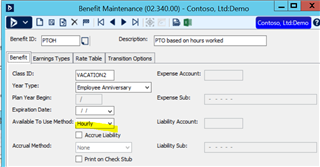

I cannot get below to work? Trying to set up a PTO benefit of .03334 hrs PTO earned for every hour worked with a maximum.

Available to use method = "hourly".

I believe I set up correctly & when we do PR calculation & pay an employee 40 regular hours & 5 OT hours , it see,s not to calculate any PTO??

Should it show hours earned in the Employees benefit tab, it does for vac that we have used for years each month but that is allocated by monthly

setup a benefit based on hours worked.

And then setup an hourly rate like 0.0333. If they work 30 hours then, they would get 99.9999 hours of PTO. The benefit awarded rounds to 2 decimals so that would be 1.00 PTO hours for 30 hours worked. But it wouldn’t trigger 1 hour of PTO every 30 incremental hours. It would award 0.3334 hours for every hour worked. An employee that worked 20 hours would get 0.67 hours of PTO awarded. An employee that worked 110 hours would be awarded 3.67 hours, etc.