Hi all, thank you for your responses, I'll try to answer all of your questions.

So for example on creation of a new Sales Order, it is automatically assigned the AR-DOM tax group.

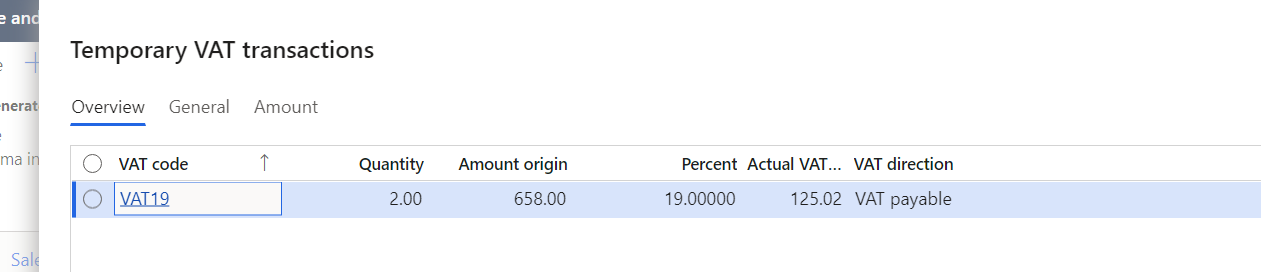

Sales Order Lines > Financials > VAT shows the calculated tax correctly:

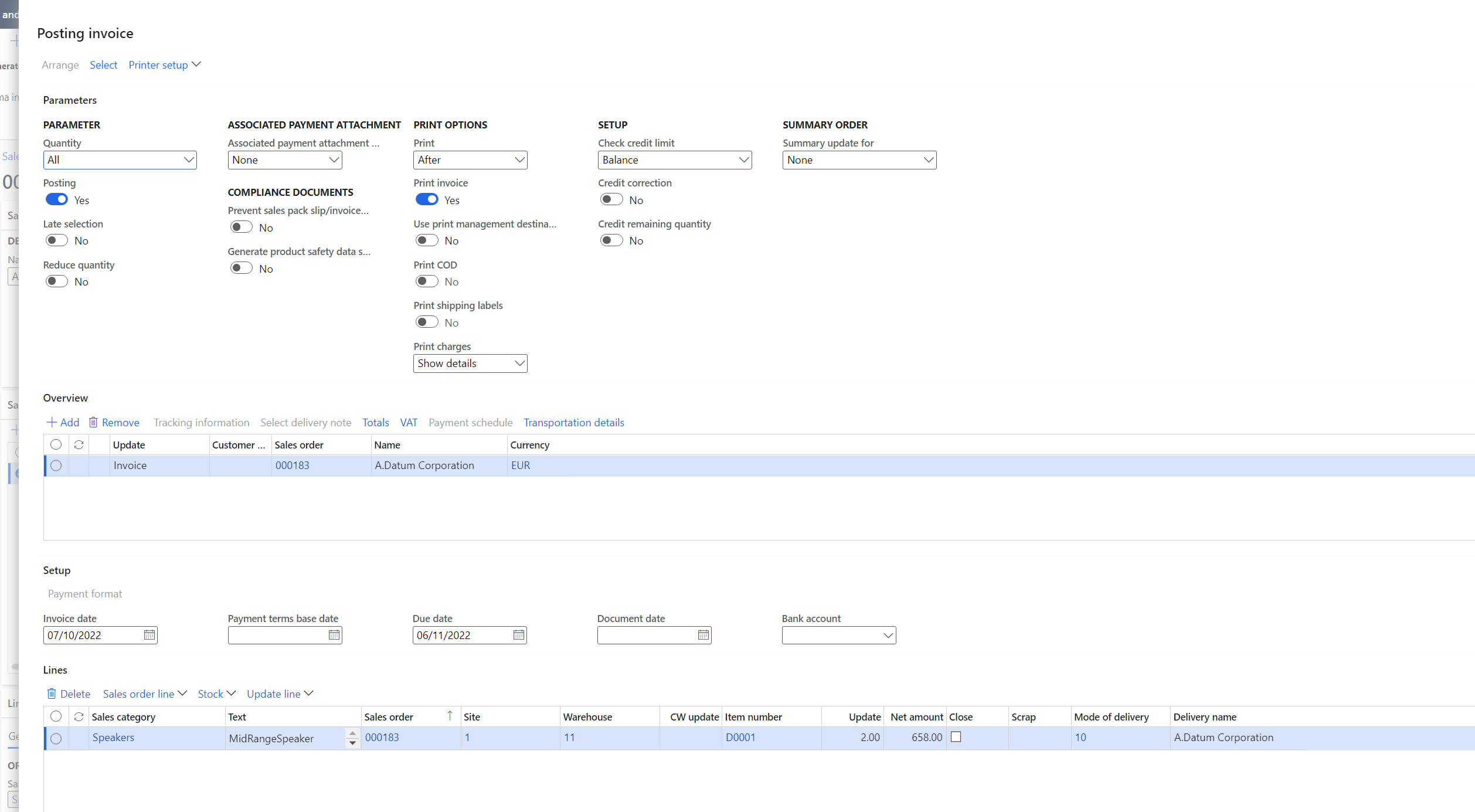

Invoice posting screen thus:

Clicking VAT shows the same values as when doing so from the Sales Order.

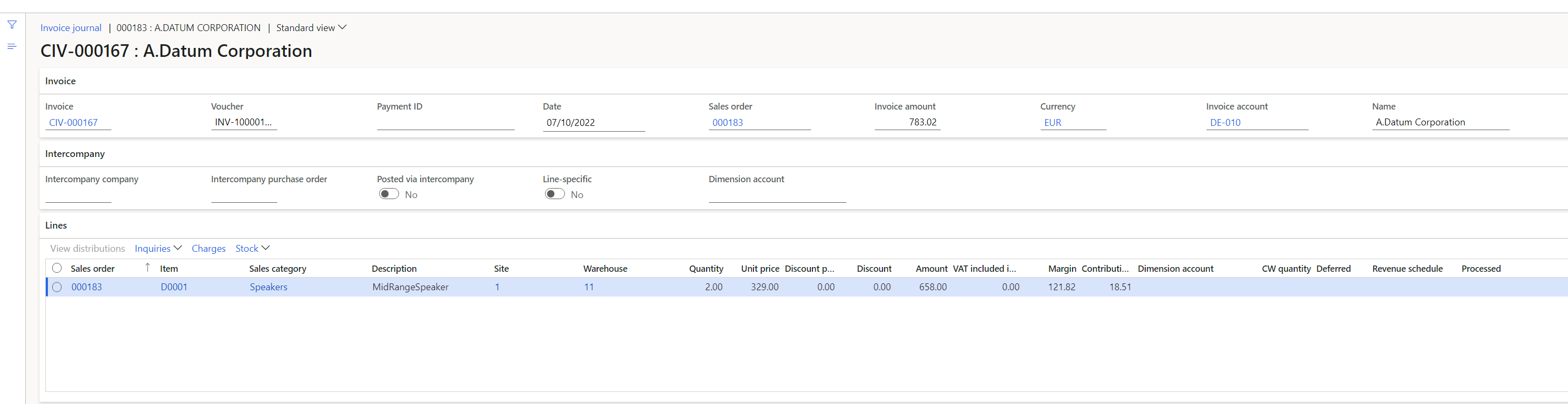

Invoice journal. As you can see Amount against the lines is excluding VAT and VAT Included in amount is 0.

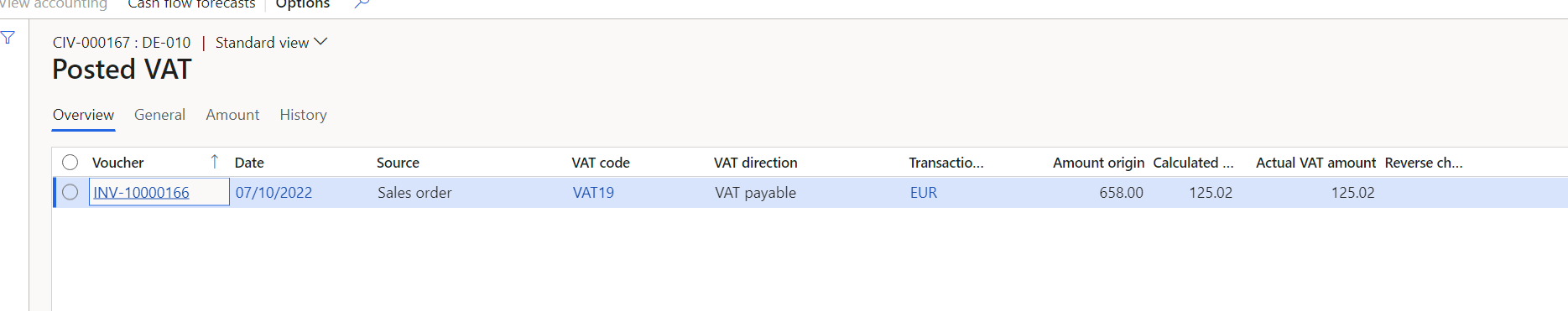

VAT has been posted against the invoice header, but isn't saved per line:

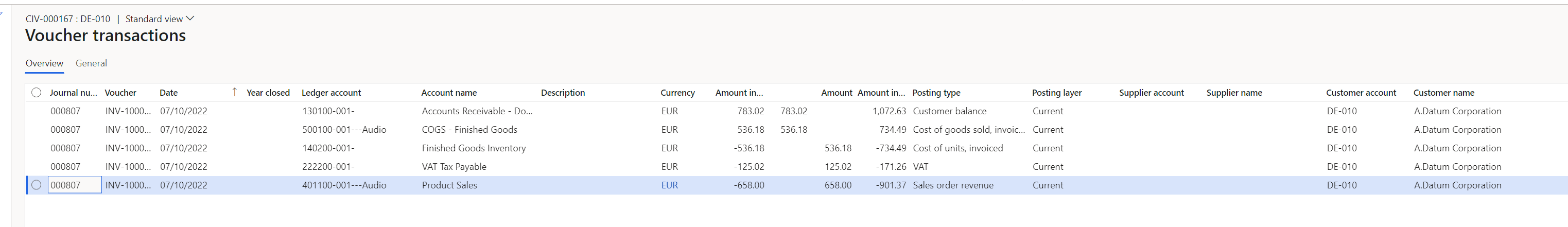

Voucher transactions:

I'm assuming that there's just a parameter somewhere that I've missed. It's calculating VAT correctly and posting it, it's just not putting it against the lines in the invoice journal, only the header.

I think I've answered all of your questions above, please flag up if I've missed one.