Hello,

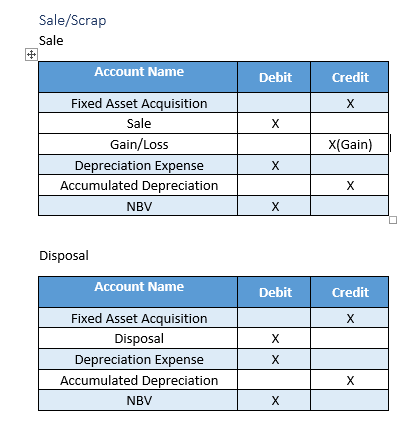

I was understanding the accounting entry for Fixed Asset Sale/Scrap. I am little confused. Here is my entry:

In case of Sale, Fixed Asset Acquisition - NBV = Sale +/- Gain Loss

In case of Disposal Fixed Asset Acquisition - NBV = Disposal

Is this correct understanding? Is this how the entry is created in D365 F&O when we sale or scrap a Fixed Asset?