Hello experts,

I am trying to automate the calculation for the Withhold taxes in the Accounts payable module. In order to make it a streamlined process, I must calculate the VAT 16% from all the vendor invoices, so the Base amount is used to calculate the Withholding taxes in the Payment journal. Consider the following:

- I am working for a Non-Profit organization, then some of those paid taxes (VAT 16%) are subject to be recovered from the Fiscal authority.

- We use Projects to debit the expenses to the company.

- With that said, when the VAT 16% is not recoverable, the whole invoice amount must be charged to the Expense account (via Projects)

The problem:

- The company is only using a Sales tax code to calculate the VAT 16 when it is recoverable, they do not record the VAT when it is not recoverable; naturally, the invoice journal only Debits Project and Credits Vendor.

- If I try to calculate the Withholding taxes without the VAT, the calculation is incorrect, because it won't be using the Base amount.

As I said, I must set up the VAT calculation for all invoices, but then the expense will not be recorded in the Project, instead, It would go to a VAT Payable account. We do not want this. So I came out with the possible workarounds:

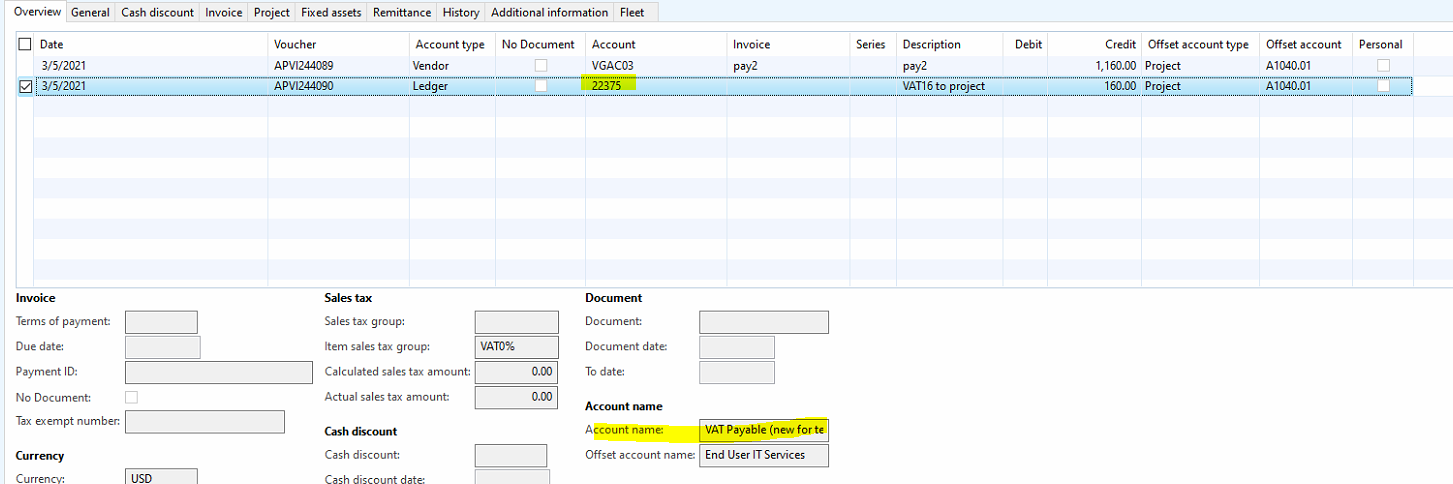

- In the same invoice journal, there should be an offsetting transaction for the VAT and charge the full invoice to the Project. Screenshot bellow.

- Post all the invoices. At the end of the exercise (month-end closing), there should be a General Journal entry to offset the balance in the VAT payable account and charge the full invoice to the projects

The questions: Is there an automatic process to settle the balance in the VAT account and charge the full amount to the Projects?

Is there another way to configure the Tax codes so I get the Base amount to calculate the Withholding taxes (and the full invoice is charged to the Projects)?

Thanks!