Hello,

I am trying to understand the behaviour of posted TAX in AX 2012 R3 RTM. Is there any papers that explain the difference between tax posting between general invoice on a purchase order or doing it through invoice register (which is how we do it).

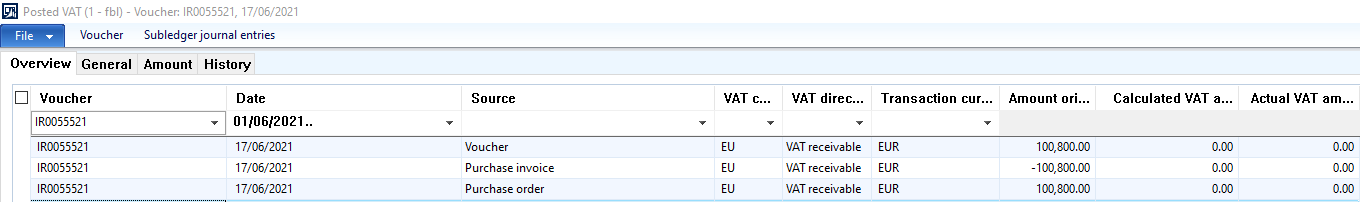

Our Financial Controller, when investigating tax in the system using the "Posted Tax" form, thinks the way the system is doing it is wrong, because the purchase order should not enter the equation and that it should just be the invoice and voucher, so I wanted to explain to them what is going on.

Is this balancing out the purchase order and purchase invoice and then posting it to the voucher?

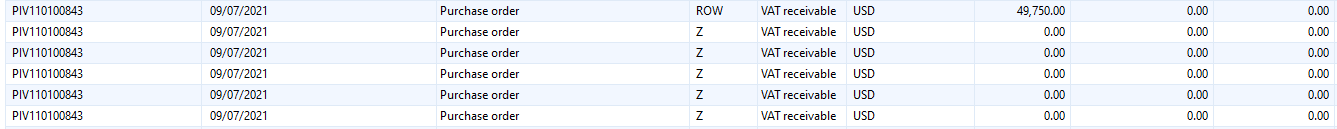

If you do a invoice on the purchase order without any register you get it like this (not the way we do it, but there is no voucher or purchase invoice classed in this posting).

Thank you.