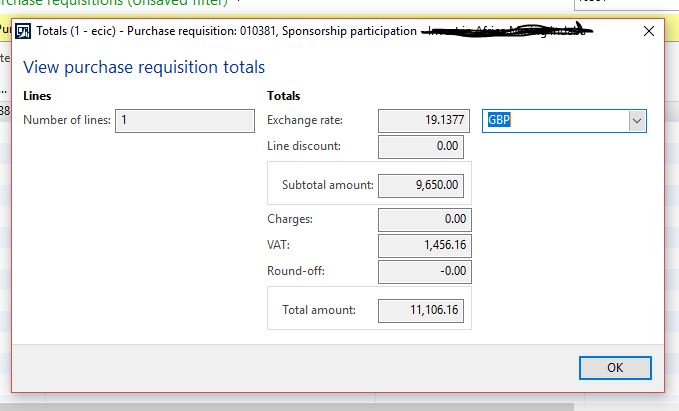

I have a Purchase requisition which is calculated as GBP -Pound.

We are using rands, but we have other currencies that are used.

The pound exchange rate is correct.

The amount is 9650 pounds and the vat is calculated at 15%. The vat amount should be 1447.5

The screenshot below shows that the vat is 1456.16.

Please assist

*This post is locked for comments

I have the same question (0)