Hi all

Imagine a scenario where a vendor sends a certain amount of goods by consignment. For this I am creating a PO and posting the product receipt. Because of the configuration made on the Item Model Group, no accounting entries are made with the product receipt. For now, the behavior is as expected.

At this point the received consignment goods can be sold to a customer. The desired flow is:

1) Receive consignment goods from vendor (post product receipt);

2) Sold items to the costumer (post packing slip and invoice);

3) Vendor sends the invoice for the items we have sold to the customer,

4) Post the vendor invoice.

I can replicate this process in D365 but I am struggling to understand how the COGS work in this situation. In the example that I did, I get the expected accounting entries for the Purchase side but on the Sales side I am not having accounting entries for the COGS (only Dr the customer and Cr the Revenue\VAT).

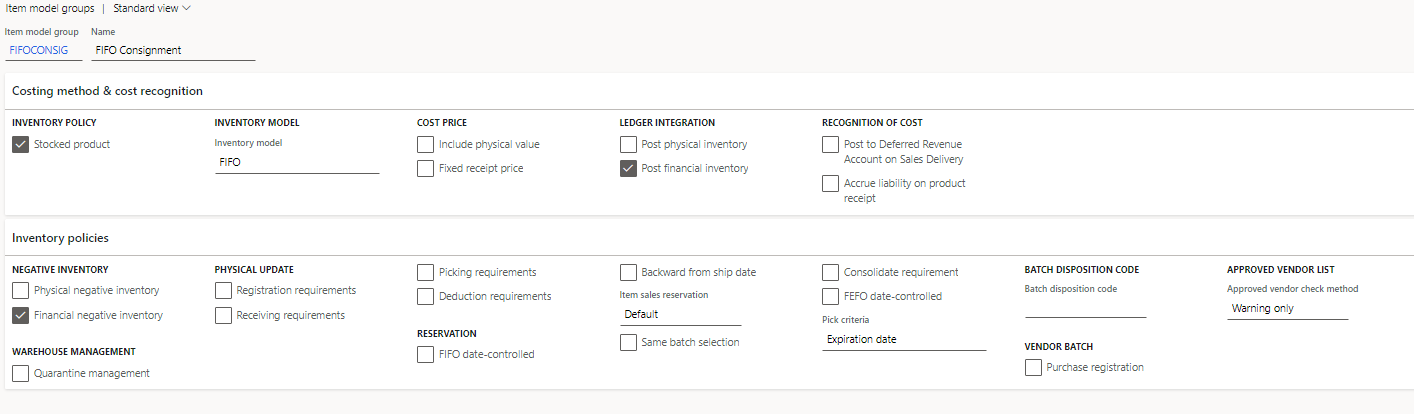

Does anyone know how can I get COGS to work in a scenario like this? I'm imagining that is some sort of definition that we must set on the Item Model Group. I never want to value this inventory in the middle of this process but I do need to recognize COGS at the end. At the moment, my Item Model Group is as follows: