Hello!

I have further questions concerning a possible calculation Setup in AX also concerning machine hour rate.

Once I have calculated the rate for certain maschines or maschine Groups, what is the best way to apply them to the calculation of the finish product?

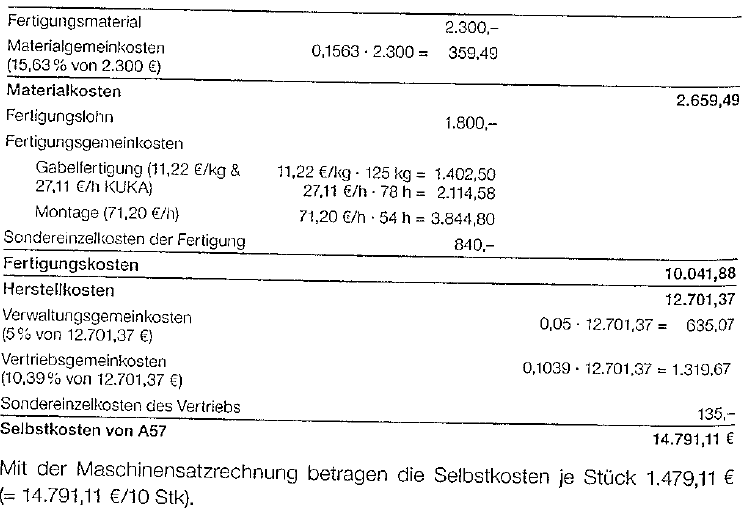

a) Include the machine hour rate in a resource and then include the resource in a Primary or secondary work step of the routes of the finish product next to the work step for the direct Labor (direct costs) or

b) Setup the machine hour rate as a surcharge or rate in the costing sheet?

c) Can I Setup indirect cost per KG (weight of the material)?

d) How can we setup Special direct costs for production in the costing sheet?

e) If we calculate production costs (Herstellkosten) with the costing sheet which we want to activate as a basic Standard cost Price, should then be the surcharges for administration and sales be in included in the Profit Setup of the cost Groups or calculation Groups respectively in order to determine the net costs (Selbstkosten).

And if we add the margin to the surchage percentage we could calculate the sales Price? Or is there a different way to achieve a parallel calculation of production costs and net costs?

Are there any other general recommendations to my questions or or best practise?

Another question would be if it is possible to implement an activity based costing or at least an activity oriented product calculation in AX? If possible is there a brief instruction possible how that could be implemented?

Thank you very much!