Hi all,

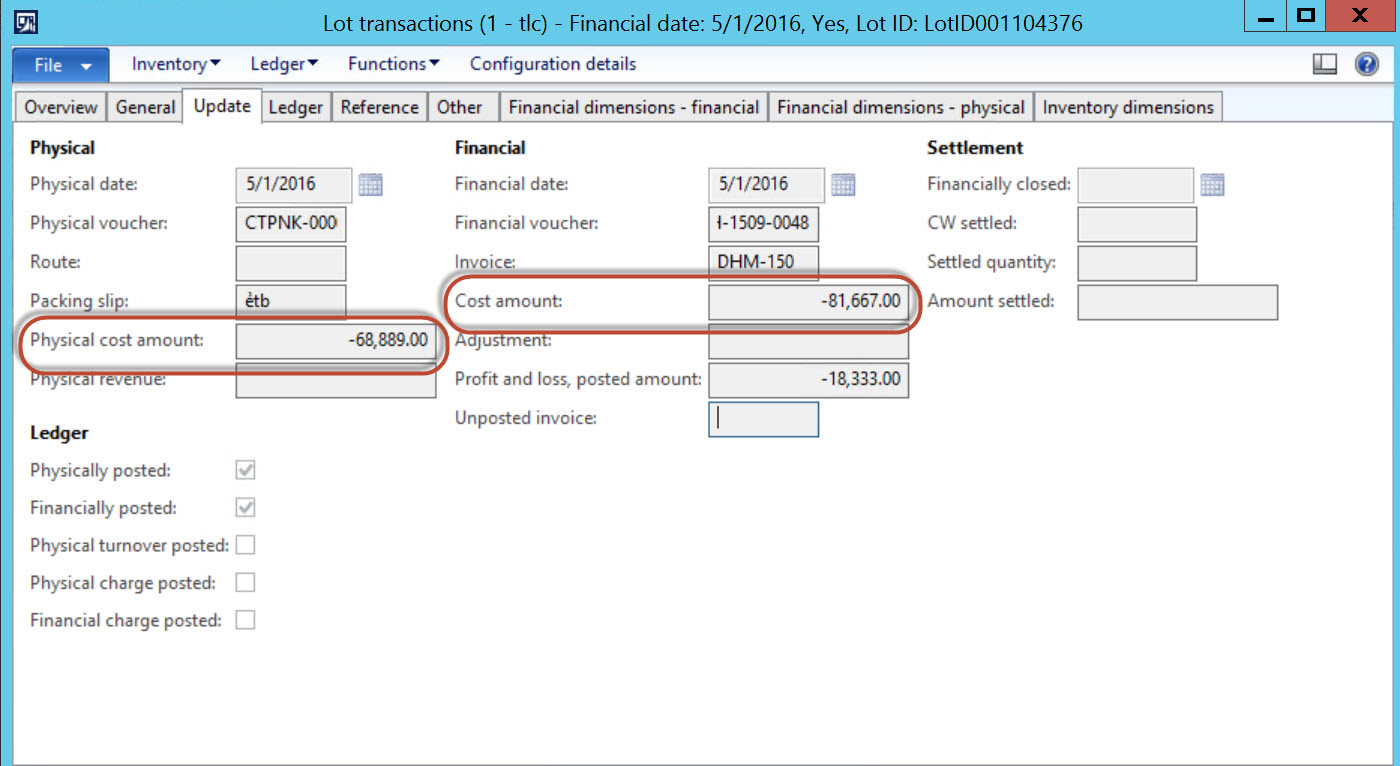

I'm making a returned purchase transaction with an item, and the cost amount posted when the product receipt was posted is different with the one posted when the order was invoiced, although there was no transaction occurred with this item in between these 2 actions. Can anyone suggest any reason why this could happen?

Thanks in advance,

Regards.

*This post is locked for comments

I have the same question (0)