Hi guys,

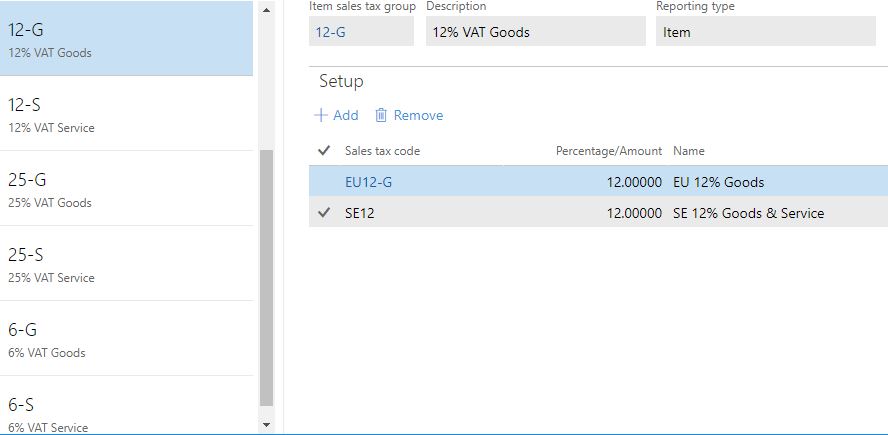

I am currently looking at the Item sales tax group setup for a company in Microsoft Dynamics 365 for operations. Transactions that are subject to sales tax must be associated with both a sales tax group and an item sales tax group. I was thinking about adding two sales tax codes to one item sales tax group. As you can see from the picture below, I have created an Item sales tax group called 12-G with a reporting type of Item. I have further added 2 sales tax codes: EU12-G that stands for 12 % VAT on European goods and SE12 that stands for 12 % VAT on Swedish goods. The setup is the same for the different Item sales tax groups: so I have attached two sales tax codes to one item sales tax code (Swedish + European) instead of for example creating one item sales tax group called 12-G with a reporting type of item and then only added one sales tax code (SE12) and further created one more item sales tax group called EU12-G with reporting type Item with the sales tax code EU12-G. Hope that you can understand the setup from the pictures below.

I was wondering what consequences/problems that the setup with 2 sales tax codes to 1 Item sales tax group could be compared to setting up item sales tax groups for each sales tax code. Which alternative is more efficient?

Thanks in advance

Br

Tony

*This post is locked for comments

I have the same question (0)