Hi Ludwig,

Thanks for your feedback.

I have inserted my comments in green:

You have a fixed asset group "FPM03-S12C", right? – Correct

This group has two value models assigned (TXPM and FAPM), right? - Correct, FAPM was created to calculate depreciation using the Straight Line Life Remaining method (value model), TXPM was created to calculate taxation over 4 years. Year 1 40%, Year 2 20%, Year 3 20%, Year 4 20% (depreciation books)

FAPM uses the straight line depreciation and TXPM the manual depreciation plan, right? - Correct

The TXPM has a different fixed asset calendar assigned that follows the calendar year, right? No - FAPM: Method - Straight line life remaining, Depreciation year - Accounting or financial, Period frequency - Financial period. TXPM: Method - Manual, Depreciation year - Accounting or financial, Period frequency - Yearly

Did you link the fixed asset books? - Yes, derived depreciation books were linked (capture 8 & 9)

If so, for what transactions? An acquisition for R135,000.00 was created on 31/03/2017 - Correct

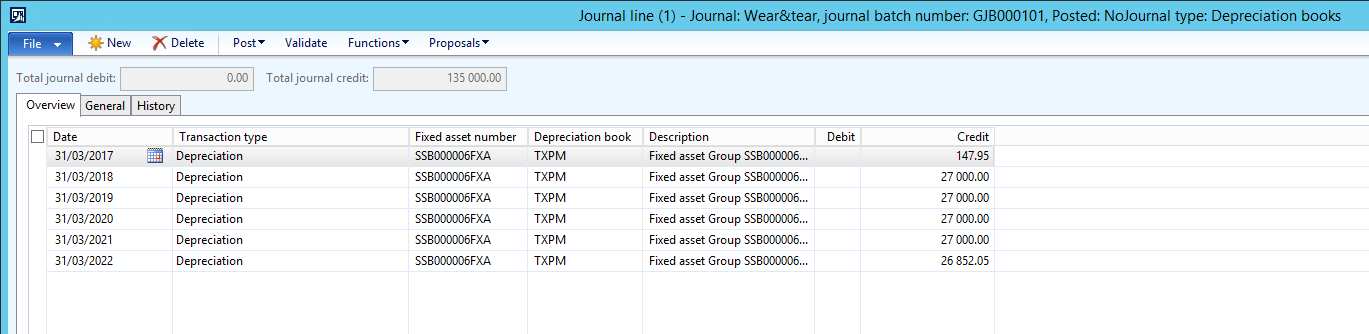

How did you create the excel sheet? I have attached the sheet for you, the section highlighted in green is what I expected the depreciation and tax should be, and is formula driven. The section highlighted in orange is the output from AX relating to depreciation (run depreciation proposal) and is in agreement with our calculations (capture10). The section highlighted in blue is the output from AX relating to taxation (run depreciation book journal) and does not agree to our calculations (capture 11) (capture 12).

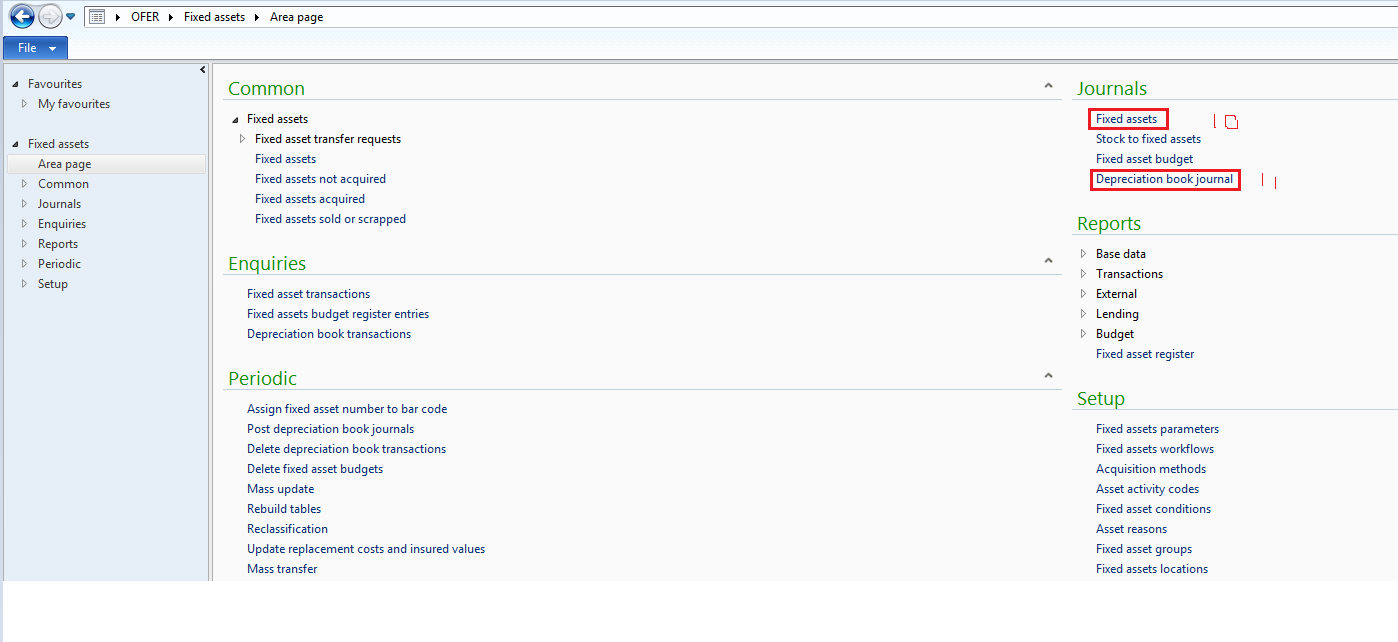

Is this the fixed asset depreciation proposal or something self-created? - FAPM - fixed asset depreciation proposal is used. TXPM – depreciation book journal depreciation proposal is used (capture 12).

Have you checked the profiles of your two books? Yes – they correspond (capture 13 & capture 14)

Kind Regards