Hello Sonali Rout,

Couple of questions.

--- Is there any specific reason to modify any standard report for example Fixed asset balances report as you mentioned; to display what is the last month depreciation value is recorded for asset?

--- Fixed asset balances report covers almost all relevant details for an asset. For example; acquisition value, depreciation value, revaluation, write-up, write-down. And based on all these, net book value also display in this report. In that case, how you are expecting to display the last month posted depreciation value?

--- Then is that value come for any calculation to determine the net book value for the asset ? Or it will just display the last month posted depreciation value only?

I hope it should not come for any calculation. Otherwise you will end up with messing the standard report itself. Please correct me if I am wrong.

Anyway.. you can consider the following to fetch the last depreciation posted value for any asset.

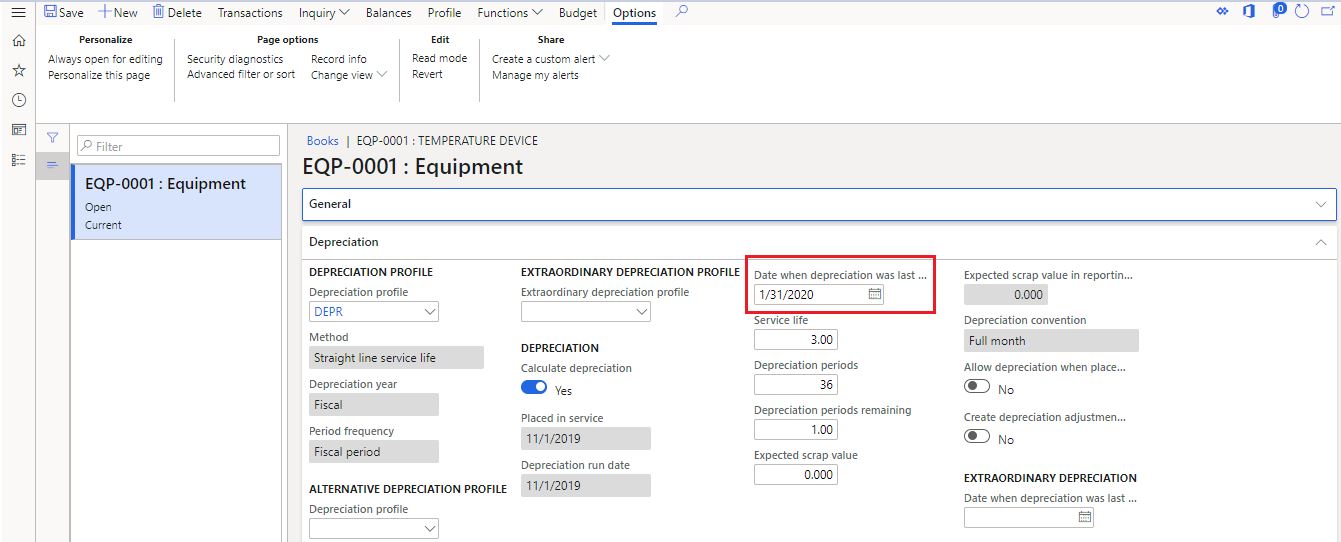

1) Go to Fixed assets > Fixed assets > Select any asset > Click on Books > Check in Depreciation section > Date when depreciation was last run.

--- Next; based on the date whatever is showing in Date when depreciation was last run field; find out what is the depreciation value recorded for the asset.

--- To determine that depreciation value on this date; you have to consider the "Transaction type" as "Depreciation".

Discuss this with technical person and explain the points to be noted here.

--- After that, create a new column in the Fixed asset balances report to display the last depreciation posted value.

Kindly check and update your feedback here.

Best regards,

Sourav Dam

Kindly mark this thread 'Yes' if this is answered your query which may help other community members in this forum.