Dear All,

We are facing a strange behavior when running the settle and post sales tax declaration.

There are multiple booking on the Sales tax code "Full". The sales tax code has a nothing special to it. No reverse charge no use tax regarding the sales tax group that is set up to it.

We have invoices booked through the project and through free text invoice. The VAT set up the same in both cases.

The VAT calculation is correct on both of the invoices.

Freetext invoice sales tax voucher

Project invoice voucher

When creating the sale tax settlement, for some reason all the booking are correct expect for the ones relating relating to the free text invoices.

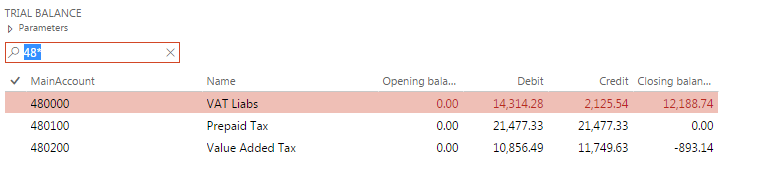

Main account 480200 is the Value added tax, 480100 is the Prepaid tax, 480000 is the vat liability

After the VAT settlement the main account 480200 is not 0, the remaining value comes from the freetext invoice VAT amount which are doubled. And are not settled in the correct direction.

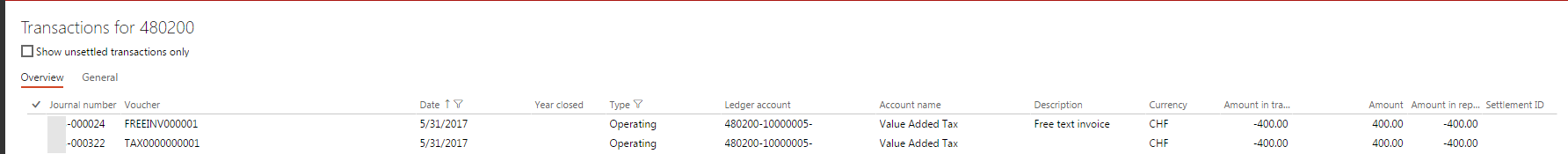

Here is one of the invoices and their VAT booking and VAT settlement

I would be grateful if any one could give some pointers what could be causing this.