Dear Community,

I am currently working on finishing the setup of 2017 for a company in Slovakia, AX2012 CU 12 to Go Live again after the break on 1.1.2021. I think we have a Czech/Slovakian Lokalization package. Due to my lack of knowledge I would kindly ask you to help me with the following questions:

1) I found out, that I can just create an XML of the SVK tax report when I allow AX to post the tax, is that correct?

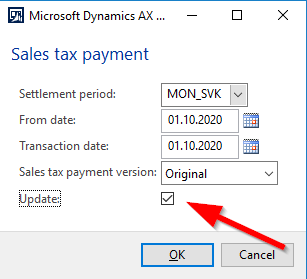

From date would be the first date of the period, transaction date would be the posting date (UPDATE) of the tax postings which are done automatically, right?

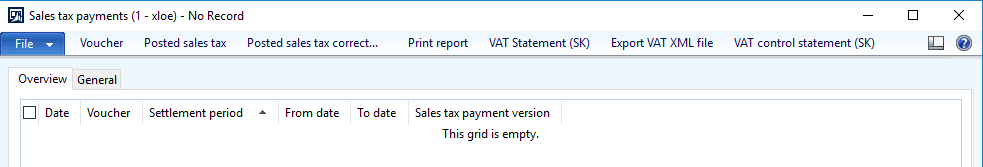

That was the only way I could get an entry here:

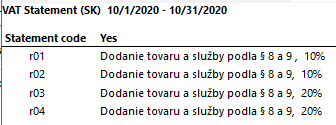

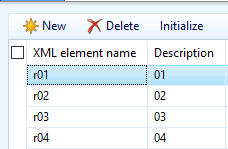

I could get the report on the screen and obviously there's a setup for XML codes (r01, r02, r03...)

I found the setup:

Does anyone of you have a manual, how these codes have to be setup for Slovakia?

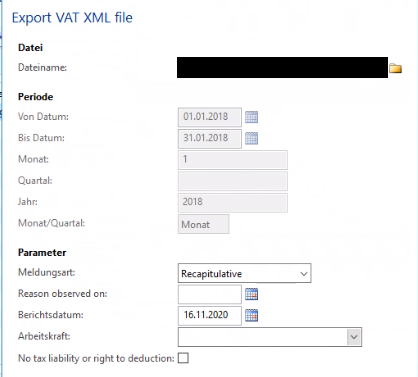

2) Which data do I have to enter to get a correct XML file? Does anyone have a manual of Slovakian Tax Report in XML?

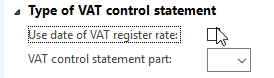

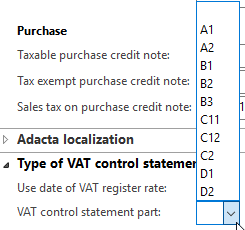

3) VAT control report: Does anyone have a manual for the setup? I found this setup in the taxcode:

I get the report but without values, I guess the missing setup in the tax code is the reason for that.

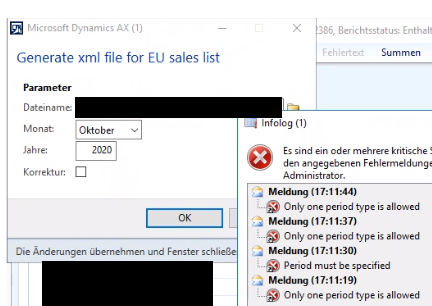

4) EU Sales List: Does anyone have a manual for the XML? I found this but I just get errors:

If I enter month + year = Only one period type is allowed

If I enter just the year = Period must be specified

If I enter just the month, the year will be filled automatically with 0 = Only one period type is allowed

The ones of you which are still reading might be able to answer the last question easily:

5) I have in mind that you have to have separate tax codes for invoices and invoice corrections (credit notes). I found out that in tax matrix both codes are given to the same combination but I can't find an invoice where both are posted at the same time (what I would expect if I have two codes for one combination). So I think there is a setup to control that tax codes for credit notes but I couldn't find any. Is that correct? Do I need two tax codes? How can I control, which one is taken when?

A big THANK YOU just for reading everything, any kind of idea, answer, help or link is greatly appreciated!

With best regards

Katy