Hi LongTNH.AX ,

Appreciate if you kindly re-check the setups as highlighted by Ludwig and see if any difference.

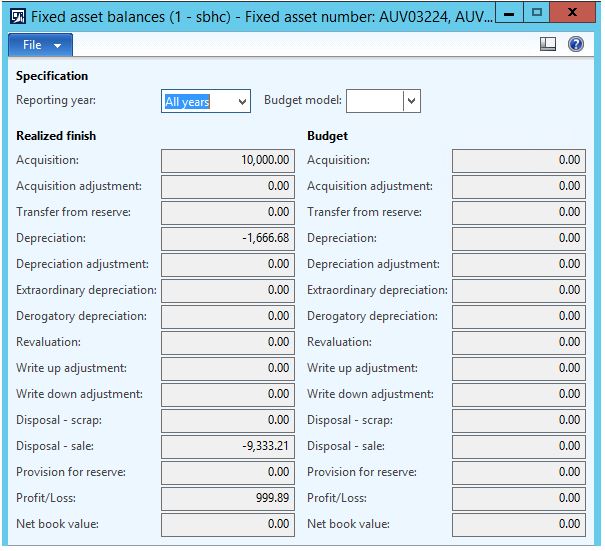

It would be good to see the net book value of that asset before posting the disposal sale. But this is not possible now as disposal already recorded and net book value must be showing "Zero" in fixed asset Balance.

I am not sure why there is a difference showing based on same setups in FA module as you mentioned, but I had tested this long time back and below is my observation.

I tested with 2 types of setups separately and got below result where in one case; net book balance was showing in the posted journal and in other case; net book balance was merged with total acquisition value of the asset after posting disposal sale.

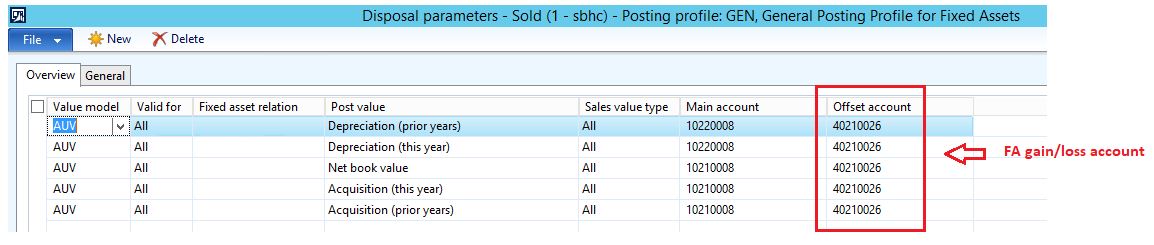

Setup - 1

Asset details

Total FA Value = 10000.00

Depreciation charged till 31st December 2018 = 1666.68

Balance / Net book value = (10000 - 1666.68) = 8333.32

Sold this asset = 9333.21

Profit on sale = (9333.21 - 8333.32) = 999.89

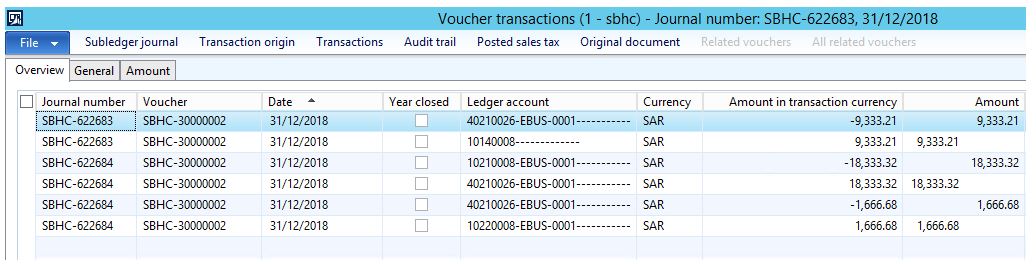

Posted Transactions based on Setup - 1

Accumulated Depreciation (10220008) - DR. 1666.68

Gain on Sale / Disposal of assets (40210026) - CR. 1666.68

Gain on Sale / Disposal of assets (40210026) - DR. 18333.32

Fixed asset (10210008) - CR. 18333.32

Note: - Credit amount of 18333.32 is the total of (Original acquisition value + Net book value).

Customer (10140008) - DR. 9333.21

Gain on Sale / Disposal of assets (40210026) - CR. 9333.21

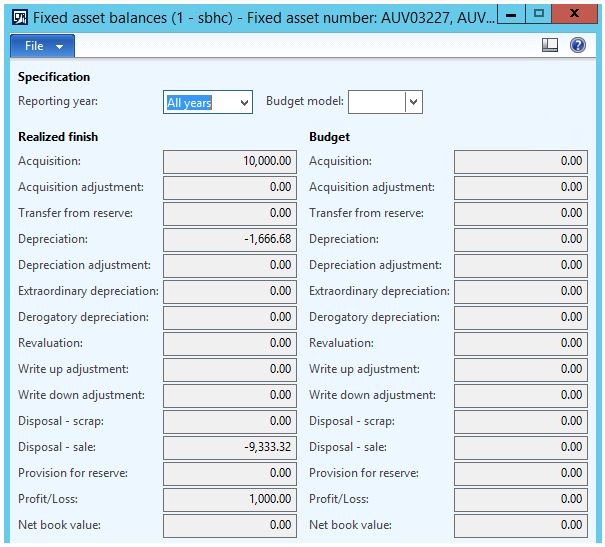

You can see the Profit / Loss earned through sale of fixed asset in the Balance form.

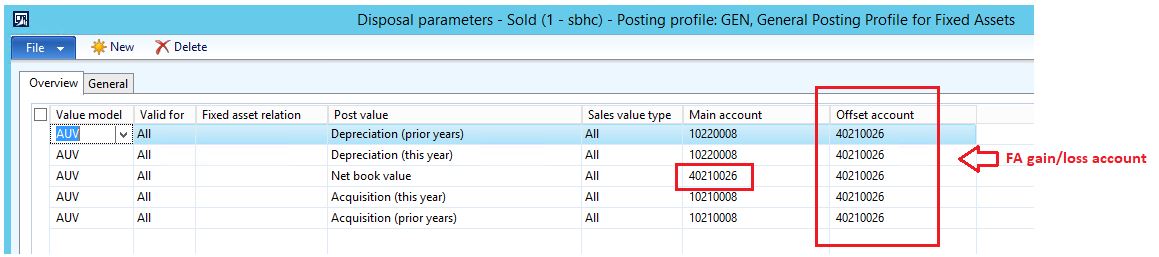

Setup - 2

Only change we have done in this setup is; replaced fixed asset main account 10210008 in 'Main account' column for Net book value by Gain on Sale / Disposal of assets (40210026).

Asset details

Total FA Value = 10000.00

Depreciation charged till 31st December 2018 = 1666.68

Balance / Net book value = (10000 - 1666.68) = 8333.32

Sold this asset = 9333.32

Profit on sale = (9333.32 - 8333.32) = 1000.00

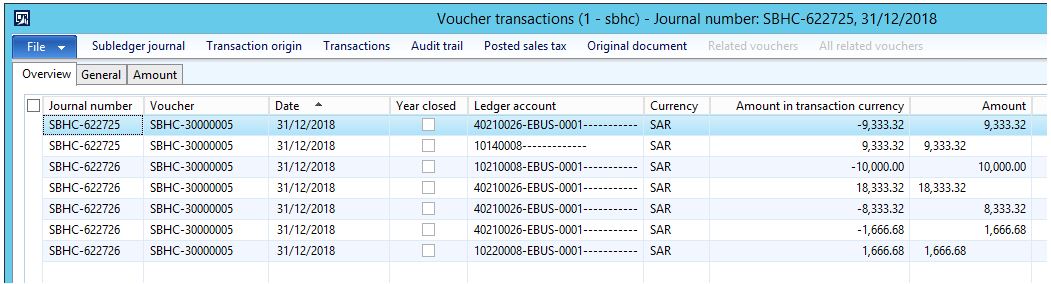

Posted Transactions on Setup - 2

Accumulated Depreciation (10220008) - DR. 1666.68

Gain on Sale / Disposal of assets (40210026) - CR. 1666.68

Gain on Sale / Disposal of assets (40210026) - DR. 18333.32

Fixed assets (10210008) - CR. 10000.00

Gain on Sale / Disposal of assets (40210026) - CR. 8333.32 (This is the Net Book Value)

Note: - Credit amount of 10000.00 is the Original acquisition value of fixed asset and Credit amount of 8333.32 is the Net book value of the fixed asset showing separately in the posted transaction.

Customer (10140008) - DR. 9333.32

Gain on Sale / Disposal of assets (40210026) - CR. 9333.32

You can see the Profit / Loss earned through sale of fixed asset in the Balance form.

Appreciate if you kindly test this in Test system and provide your feedback.

Also; please check the setups again as highlighted by Ludwig.

Best regards,

Sourav Dam

Kindly mark this thread 'Yes' if this is answered your query which may help other community members in this forum.