Hi,

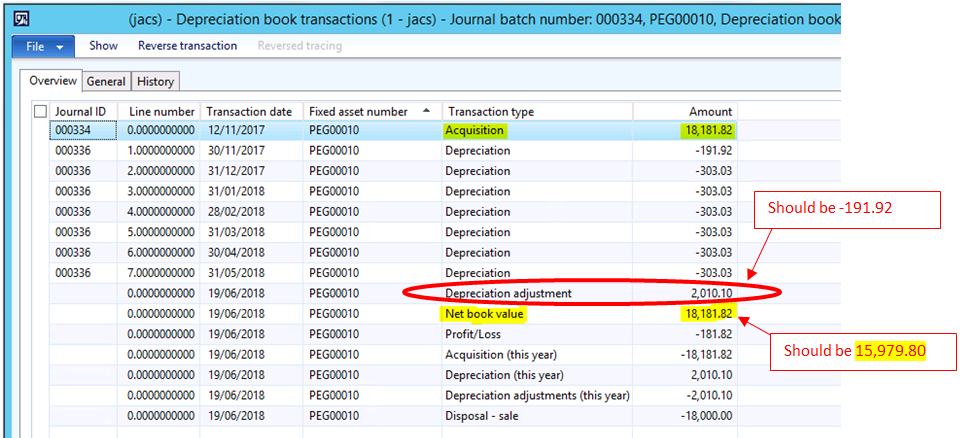

I am using AX2012 R3 and I have the 'Automatically create depreciation adjustment amounts with disposal' option ticked in the Fixed Asset parameters.

I would like to know whether there is a bug with the Reducing balance depreciation method where AX creates a depreciation adjustment transaction on disposal of the asset to offset all posted depreciations - which results in the net book value to be the same as the original acquisition cost. Please refer to the screenshot for an example:

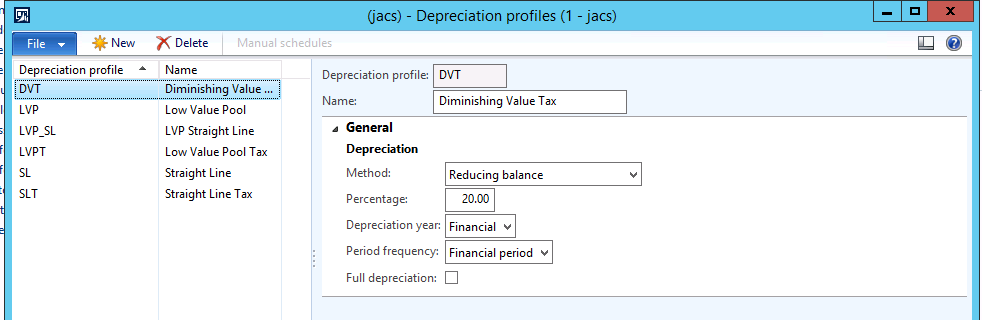

Here is the Depreciation Profile setup for Reducing Balance

Thanking you in advance for your time.

Sarita

*This post is locked for comments

I have the same question (0)