When recording a purchase, where resulting tax code is a 0% tax, no posting is created in the tax sub-ledger (the Posted VAT / Posted Sales Tax forms).

So for example:

Sales Tax Group = AP-DOM (Domestic)

Item Sales Tax Group = WITHOUT (0% tax)

according to setup, resulting sales tax code is InVAT0 (this code is part of both the sales tax group and item sales tax group)

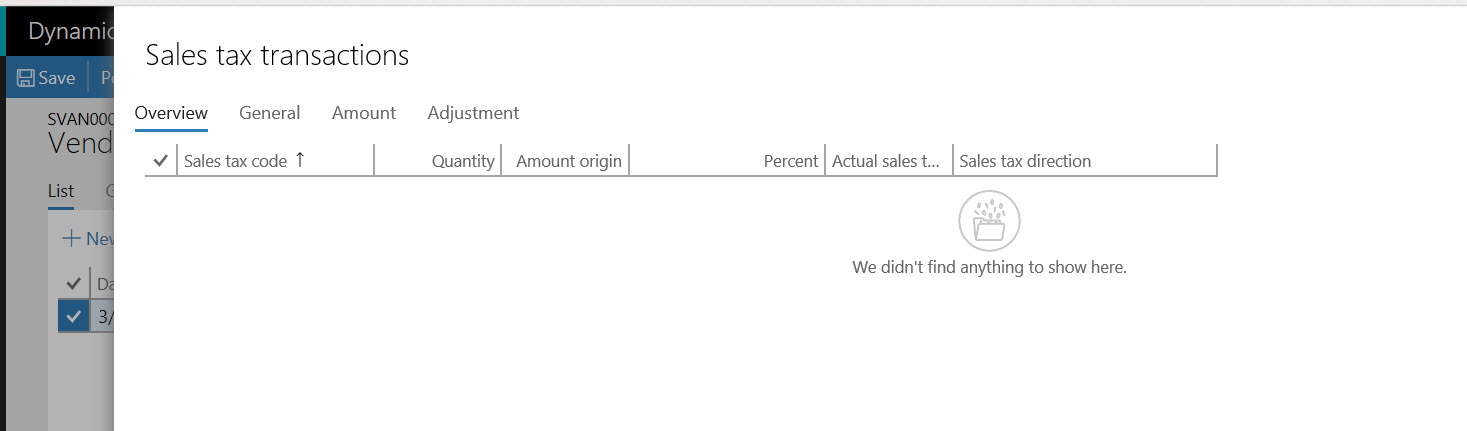

However, pressing "Sales Tax" button on the journal shows NO SALES TAX posting, and after posting the journal, no new line is created in the Posted Sales Tax form.

This looks like a change from the behavior in AX 2012 - as even 0% tax transaction are recorded (as they need to .... it's a legal requirement).

I noticed it in our own test environment, but managed to easily recreate the issue in the Microsoft own demo environment in company DEMF, using the setting in the example above.

Anyone is seeing that in their own D365 environment?