Hi!

As far as I know Indirect cost component are used for posting indirect cost in hour transactions but not revenue as in direct cost components. The ways to recognize revenue in time and material project are:

1. invoicing project transactions with a line property with chargeable checkbox marked. In case accrue revenue has been posted, it will also be cancelled.

2. Using Accrued revenue, you will be able to recognize revenue temporarily till project transaction is included in a project invoice where the revenue will be recognized definitely and accrued revenue (temporary revenue) will be cancelled.

There are two options to work with accrued revenue:

1. Mark accrue revenue parameters in project group so that temporary revenue is posted automatically when posting hour costs, expense cost,...

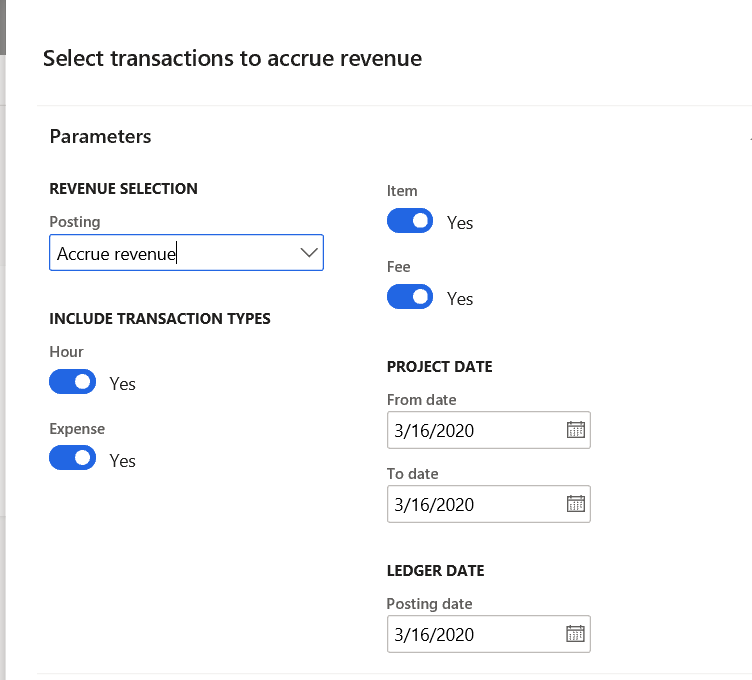

2. Use project group without accrue revenue and post manually accrue revenue by using Accrue revenue process (From project/ Manage tab/ Accrued revenue/ Time and Material or From Periodic/ Time and Material/ Accrue revenue). Setting Accrue revenue option, you will recognize revenue temporarily:

As well this process allows you to reverse accrue revenue or temporary revenue by selecting Reverse revenue option. It will reverse accrued revenue voucher and then the project invoice will post definitive revenue,

Note that with this process, the user will be able to select which project transactions will recognize temporary revenue as long as it contains a line property with accrue revenue marked but it will recognize the entire transaction and not a percentage of transaction.

So this means you only can recognize definitive revenue in a time and material project by invoicing it but you can temporarily recognize revenue by using accrue revenue that will be cancelled in the invoice. Then possible work arounds to use accrued revenue functionality to recognize part of revenue in time and material projects before invoicing:

- Define project group with accrue revenue only for fee transactions (not for the rest). Post hour, expense, item transactions with a line property defined as chargeable. These transactions will be used to post cost amounts and definitive revenue when invoicing them. Then post fee transactions with line property defined as chargeable and as accrue revenue when you need to recognize partially revenue and previously posting definitive revenue. Finally before posting the project invoice, you will need to cancel accrue revenue by using Accrue revenue process with Reverse revenue option.

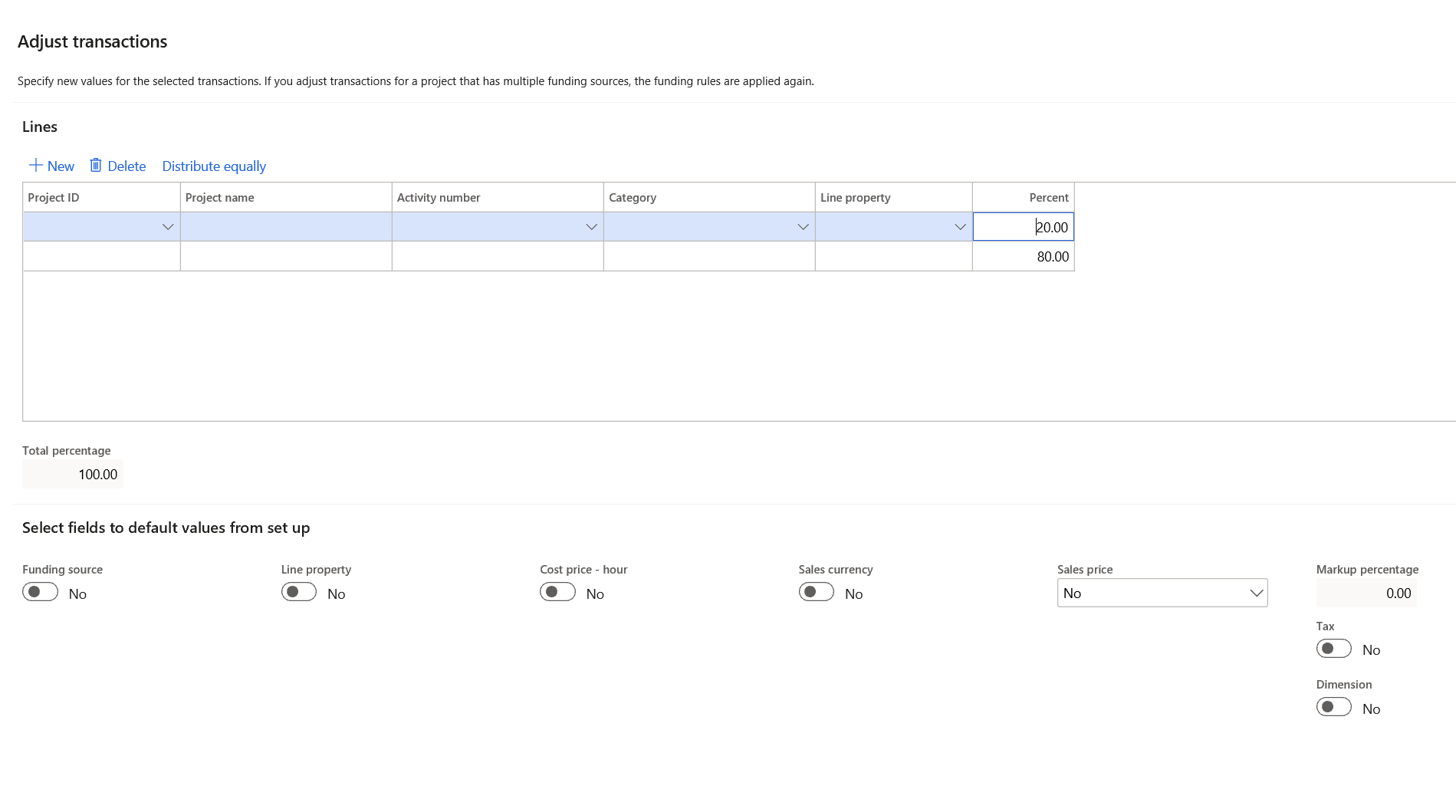

- Other option is not to use fee transactions to post accrue revenue and work with a project group without accrue revenue. Then use Accrue revenue process to select some of project hour, expense,..transactions to post temporary revenue (Line property will be setup with chargeable and Accrue revenue checkboxes). In case, you need to split the project transaction to recognize partially revenue, you will be able to run project adjustment to do that creating additional lines and using percent field to distribute amounts:

This will allow you to select one of new adjusted transactions when running Accrue revenue process to recognize revenue partially. Take into account that as well cost amount will distributed in two or more project transaction according to percentage defined when adjusting.

Finally accrue/temporary revenue will be canceled in project invoice, when definitive revenue will be posted either.

Best regards,

Natalia