Hi Momen,

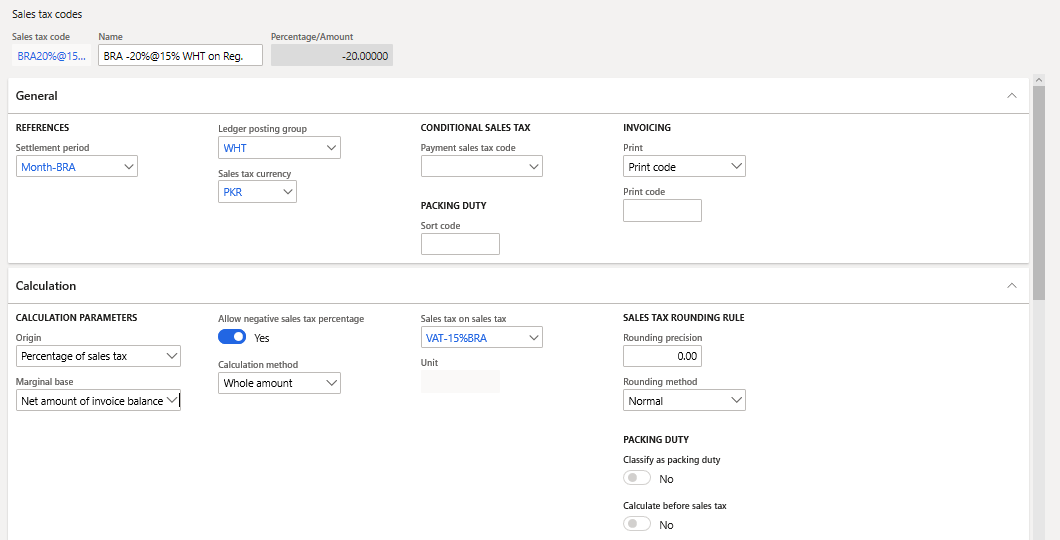

-20% code is also required in this group, user deduct -20% sales tax on top of 15% (VAT-15%BRA) when vendor is unregistered. This is the ultimate code due to which I posted this. Sales Tax codes, sales tax group and Item sales tax groups setups are given below for your information. Secondly, Lets ignore reverse charge, I unchecked reverse charge option. System is calculating same sales tax when reverse charge option is not selected.

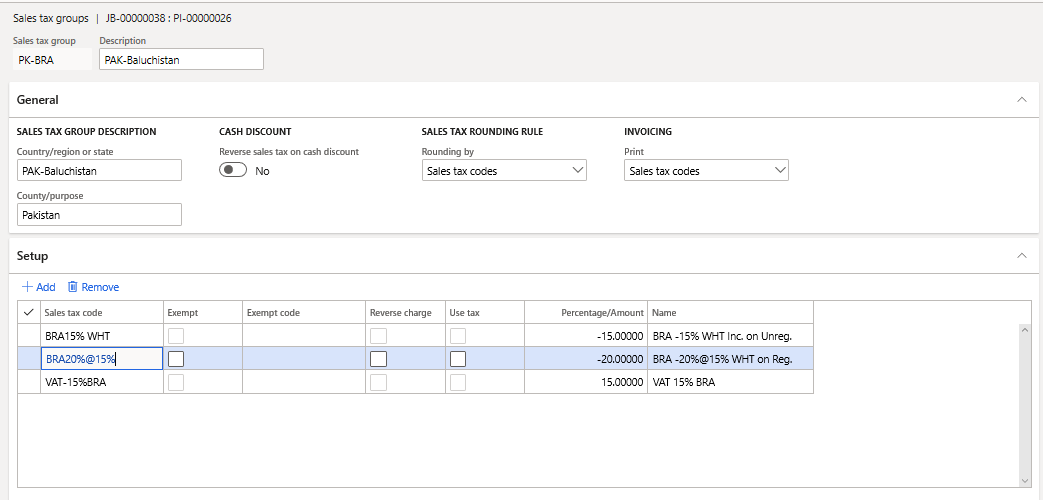

Sales Tax Group Setup (PK-BRA)

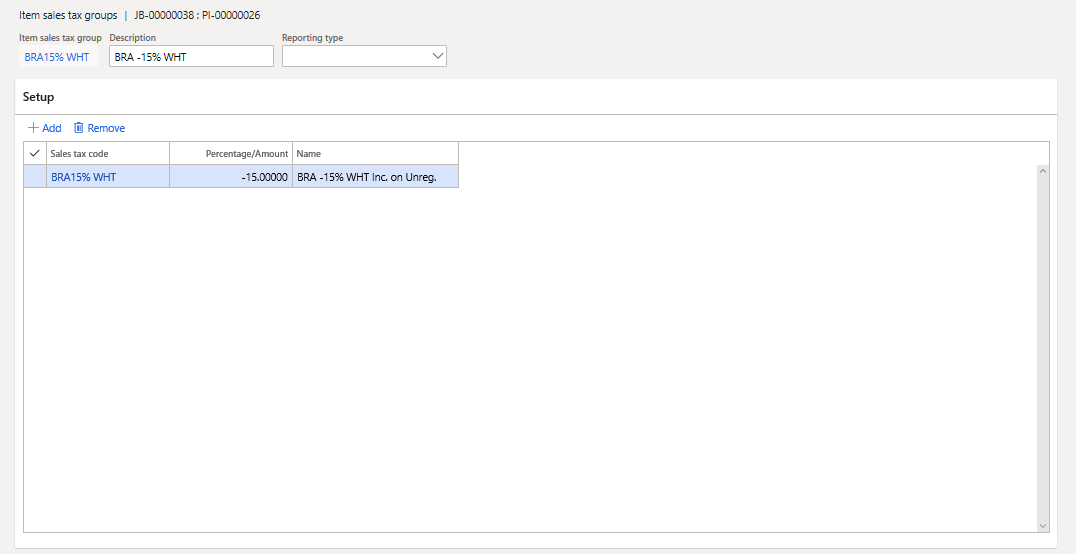

1. Item Sales Tax Group Setup (BRA15% WHT)

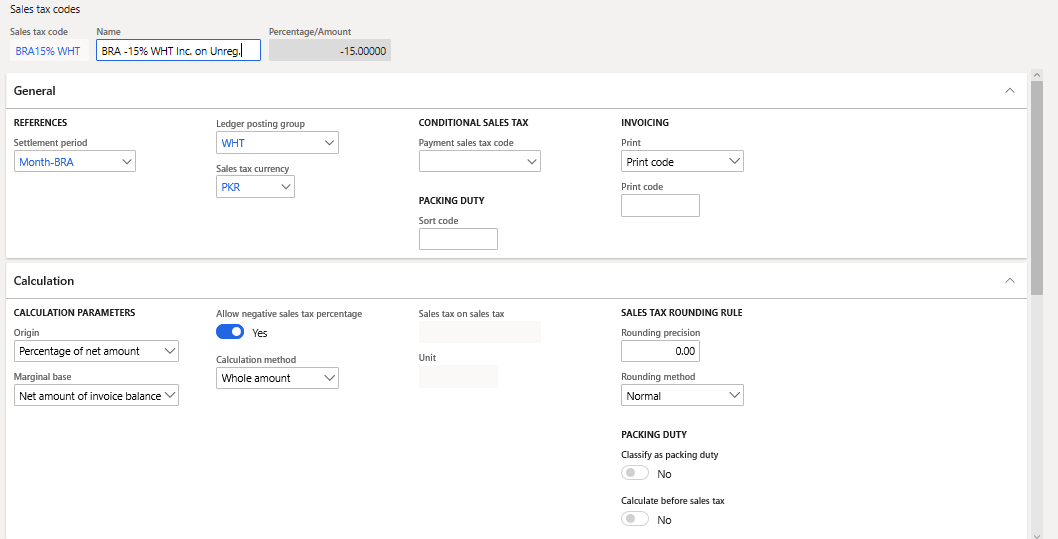

1.1 Sale Tax Code (BRA15% WHT)

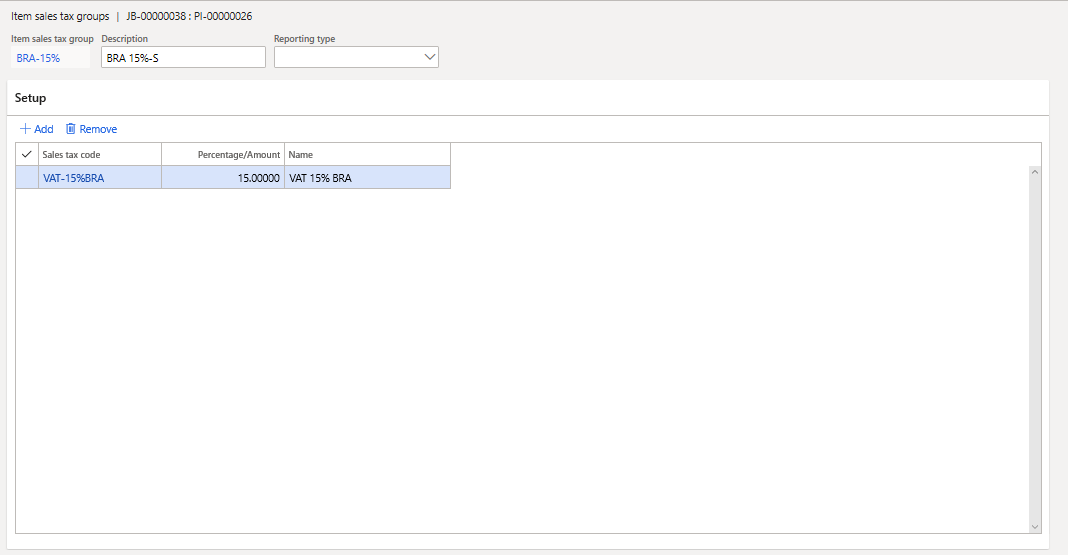

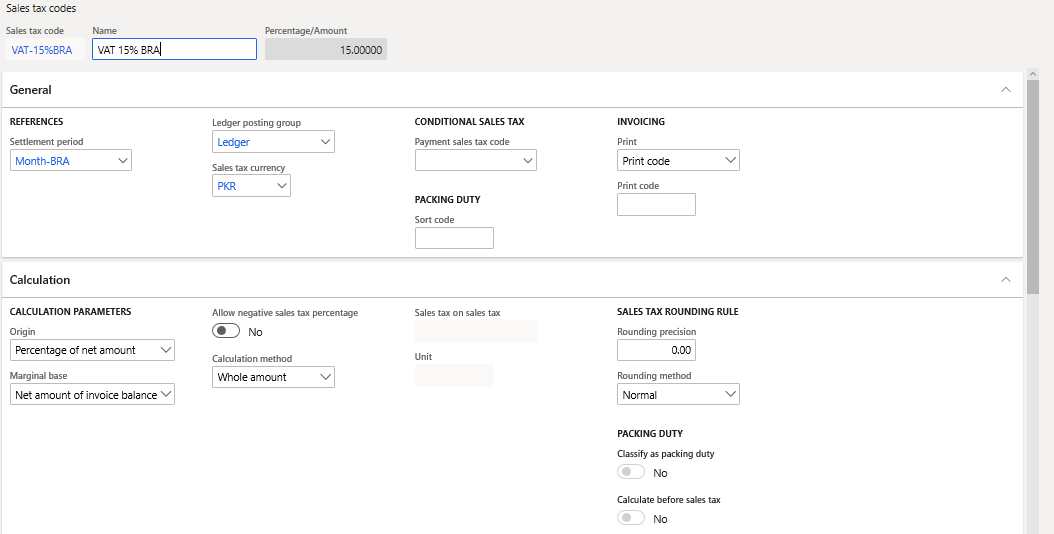

2. Item Sales Tax Group Setup (BRA-15%)

2.1 Sales Tax Code (VAT-15%BRA)

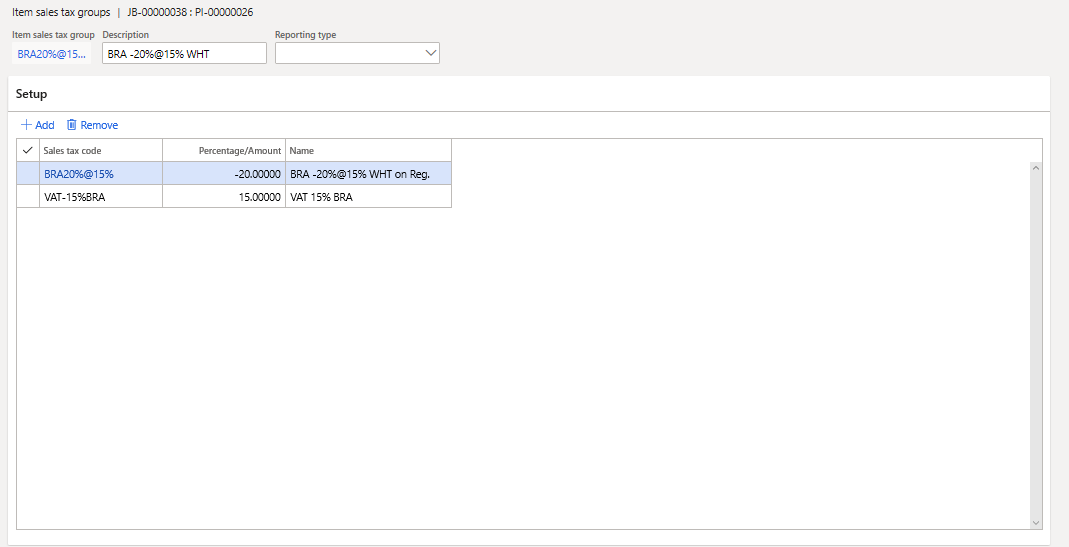

3. Item Sales Tax Group Setup (BRA20%@15%)

3.1 Sale Tax Code (BRA20%@15%)

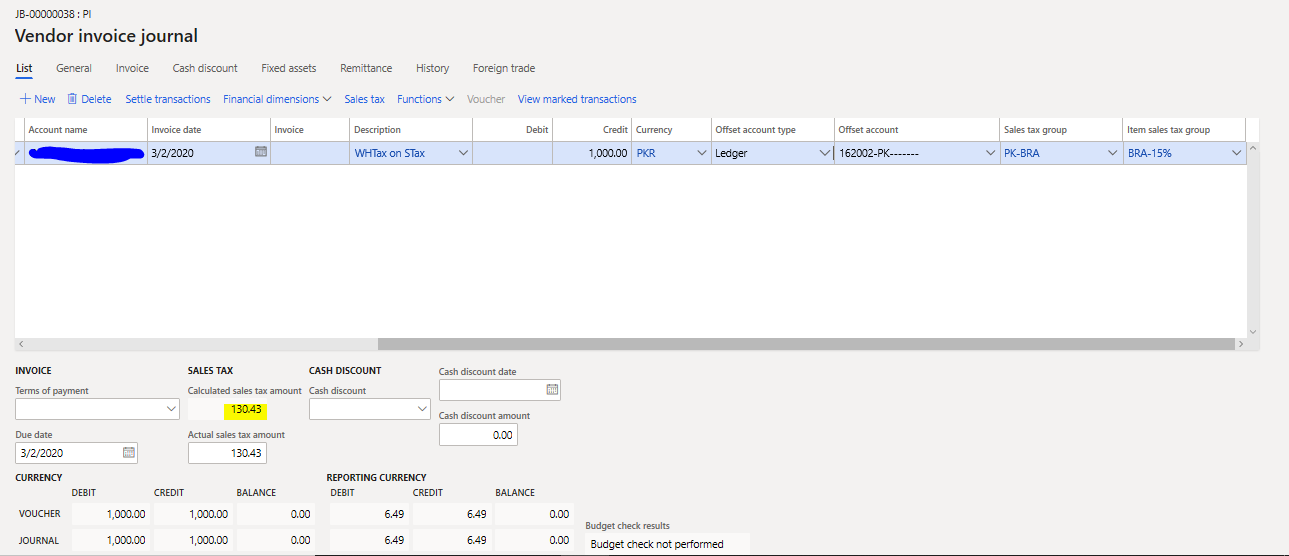

1. Transaction (Case 1)

Invoice Journal: Correct Calculation when using 15% tax

Item Sales Tax: BRA-15%

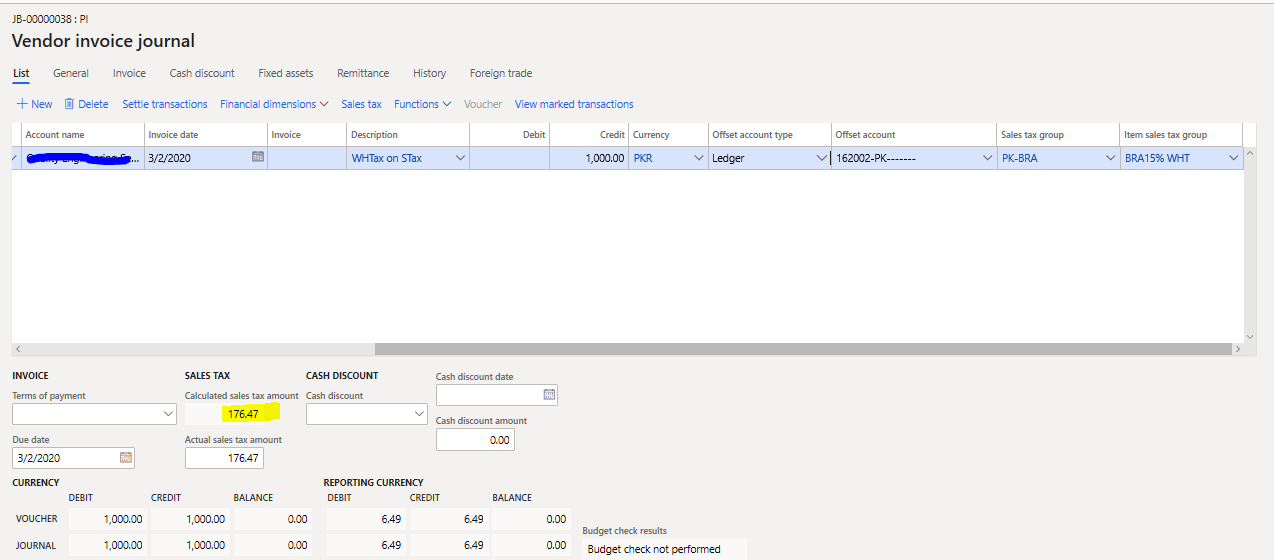

Invoice Journal: Wrong Calculation when using -15%

Item Sales Tax: BRA15% WHT

System should calculate 1000*15/115=130.43 however it is calculating 176.47

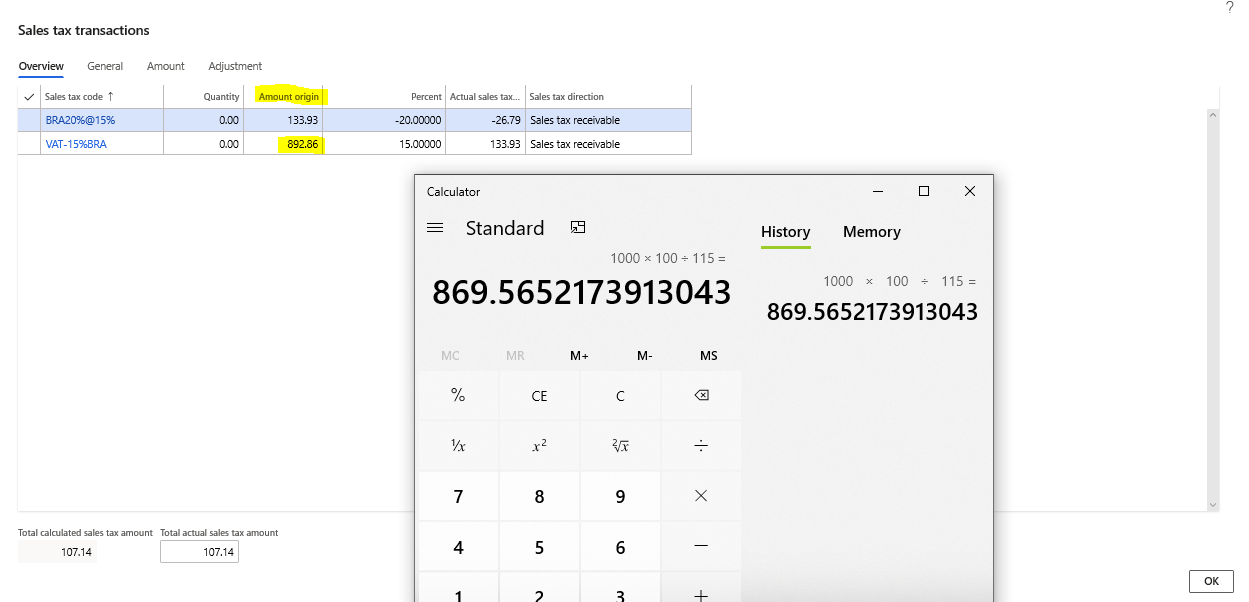

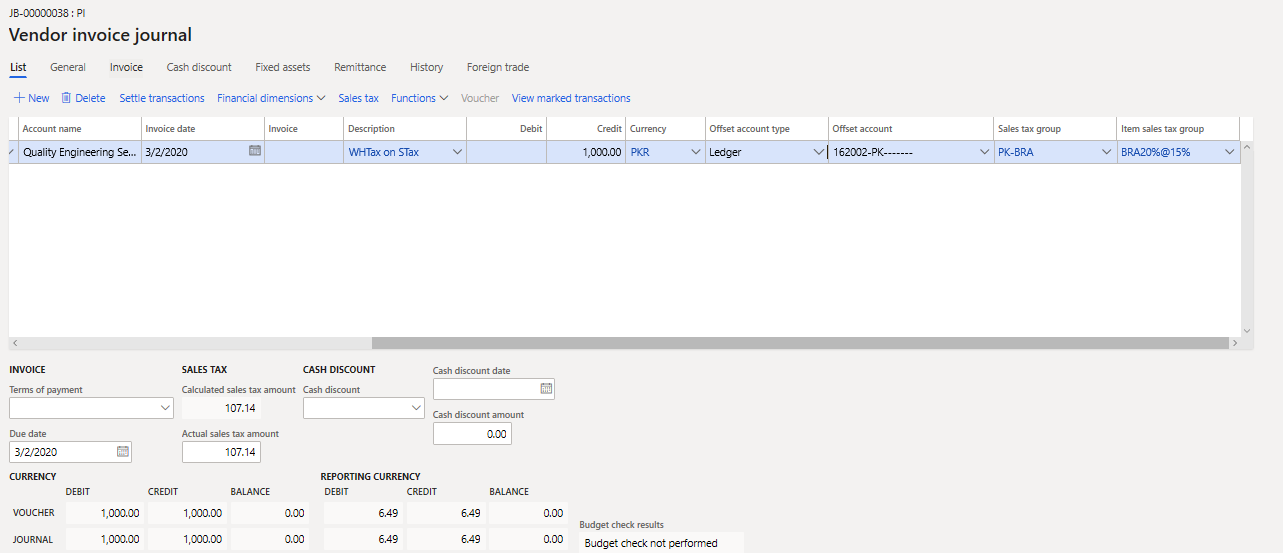

2. Transaction (Case 2)

Now lets talk about the -20% code which is the ultimate goal to achieve correct calculation for.

Invoice Journal: Wrong Calculation when using 15%-20%

Item Sales Tax: BRA20%@15%

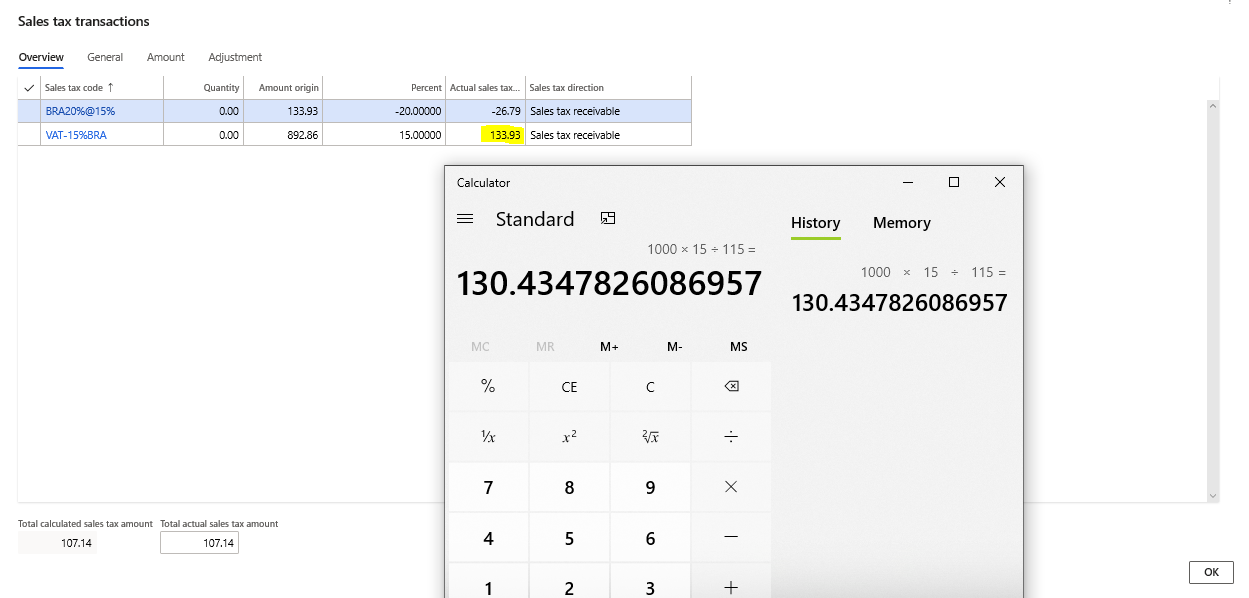

System should calculate 1000*15/115=130.43 however it is calculating 133.93.

This is because system is using wrong amount origin, it should be 869.56 instead of 892.86.