Hello all -

I have a client that needs to post sales tax amounts to one of their general ledger only entities. Since the accounts are shared between all entities they get an error when trying to post to one of these accounts on their trial balance upload stating that a sales tax code is required for ledger accounts marked as posting type 'Sales Tax'. They do not have the tax module configured in this ledger only entity. Is there a work around that will allow them to post manual journals to tax accounts without specifying sales tax codes?

Below is note I received from the client regarding this issue.

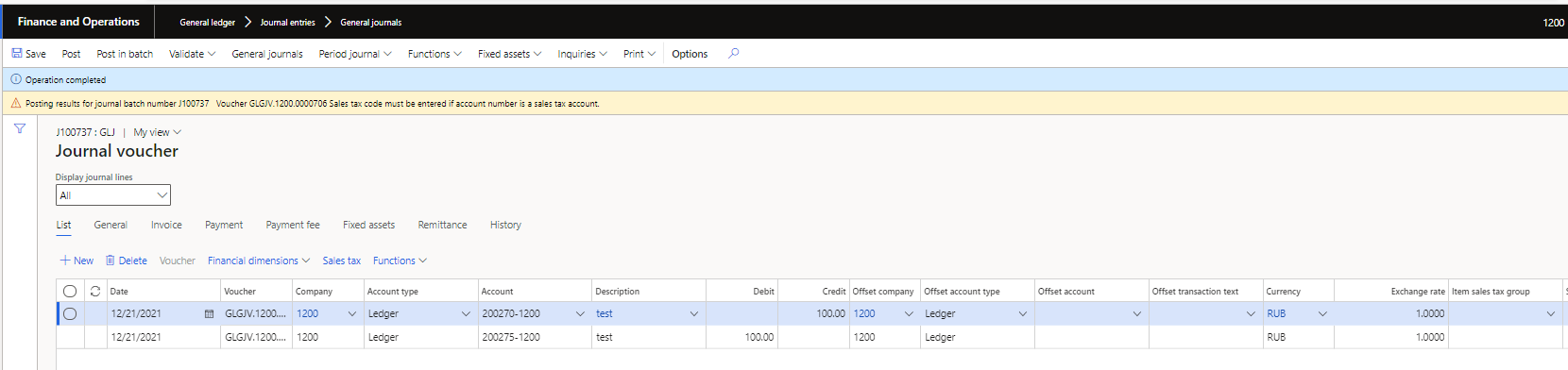

In the Russia entity (1200) which is a General Ledger only country, our accountants are trying to start making GJ entries to tax main accounts (200270 200275 & 200300) to make D365 reflect the balances in our external accounting firm's accounting system ledger.

When trying to post GJ entries directly to main accounts that are defined as Sales Tax accounts, we get error messages from D365 and can't post the entries (see attached).

In the General Ledger>Main Accounts, these 3 accounts are setup as "Sales Tax" Posting Type.

In the Russian entity we have only the most basic Sales Tax Categories/Codes setup.

We are looking for suggestions on how to configure D365 in the Russia entity to allow for GJ entries to be posted directly to main account #s 200270, 200275 and 200300.

Thanks in advance for any advice offered.