Hi Everyone,

I rerun a vendor aging and compared this aging on the previous report and found out that my aging balance are not the same. Found the variance but I can't find the reason why I have missing invoices for this vendor. Maybe I have the wrong criteria.

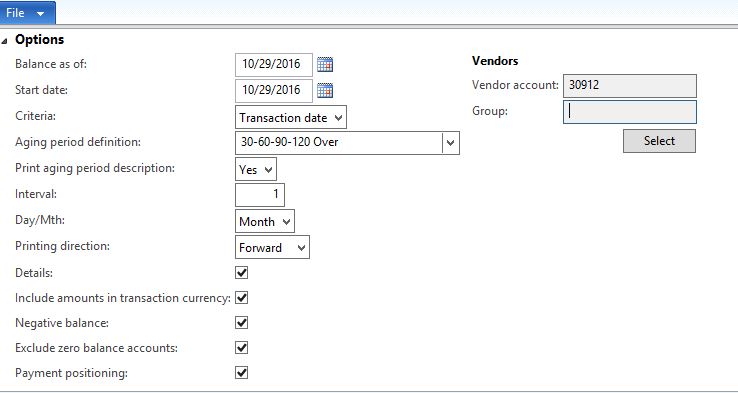

.1 Criteria used for the aging report, I need to get vendor aging for OCT29, 2016

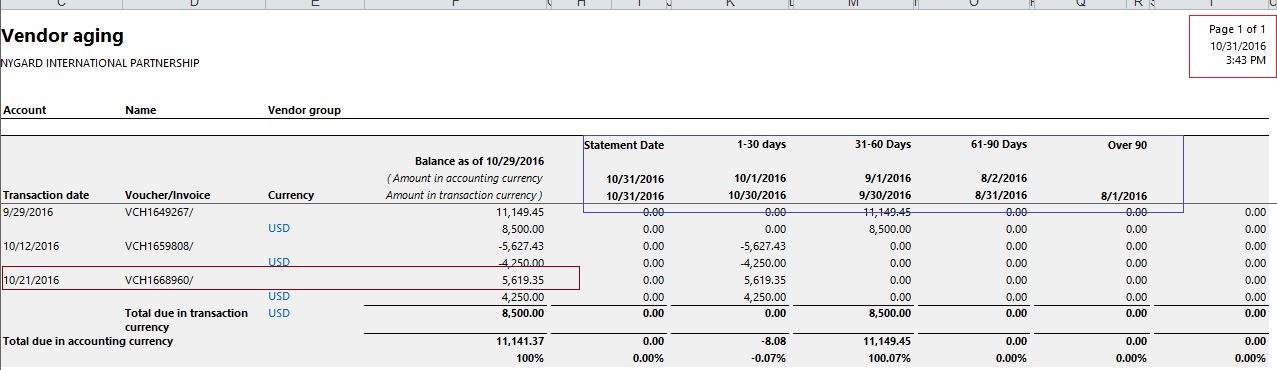

.2 Run date is OCT31, 2016, 3 invoices are outstanding

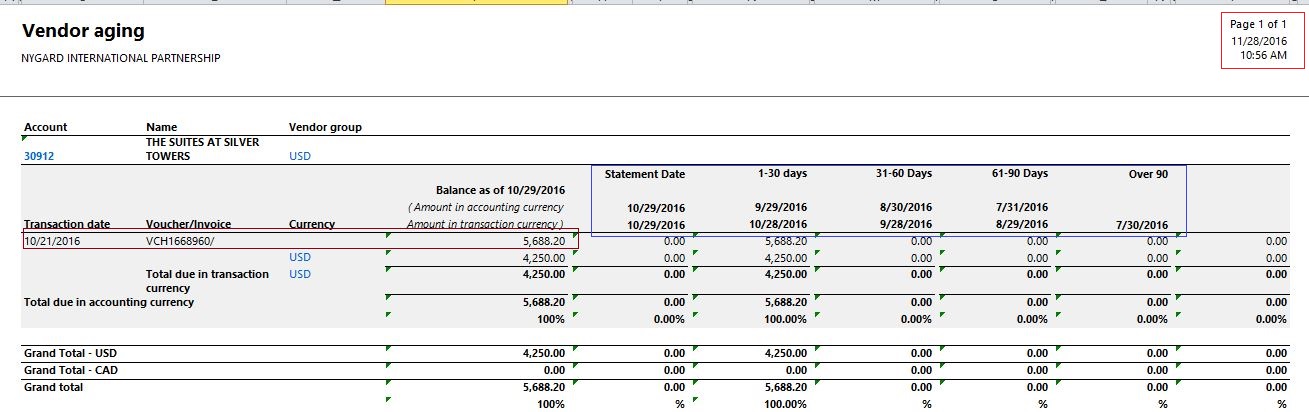

.3 Run date is NOV28, 2016, 1 invoice outstanding, Invoice amount from above report not the same and aging period not the same

Anyone can help me achieve the amounts from previous report?

Thanks,

Jesa

*This post is locked for comments

I have the same question (0)