Hi All,

We need to set up reverse charge for UK VAT reporting for trading with EU.

We cannot use the inbuilt RC function because the legal entity is Danish, but has a UK trading warehouse within it.

We are instead using the Use Tax functionality to achieve the RC function

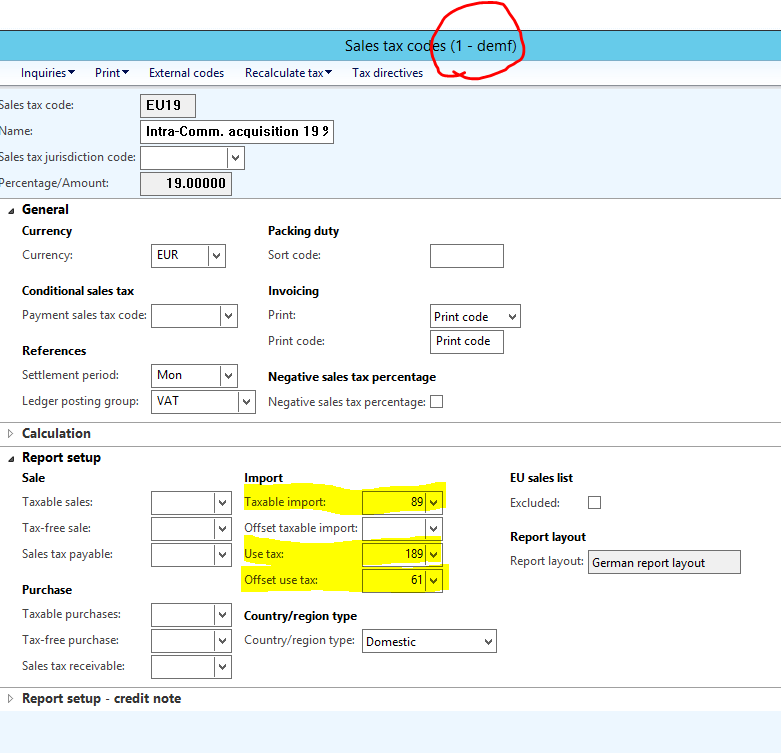

I understand that there is a way to configure the VAT report in the 'Report setup' section of the Sales tax code to achieve correct reporting(for e.g. in the German DEMF Contoso entity below):

Does anyone know if this is possible for our scenario (i.e. for the English report layout) and what the values are?

Many thanks